Short Put

If you firmly believe the market is not going down. Sell out-of-the-money (lower strike) options if you are only somewhat convinced, sell at-the-money options if you are very confident the market will stagnate or rise. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit.

Overview

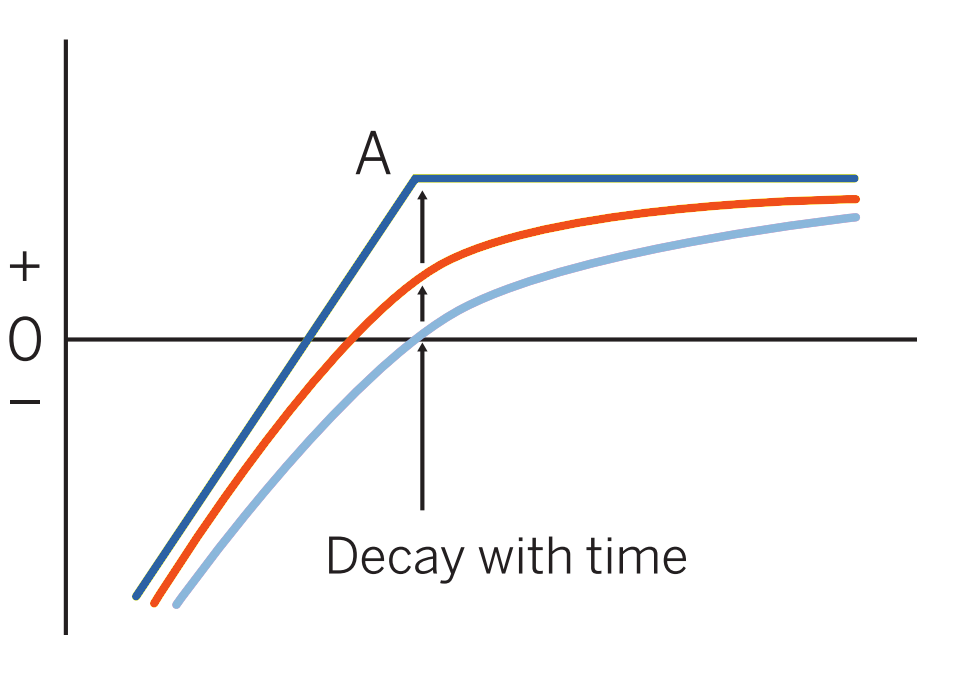

Pattern evolution:

When to use: If you firmly believe the market is not going down. Sell out-of-the-money (lower strike) options if you are only somewhat convinced, sell at-the-money options if you are very confident the market will stagnate or rise. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit.

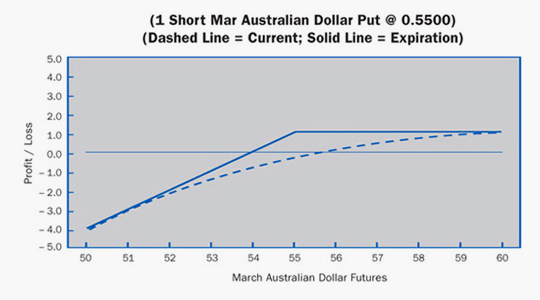

Profit characteristics: Profit limited to premium received from put option sale. At expiration, break-even point is exercise price A – premium received. Maximum profit realized if market settles at or above A.

Loss characteristics: Loss potential is open-ended. Loss increases as market falls. At expiration, losses increase by one point for each point market is below break-even. Because risk is open-ended, position must be watched closely.

Decay characteristics: Position benefits from time decay. The option seller’s profit increases as option loses its time value. Maximum profit from time decay occurs if option is at-the-

money.

CATEGORY: Directional

SYNTHETICS: Long instrument, short call

Example

Scenario:

This trader feels very strongly that Australian Dollar futures will not fall. He thinks, though, that the market has an equal chance of going up or leveling out. He also expects implied volatility to fall about 11%. The trader decides to sell a put option.

Specifics:

Underlying Futures Contract: March Australian Dollar

Futures Price Level: 0.5500

Days to Futures Expiration: 50

Days to Options Expiration: 40

Option Implied Volatility: 14.1%

Option Position: Short 1 Mar 0.5500 Put + .0111 ($1110)

At Expiration:

Breakeven: 0.5389 (0.5500 strike – 0.0111 credit)

Loss Risk: Unlimited; with losses increasing as futures fall past 0.5389 breakeven.

Potential Gain: Limited to the premium received 0.0111 ($1110). This occurs when futures is above 0.5500 strike at option expiration.

Things to Watch:

As with all unlimited risk situations, the trader must watch this position carefully. Special consideration must be give to foreign currency trading, due to foreign and domestic central bank policy changes. The worst scenario is to be in this position with volatility rising and futures falling. Always re-evaluate this position at some predetermined point.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.