Orders in the Pit

Learn about pit traded orders.

A futures brokerage firm (“house”) that is a member of Chicago Mercantile Exchange (CME) places orders to buy or sell futures or options contracts for companies or individuals and earns a commission on each transaction. Everyone who trades futures and options on futures contracts must have an account with a futures brokerage house, which is officially called Futures Commission Merchant (FCM). Futures brokerages are not the same as stock brokerages, but some companies are licensed to trade both stocks and futures.

How do pit-traded orders come in?

Customers of a futures brokerage firm send orders to CME via telephone or a computerized order-entry system. The brokerage firm receives the order at its communication desk on the floor of the Exchange.

Placing the Order

When you place an order over the phone or via your computer, you specify the futures contract you want to buy or sell, including the contract month. Each commodity has more than one contract, each one with a different maturity date. For example, there are 10 Eurodollar futures contracts with maturity dates of March, June, September and December. So if you want June Eurodollars, you have to let the brokerage firm know that. You also say whether you’re buying or selling and how many contracts you want bought or sold. With certain types of orders, you even specify the price.

Trading Language

When you place an order, you need to use the right language. “Buy me” means to go “long” or buy contracts. (Going “short” means to sell contracts).

A market order is one type of order. When you place a market order, you are asking that order to be filled at the best available price immediately after receipt of the order. You might say, “Buy two December Swiss francs at the market.” After the brokerage firm writes up this order, it’s rushed to the floor broker in the pit, who executes it right away. Or, if you place an order online for one of CME’s electronically traded contracts, your order is filled via a computer matching system.

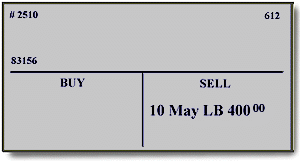

If you place a limit order, you’re asking the broker to fill the order at a specified price. If you say, “Buy 20 January Lumber at 395 even” ($395.00/thousand board feet), the floor broker can fill the order at 395.00 or any price lower, but not at a higher price. Likewise, if you say “Sell 10 May Lumber at 40 even” ($400.00/thousand board feet), the floor broker can fill the order at 400.00 or any price higher, but not at a lower price.

If the price you state in your limit order isn’t reached during the trading session, your order won’t be filled at all.

A spread trade is a specialized type of trade involving the simultaneous purchase and sale of two different but related futures contracts. The spread is the price difference between the two contracts.

Spread trading can include trading different delivery months of the same commodity (March Lumber versus July Lumber) or trading the same months of different futures contracts.

Additional Lessons

- Futures Exchange

- Contracts Traded

- Supply and Demand

- Fundamental Analysis

- Technical Analysis

- Orders in the Pit

- Trading Pit

- Risk Management

- Hedgers & Speculators

- Options on Futures

- Reading Quotes

- GLOBEX

- Hand Signals

- Expiration Months

- Futures Contract

Contents Courtesy of CME Group.