Play Turner’s Take Ag Marketing Podcast Episode 286

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

In today’s podcast we go over the US Federal Reserve increasing interest rates and tapering bond purchases. We also talk about Natural Gas and how high prices this winter could impact fertilizer prices and acres/yields next growing season. Make sure you take a listen to this week’s Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Natural Gas

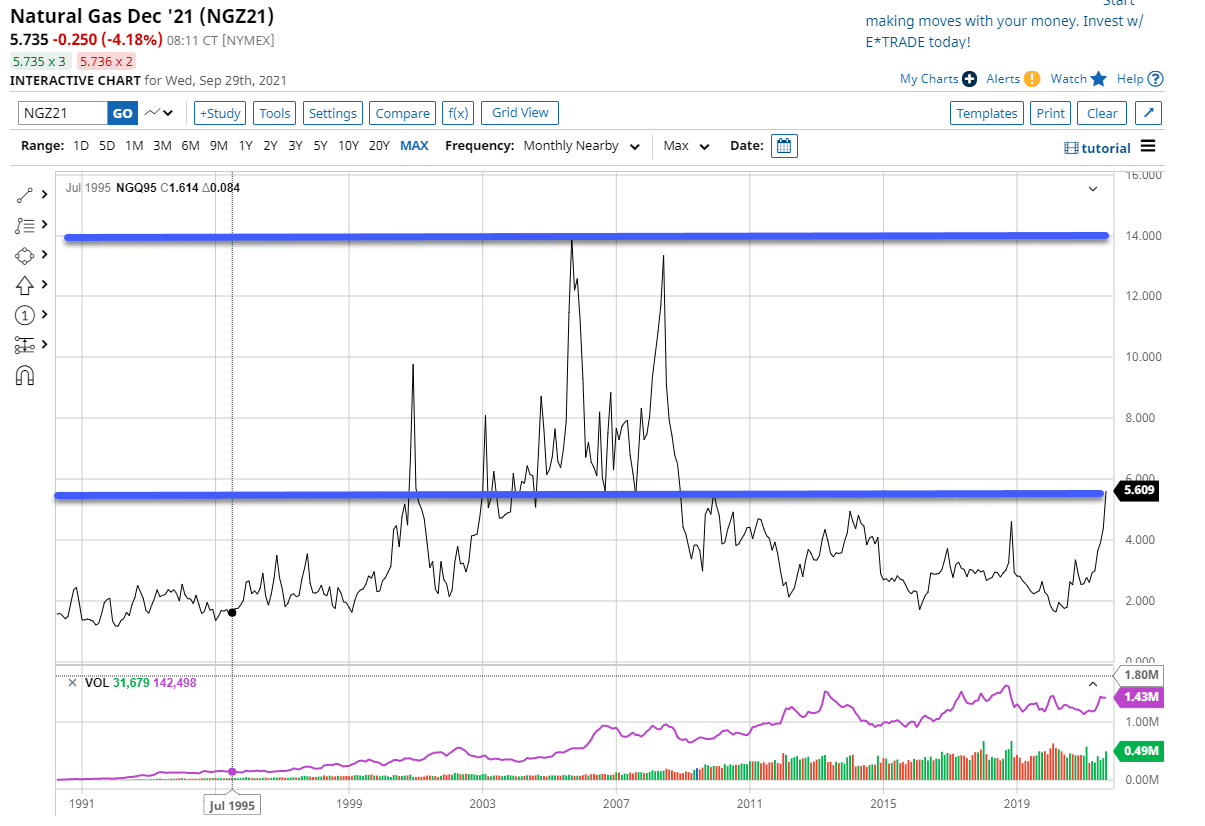

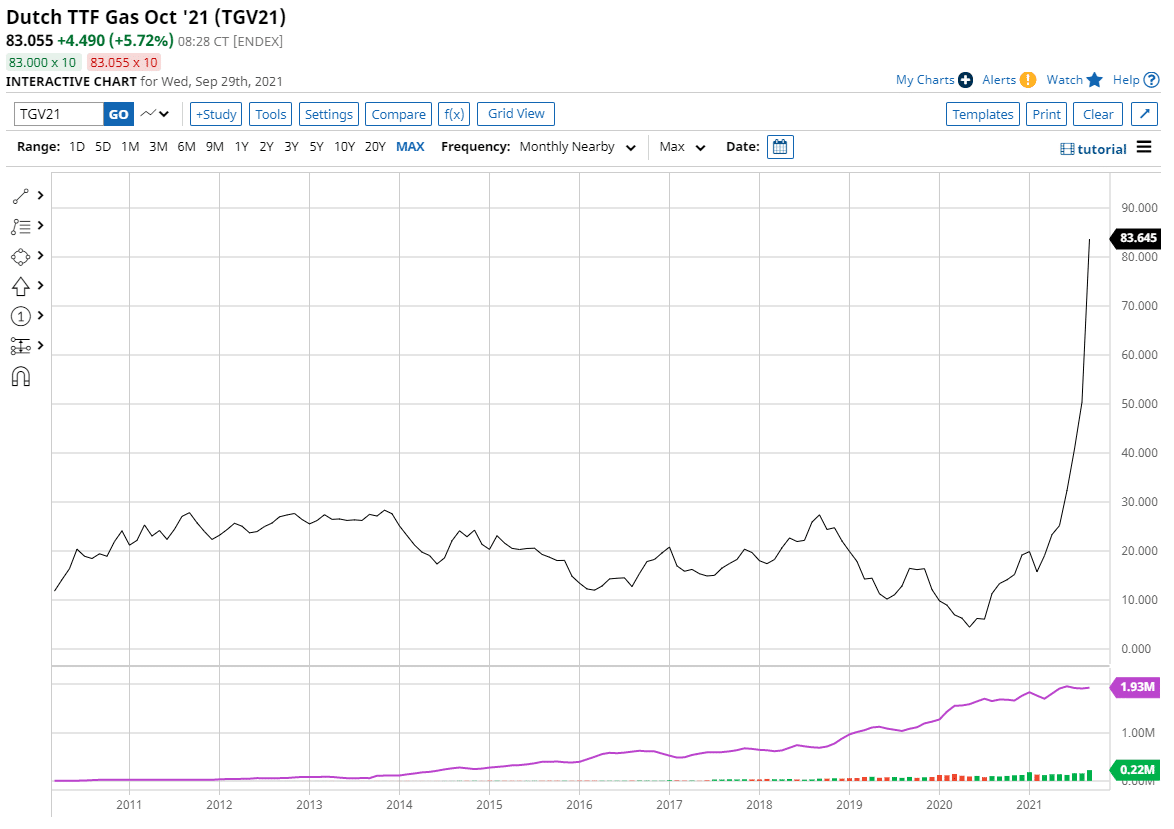

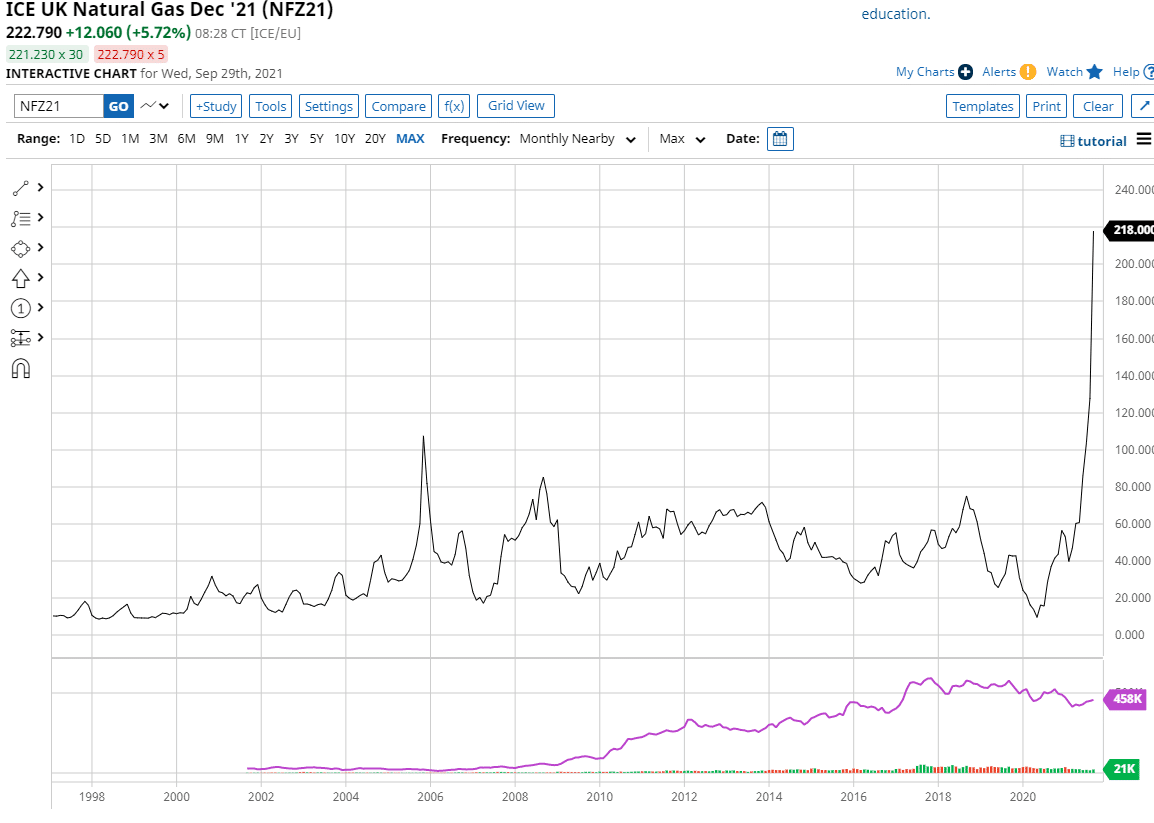

If you’ve seen a recent chart of Natural Gas then you’ll know what the subject of this podcast is referring. Wow! I thought NG could hit $6 this winter. I did not think it would happen by Sept 28th. Below are some charts for US, UK, and Dutch NG futures. When Natural Gas is in tight supply in the US it traded between $6 and $14 from 2001 to 2009. Those years of high prices brought out a lot of investment in energy resources and development, and kept the NG market well supplied for more than a decade.

Take a look at what is going on in Euro (Dutch NG futures) and the UK. Prices are higher across Europe and the United Kingdom has it the worst at the moment. On average Natural Gas prices are about 5 times higher than normal. In the US supplies are tight and this is the time of year when we need to be building inventory for the winter. Production is lower and part of that is from the slowdown during COVID shutdowns, but part of it is also from the move to clean energy. Natural Gas is in higher demand now and policy initiatives have discouraged the use of coal.

Volatility

NG is going to be volatile. I doubt the move higher is over. For users of energy, natural gas and fertilizer, I like think you have two options. The first is you lock in as much physical as possible and then buy a put just in case the market crashes. If you don’t want to commit to physical purchases I would look into calls as insurance against higher prices this winter.

Speculators should look into buying futures and a put for protection. I also like buying Dec call spreads and collection some premium selling Nov put spreads.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Grains & Oilseeds

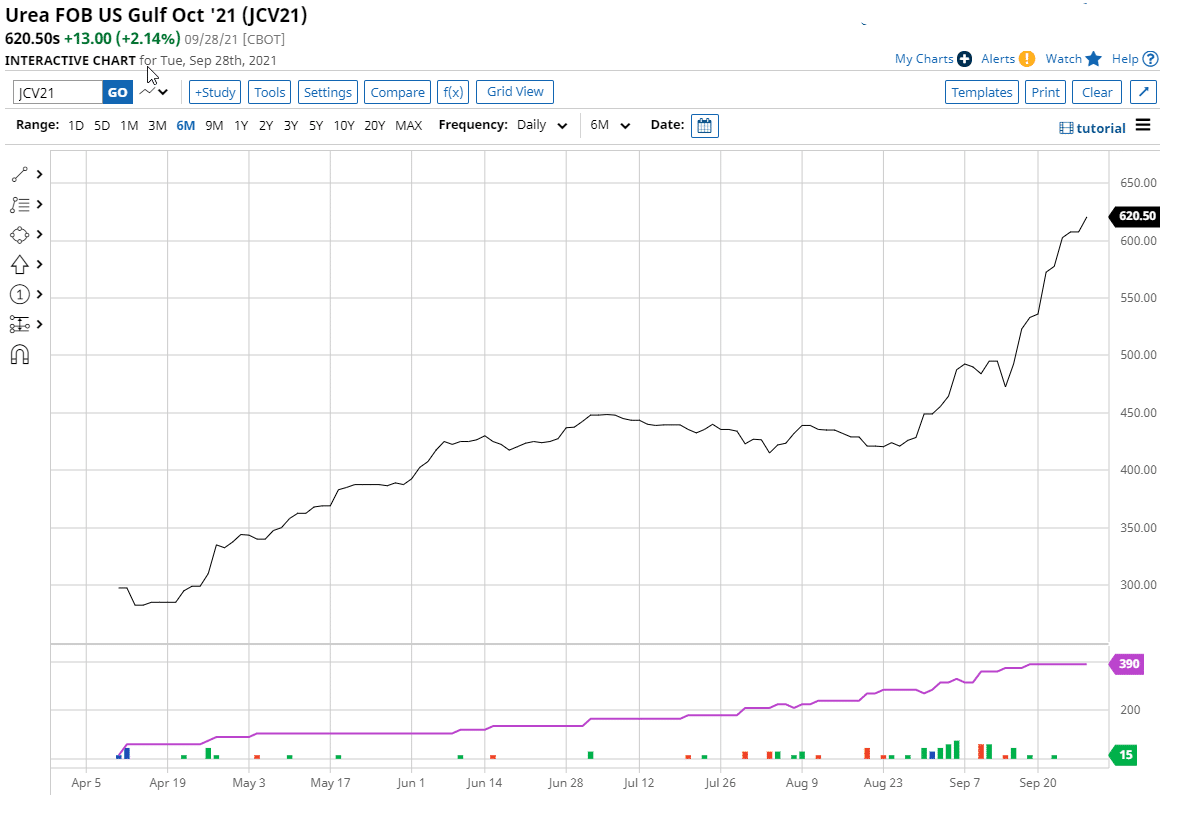

Sticking to the NG theme I have a chart of Urea below. It could have been a chart of any type of fertilizer. They all look the same. The price of NG is increasing prices for fertilizer across the board. NG can make up to 60% to 90% of fertilizer depending on the type and how high natural gas prices are during manufacturing.

The big concern about high natural gas prices and the grain markets are two fold. The first is availability. The market needs a lot of acres next year for all major crop. We are tight in corn, wheat, and oilseeds. If input prices for corn are much higher than do we see more wheat and soybean acres? If we get record corn acres will fertilizer use be lower due to high prices or limited availability?

Producers

I would be looking to buy back new crop corn sales with futures in March and then buying a put for protection. For new sales I would look at the $6 March Corn Calls and then sell the March $5/$4.50 put spread. The whole package would cost about a nickel. For soybeans I would either buy the $14 March call for 25 cents or the $15 for 12 cents and then use those call options to sell into if we get a big rally during the South American weather season.

End Users

Buying physical inputs at these levels makes sense and then you can buy a put for protection in case the markets collapse. I think that works for corn, wheat, soybeans, meal, and oil. Grain and oilseed stocks will be tight for another year and the natural gas/fertilizer issue is not going away any time soon. If you can’t lock in physical inventory now I would also look into buying calls for future needs just in case we get a big rally this winter and spring. Call me for specific strategies based on your business.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.