Short Risk Reversal

When you are bearish on the market and uncertain about volatility. Normally this position is initiated as a follow-up to another strategy. Its risk/reward is the same as a Short Futures except that there is a flat area of little or no gain/loss.

Overview

Pattern evolution:

When to use: When you are bearish on the market and uncertain about volatility. Normally this position is initiated as a follow-up to another strategy. Its risk/reward is the same as a SHORT FUTURES except that there is a flat area of little or no gain/loss.

Profit characteristics: Profit increases as market falls below the long put strike price. Profit at expiration is open-ended and is based on the exercise price of A +/– premium received or

paid to initiate position.

Loss characteristics: Loss increases as market rises above the short call. Loss at expiration is open-ended and is based on the exercise price of B +/– premium received or paid to initiate

position.

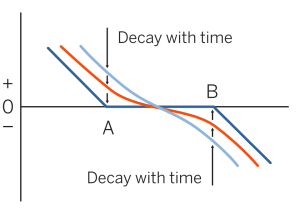

Decay characteristics: Time decay characteristics vary according to the relationship of the call strike price, put strike price and the underlying futures price at the time the position is established. The position is time decay neutral (not affected) if the futures price is exactly mid-way between the call and put strike prices; long time decay (benefits from time decay) when the futures price is closer to the put than the call strike price and short time decay (time decay erodes the value of the position) when the futures price is closer to the call than the put strike price.

CATEGORY: Directional

Long put A, short call B

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.