Long Straddle

This trader looks at the low implied volatility and feels that options are relatively inexpensive. The expectation is the market is poised for a big move.

Overview

Pattern evolution:

When to use: If market is near A and you expect it to start moving but are not sure which way. Especially good position if market has been quiet, then starts to zigzag sharply, signaling potential eruption.

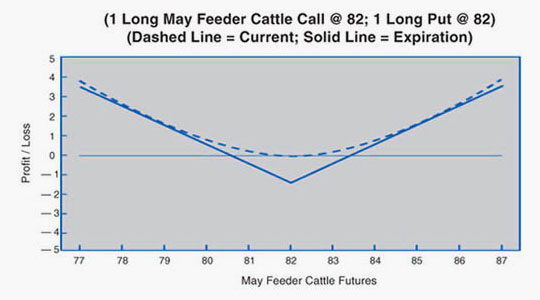

Profit characteristics: Profit open-ended in either direction. At expiration, break-even is at A, +/– cost of spread. However, position is seldom held to expiration because of increasing time decay with passage of time.

Loss characteristics: Loss limited to the cost of spread. Maximum loss occurs if market is at A at expiration.

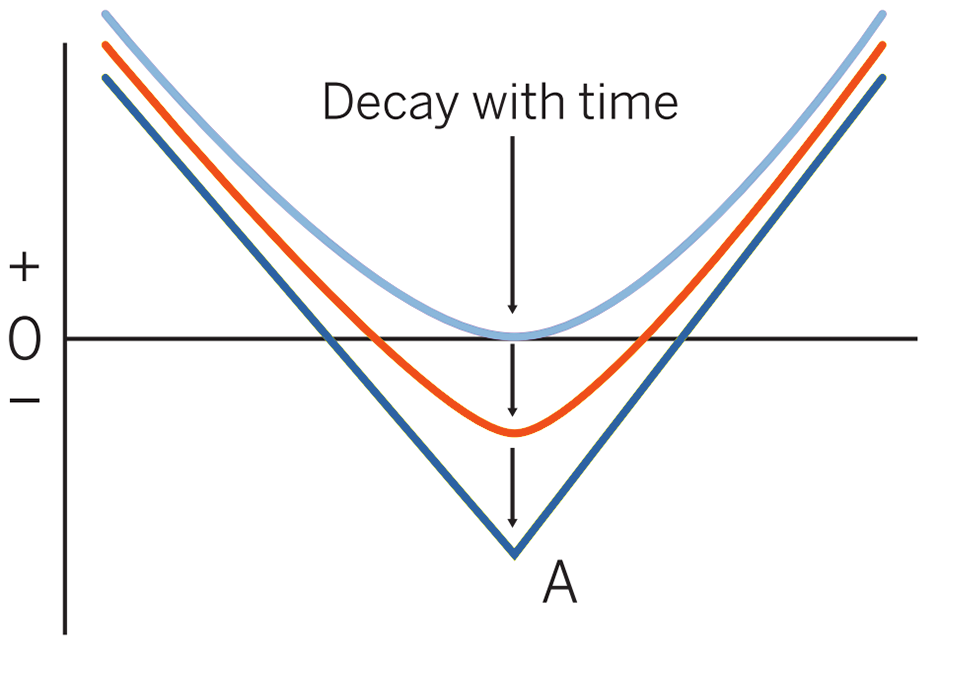

Decay characteristics: Time decay accelerates as options approach expiration. Position is generally liquidated well before expiration.

CATEGORY:Precision

Long call A, long put A

SYNTHETICS: Long 2 calls A, short instrument

Long 2 puts A, long instrument

(All done to initial delta neutrality. A delta neutral spread

is a spread established as a neutral position by using

the deltas of the options involved. The neutral ratio is

determined by dividing the delta of the purchased option

by the delta of the written option).

Example

Scenario:

This trader looks at the low implied volatility and feels that options are relatively inexpensive. The expectation here is that this market is poised for a big move. However, the trader is not sure which way it will be. So a decision is made to buy both a call and a put.

Specifics:

Underlying Futures Contract: May Feeder Cattle

Futures Price Level: 81.00

Days to Futures Expiration: 20

Days to Options Expiration: 20

Option Implied Volatility: 8.4%

Option Position:

| Long 1 May 82.00 Call | – 0.25 ($110.00) |

| Long 1 May 82.00 Put | – 1.25 ($550.00) |

| – 1.50 ($660.00) |

At Expiration:

Breakeven: Downside: 80.50 (82.00 strike – 1.50 debit). Upside: 83.50 (82.00 strike + 1.50 debit).

Loss Risk: Losses bottom out at 82.00 strike with a maximum loss of 1.50 ($660).

Potential Gain: Unlimited; gains begin below 80.50 breakeven and increase as futures fall. Also, gains increase as futures rise past 83.50 breakeven.

Things to Watch:

This is primarily a volatility play. A trader enters into this position with no clear idea of market direction, but a forecast of greater movement (risk) in the underlying futures.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.