Long Put

Long put options may be a strategy to consider when you are bearish to very bearish on the market. Profit increases as markets fall.

Overview

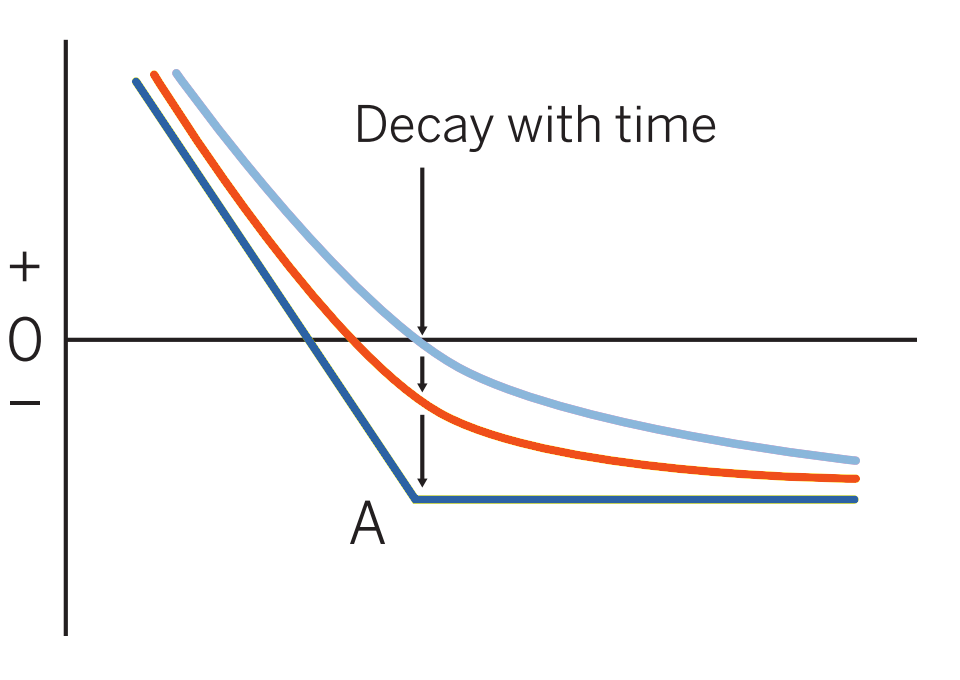

Pattern evolution:

When to use: When you are bearish to very bearish on the market. In general, the more out-of-the-money (lower strike) the put option strike price, the more bearish the strategy.

Profit characteristics: Profit increases as markets fall. At expiration, break-even point will be option exercise price A – price paid for option. For each point below break-even, profit

increases by additional point.

Loss characteristics: Loss limited to amount paid for option. Maximum loss realized if market ends above option exercise A.

Decay characteristics: Position is a wasting asset. As time passes, value of position erodes toward expiration value.

CATEGORY: Directional

SYNTHETICS: Short instrument, long call

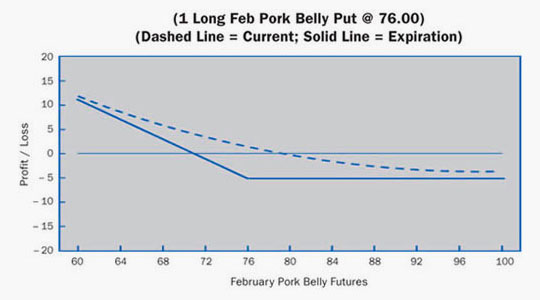

Example

Scenario:

Pork Bellies have been trading at contract highs of between 75 and 85 cents per pound. The trader feels that a major decline is very likely. However, the trader is not sure when it will come. He decides to buy a long-term put option. By doing this he initially has very little time decay. He can ride out a temporary upward move and still be in for the big break.

Specifics:

Underlying Futures Contract: February Pork Bellies

Futures Price Level: 80.15

Days to Futures Expiration: 210

Days to Options Expiration: 180

Option Implied Volatility: 33.2%

Option Position: Long 1 Feb 76 Put – 5.10 ($2040)

At Expiration:

Breakeven: 70.90 (76.00 strike – 5.10 premium)

Loss Risk: Limited to the premium paid. Loss above 70.90 with maximumloss of 5.10 above 76.00.

Potential Gain: Unlimited, with profits increasing as the futures fall further and further past 70.90 breakeven.

Things to Watch:

This trader must be very bearish, with volatility increasing, to make this trade profitable. If held to expiration, the futures would have to fall more than 10% by expiration just to break even. Check the follow-up strategies if the futures fall or volatility rises to the levels expected before expiration.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.