Short Straddle

If market is near A and you expect market is stagnating. Because you are short options, you reap profits as they decay — as long as market remains near A.

Overview

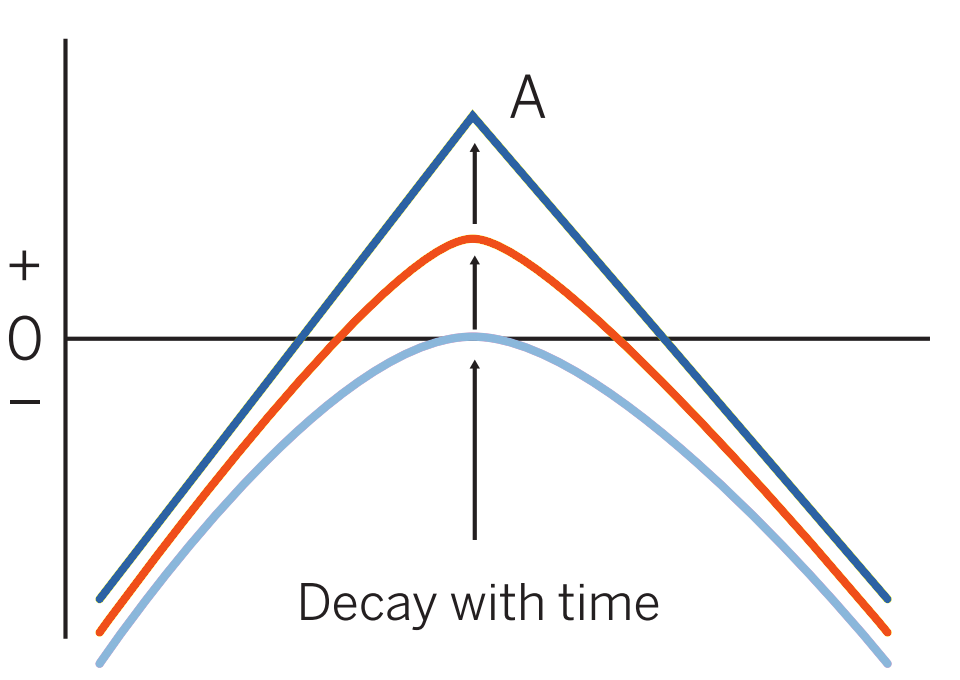

Pattern evolution:

When to use: If market is near A and you expect market is stagnating. Because you are short options, you reap profits as they decay — as long as market remains near A.

Profit characteristics: Profit maximized if market, at expiration, is at A. In call-put scenario (most common), maximum profit is equal to the credit from establishing position; break-even is A +/– total credit.

Loss characteristics: Loss potential open-ended in either direction. Position, therefore, must be closely monitored and readjusted to delta neutral if market begins to drift away from A.

Decay characteristics: Because you are only short options, you pick up time-value decay at an increasing rate as expiration approaches. Time decay is maximized if market is near A.

CATEGORY: Precision

Short call A, short put A

SYNTHETICS:

Short 2 calls A, long instrument

Short 2 puts A, short instrument

(All done to initial delta neutrality)

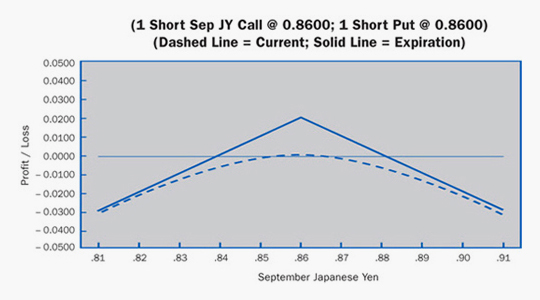

Example

Scenario:

This trader finds a market with relatively high implied volatility. The current feeling is the market will stabilize after having had a long run to its present level. To take advantage of time decay and dropping volatility this trader sells both a call and a put at the same strike price.

Specifics:

Underlying Futures Contract: September Japanese Yen

Futures Price Level: 0.8600

Days to Futures Expiration: 40

Days to Options Expiration: 30

Option Implied Volatility: 12.6%

Option Position:

| Short 1 Sep 0.8600 Call | + 0.0100 ($1250.00) |

| Short 1 Sep 0.8600 Put | + 0.0100 ($1250.00) |

| + 0.0200 ($2500.00) |

At Expiration:

Breakeven: Downside: 0.8400 (0.8600 strike – 0.0200 credit). Upside: 0.8800 (0.8600 strike + 0.0200 credit).

Loss Risk: Unlimited; losses increase as futures fall below 0.8400 breakeven or rise above 0.8800 breakeven.

Potential Gain: Limited to credit received; maximum profit of 0.0200 ($2500) achieved as position is held to expiration and futures close exactly 0.8600 strike.

Things to Watch:

This is primarily a volatility play. A trader enters into this position with no clear idea of market direction but a forecast of less movement (risk) in the underlying futures. Be aware of early exercise. Assignment of a futures position transforms this strategy into a synthetic short call or synthetic short put.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.