Short Strangle

If market is within or near (A-B) range and, though active, is quieting down. If market goes into stagnation, you make money; if it continues to be active, you have a bit less risk then with a short straddle.

Overview

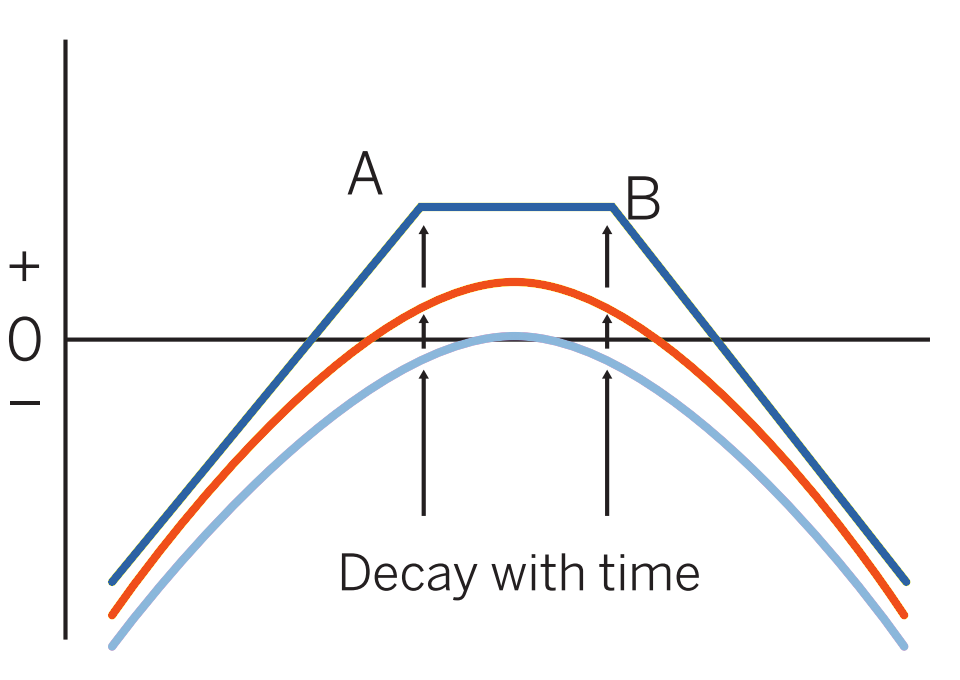

Pattern evolution:

When to use: If market is within or near (A-B) range and, though active, is quieting down. If market goes into stagnation, you make money; if it continues to be active, you have a bit less risk then with a short straddle.

Profit characteristics: Maximum profit equals option premium collected. Maximum profit realized if market, at expiration, is between A and B.

Loss characteristics: At expiration, losses occur only if market is above B + option premium collected (for put-call) or below A – that amount. Potential loss is open-ended. Although less risky than short straddle, position is risky.

Decay characteristics: Because you are short options, time value decays at an increasing rate as the option expiration date approaches; maximized if market is within (A-B) range.

CATEGORY: Precision

Short put A, short call B

(All done to initial delta neutrality)

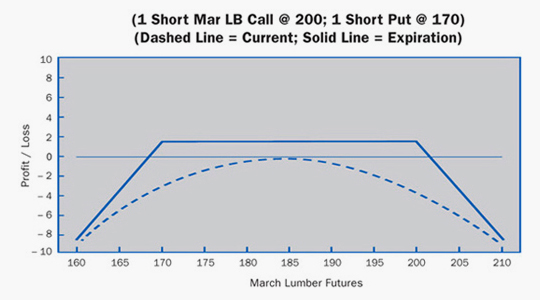

Example

Scenario:

This trader finds current implied volatility at relatively high levels. The expectation now is for a very lackluster trading month with no trend, and reduced volatility. The trader could sell a straddle, but feels more comfortable with the wider range of maximum profit of the short strangle.

Specifics:

Underlying Futures Contract: March Lumber

Futures Price Level: 185.00

Days to Futures Expiration: 65

Days to Option Expiration: 45

Option Implied Volatility: 19.4%

Option Position:

| Short 1 Mar 200.00 Call | + 0.80 ($120.00) |

| Long 1 Dec 1.0000 Put | |

| Short 1 Mar 170.00 Put | + 0.60 ($ 90.00) |

| + 1.40 ($210.00) |

At Expiration:

Breakeven: Downside: 168.60 (170.00 strike – 1.40 credit). Upside: 201.40 (200.00 strike + 1.40 credit).

Loss Risk: Unlimited; losses continue to mount as futures fall below 168.60 breakeven or rise above 201.40 breakeven.

Potential Gain: Maximum gains occur between strikes (a 30.00 range of maximum profit).

Things to Watch:

There is a high probability that futures will expire in this range, thereby yielding the maximum profit. However, the profit received is relatively small for the amount that could be at risk if futures were to rally or drop sharply. Assignment of a futures position transforms this strategy into a synthetic short call or synthetic short put.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.