Lumber Futures

No two trees produce the exact same lumber, especially because of knots, slope of grain, and natural wear. As a result, The American Lumber Standard outlined specific national standards for lumber in the early 1920s, a job that is presently handled by the American Lumber Standard Committee. This ruling standardized lumber dimensions, grade, and moisture content.

No two trees produce the exact same lumber, especially because of knots, slope of grain, and natural wear. As a result, The American Lumber Standard outlined specific national standards for lumber in the early 1920s, a job that is presently handled by the American Lumber Standard Committee. This ruling standardized lumber dimensions, grade, and moisture content.

Lumber Contract Specifications

→ Click Here for Lumber Contract Specifications

Lumber Facts

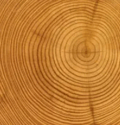

Although lumber has been utilized for construction for thousands of years, large-scale lumbering did not occur until the Industrial Revolution. Lumber is derived from either softwood or hardwood. Hardwood lumber, which includes oak and maple wood, is used for a variety of commercial industry needs, primarily wood pallets. Those with interesting patterns and colors are in high demand for many high-end furniture and home products from flooring to cabinets. Softwoods, such as southern yellow pine and Douglas fir, are used as structural lumber. The U.S. is known for producing softwood and is a leader in global market production of lumber. Lumber prices in the U.S. are mostly based on the strength and demand for domestic home building.

Source: Barchart

Last updated May 2013.