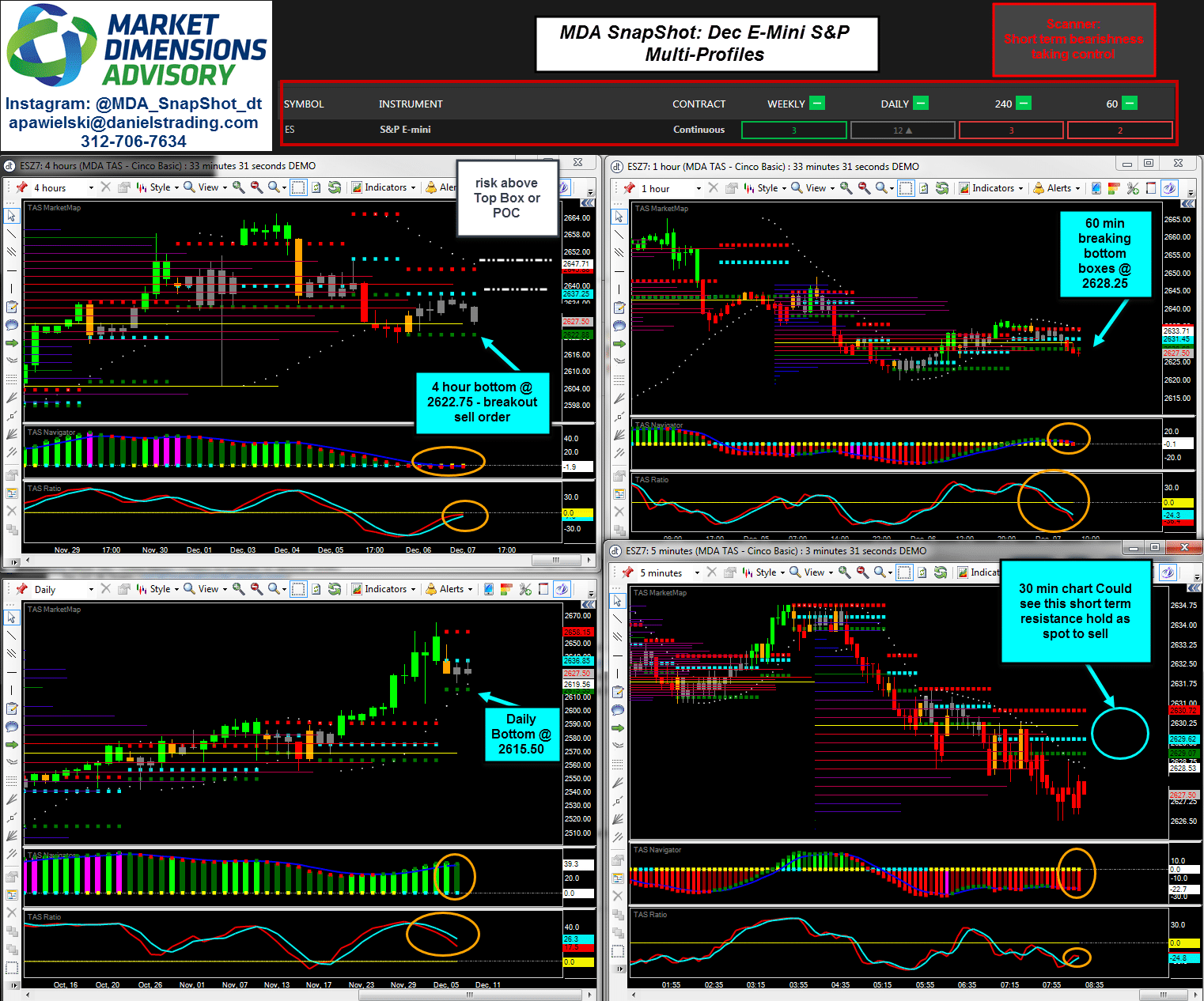

December E-Mini S&P – Multi-Profiles – Sell Zones

CLICK IMAGES TO OPEN CHART CONTENT

Breakdown of Today’s Update

Published 12/7/17 8:30 am central:

Traders,

We have seen bears beginning to try and take control over the last couple sessions and the most recent move lower. We are seeing on scanner 2 of the 4-time frames bearish. We had a weak overnight and the bears have a chance to push this further if we are able to break 2 key levels. The 4-hour bottom boxes and the Daily bottom boxes.

If you are bullish today, you will want to have stops below the 4-hour bottom and use that as your defensive line.

Outlined on the chart we are showcasing sell orders in line with the 4-hour bottom zones. We are seeing bearish confirmations that show there could high probability chances of this moving lower. However, keep in mind every bearish longer-term setup has been short-lived with large buyers stepping in. Keep that in context.

The other area to look to short is the 5 min top boxes @ 2631 level as a failed breakout attempt to move higher.

Review the setups on the chart and if you have questions let me know.

REMINDER Webinars:

Make sure to sign up for my LIVE MDA SnapShot Webinar every Wednesday. You will be able to see all of these tools in real time, as well as, the markets and time frames you want to watch with instant analysis. Even if you cannot attend live, sign up, as you will get a recast email of the event.

- WEBINAR Sign Up: https://www.danielstrading.com/webinar/mda-snapshot-pre-market-chart-analysis

- Webinar Recasts: https://www.danielstrading.com/mda/recasts

Background

Below you will see published updates from the Market Dimensions Advisory. These are sent in real-time to subscribers. Do Not Miss them going forward, subscribing below for FREE. These blog updates are showcasing the levels and positions that potentially could be executed by traders who are following the MDA SnapShot updates.

If you would like to follow these trading alerts in real-time and have the ability to speak with me, you will need to subscribe to the newsletter and become a client of our firm.

To get these updates sent directly to your inbox, please SUBSCRIBE Below.

Contact me directly @ 800-958-9571 or via email: apawielski@danielstrading.com

Twitter @MDA_SnapShot

SUBSCRIBE: (Copy Paste into Browser): http://buff.ly/1KHifiZ

Below the updates, you will see the original charts showing buy/sell zones

Risk Disclosure

STOP ORDERS DO NOT NECESSARILY LIMIT YOUR LOSS TO THE STOP PRICE BECAUSE STOP ORDERS, IF THE PRICE IS HIT, BECOME MARKET ORDERS AND, DEPENDING ON MARKET CONDITIONS, THE ACTUAL FILL PRICE CAN BE DIFFERENT FROM THE STOP PRICE. IF A MARKET REACHED ITS DAILY PRICE FLUCTUATION LIMIT, A "LIMIT MOVE", IT MAY BE IMPOSSIBLE TO EXECUTE A STOP LOSS ORDER.

THE RISK OF LOSS IN TRADING COMMODITY FUTURES AND OPTIONS CONTRACTS CAN BE SUBSTANTIAL. THERE IS A HIGH DEGREE OF LEVERAGE IN FUTURES TRADING BECAUSE OF SMALL MARGIN REQUIREMENTS. THIS LEVERAGE CAN WORK AGAINST YOU AS WELL AS FOR YOU AND CAN LEAD TO LARGE LOSSES AS WELL AS LARGE GAINS.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.