Long Iron Butterfly

This strategy is best for traders who anticipate very little price movement in the underlying asset and want to profit from low volatility conditions by collecting premium income from selling options, while also limiting potential losses through the purchase of options at wider strike prices.

Overview

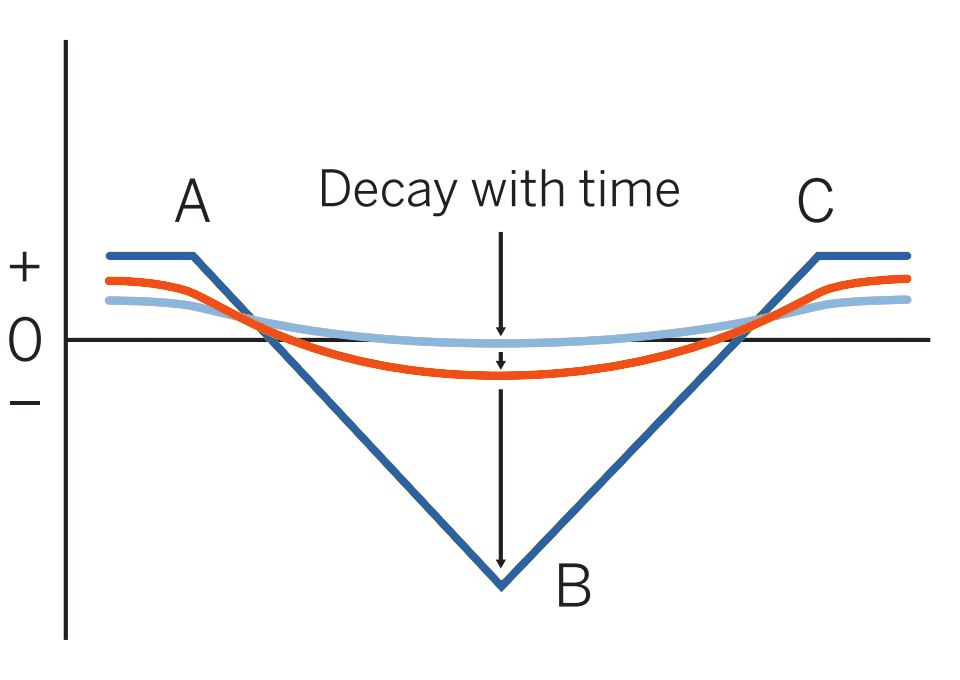

Pattern evolution:

When to use: When the market is either below A or above C and the position is underpriced with a month or so left. Or when only a few weeks are left, market is near B, and you expect an imminent breakout move in either direction.

Profit characteristics: Maximum profit equals (B – A) less the net debit to create the position. Occurs when market, at expiration, is below A or above C.

Loss characteristics: Maximum loss occurs if market is at B at expiration. Amount of that loss is net debit to create the position. Break-evens are at B + and – initial debit.

Decay characteristics: Decay negligible until final month, during which distinctive pattern of butterfly forms. Maximum loss is at B. If you are away from (A-C) range entering last month, you may wish to hold the position.

CATEGORY: Precision

Long straddle B, short strangle at AC

Short put A, long put B, long call B, short call C

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.