Bear Spread

Use this if you think the market will go down, but with limited downside. Good position if you want to be in the market but are less confident of bearish expectations.

Overview

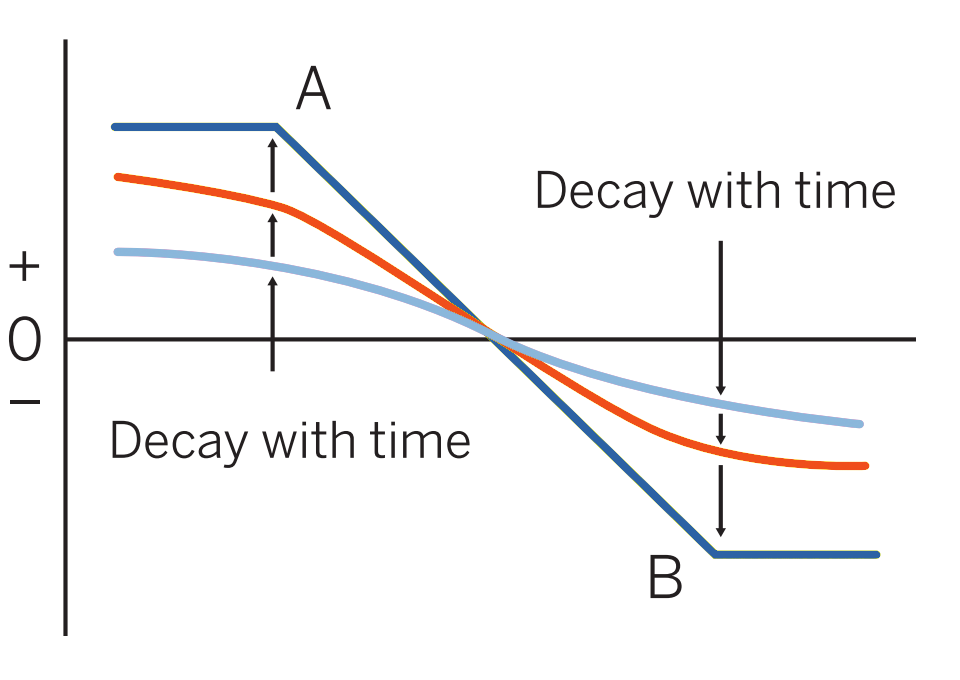

Pattern evolution:

When to use: If you think the market will go down, but with limited downside. Good position if you want to be in the market but are less confident of bearish expectations. The most popular position among bears because it may be entered as a conservative trade when uncertain about bearish stance.

Profit characteristics: Profit limited, reaching maximum at expiration if market is at or below strike price A. If put-vs.-put version (most common) used, break-even is at B – net cost of spread. If call-vs.-call version, break-even is at A + net premium collected.

Loss characteristics: By accepting a limit on profits, you also achieve a limit on losses. Losses, at expiration, increase as market rises to B, where they are at a maximum. With put-vs.- put version, maximum loss is net cost of spread.

Decay characteristics: If market is midway between A and B, little if any time decay effect. If market is closer to A, time decay is generally a benefit. If market is closer to B, time decay is generally detrimental to profitability.

CATEGORY: Directional

Short put A, long put B

Short call A, long call B

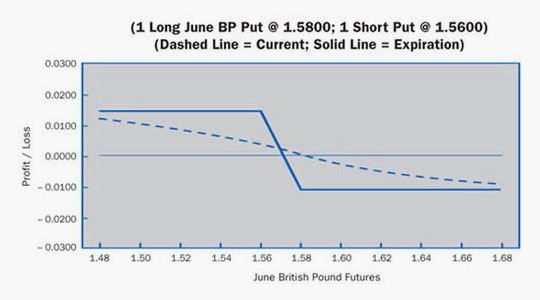

Example

Scenario:

This trader is convinced the British Pound market is going to fall. The trader does not expect a sharp drop, just a gradual decline to about 1.5600 US$/pound. He decides on a bear spread with the written put at the target price.

Specifics:

Underlying Futures Contract: June British Pound

Futures Price Level: 1.5850

Days to Futures Expiration: 80

Days to Options Expiration: 70

Option Implied Volatility: 12.0%

Option Position:

| Long 1 Jun 1.5800 Put | – .0320 ($2000.00) |

| Short 1 Jun 1.5600 Put | + .0210 ($1312.50) |

| – .0110 ($ 687.50) |

At Expiration:

Breakeven: 1.5690 (1.5800 strike – .0110 debit)

Loss Risk: Losses start above 1.5690, but limited to the debit paid. Maximum loss above 1.5800.

Potential Gain: Gains mount as futures fall below 1.5690. Maximum profit of .0090 ($562.50) at or below 1.5600(the difference between strikes .0200 – debit .0110).

Things to Watch:

If the trader had a target price in mind, this would be an effective strategy. Why should the trader pay for an option with unlimited potential when he thinks the move is limited? Selling an option at the target price will reduce the cost of an outright long option.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.