The strategies in this guide are not intended to provide a complete guide to every possible trading strategy, but rather a starting point. Whether the contents will prove to be the best strategies and follow-up steps for you will depend on your knowledge of the market, your risk-carrying ability and your commodity trading objectives.

How to Use This Guide

Futures & Options Strategies Guide Overview

This publication was designed, not as a complete guide to every possible scenario, but rather as an easy-to-use manual that suggests possible trading strategies. One way to use it effectively is to follow these simple steps:

1. Determine Your Market Outlook.

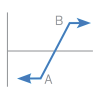

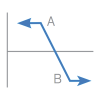

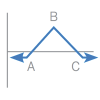

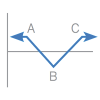

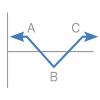

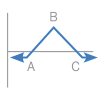

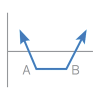

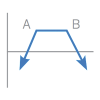

Are you generally bullish, bearish, or undecided on future market moves?

2. Determine Your Volatility Outlook.

Do you feel that volatility will rise, fall, or are you undecided?

3. Look Up the Corresponding Strategy on the Appropriate Table.

Whether you are initiating a position or trying to follow up a current position, line up the correct row and column on the proper table to find a strategy that will help you make the most of your outlook.

4. Determine the “Best” Strike Price.

By analyzing your market and volatility outlook further you should be able to select the option strike that provides the best opportunity. The Guide does not go into detail on selecting the best strikes. You can do this by calculating a few “What-If” scenarios.