Play Turner’s Take Ag Marketing Podcast Episode 271

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

Today we look at what the Planting Intentions report means for potential price moves this summer. Corn and soybean acres were lower than expected last week. We think acres will come up but not enough to prevent tight new crop ending stocks. Weather rallies this spring and summer could be the biggest we’ve seen in years if conditions are hot and dry. Make sure you take a listen to this week’s Turner’s Take Podcats!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Spring & Summer Weather Rally Potential

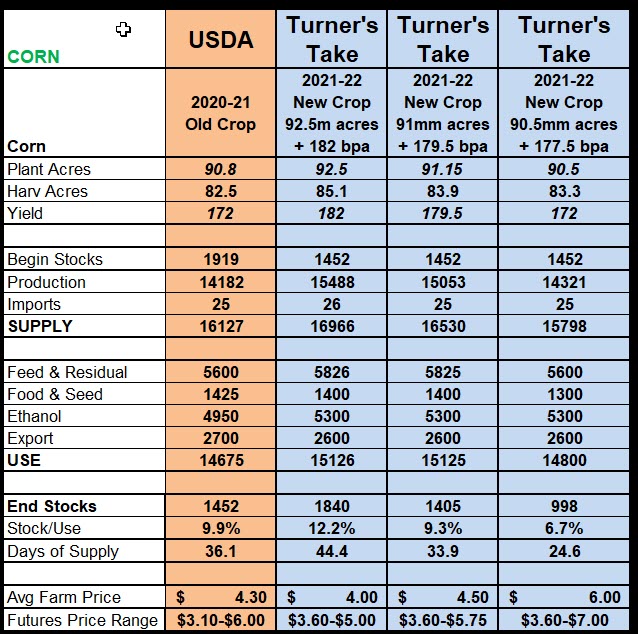

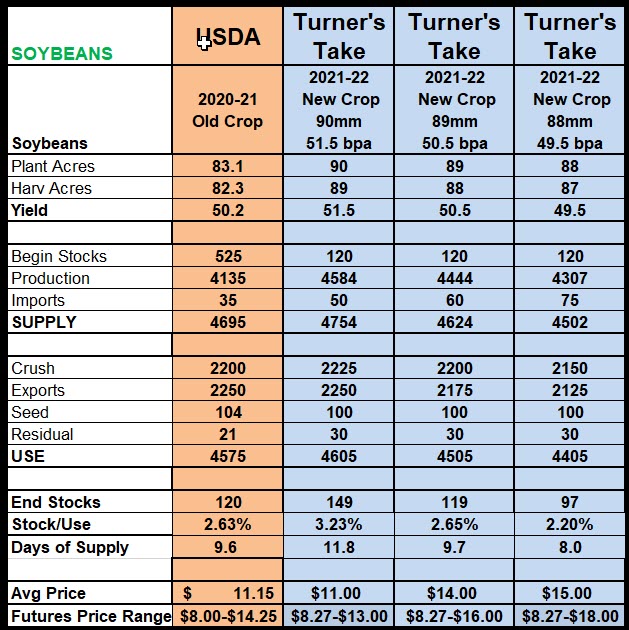

The Planting Intentions report sets up the possibility of big weather rallies this spring and summer. If conditions are hot and dry the US planting and growing season will be challenging. Below are two supply and demand scenarios for corn and soybeans. Any loss in yield could send prices higher and the market will be volatile with each change in the weather forecast this season.

I like using options for weather markets this spring and summer. Futures will be hard to hold onto during the volatility. Here are some ideas for both old crop and new crop. Please call me at 312-706-7610 or email craig.turner@stonex.com with questions. We can always adjust these ideas based on your account, strategies, and risk/reward preferences.

Old Crop Soybean Oil – July Soybean Oil 55/60 bull call spreads are about 1.15 cents. The 50/47 Put spread is about 1 cent. You could buy the call spread and sell the put spread for about 10 to 20 ticks. Each tick in bean oil is $6

New Crop Soybeans – Nov Soybean $15 calls are about 24 cents. You could sell the $17 for 8 cents to make is a 16 cent spread for $2 of upside. The $11.60/$11.00 puts are trading about 12 cents so you pay for most of the call spread by selling a put spread but you do open yourself up to 60 cents of risk.

Old Crop Corn – $6 July Calls are 13 cents. This is a bit of a flier but if acres don’t increase and we lose 5 to 10 bpa this summer, corn could be well above $6. The $5.70/$6.20 July call spread is about 11 or 12 cents. That is a good limited risk way to play old crop corn too.

New Crop Corn – The Dec Corn $5/$6 call spread is about 25 cents. The $4.40/$4.00 put spread is 13 cents. You could probably be long the call spread and short the put spread for around 12 cents.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.