Play Turner’s Take Podcast Episode 236

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

Today we talk about why the stock market valuation are so much higher than what their earnings suggest and why it is likely to continue. We also dive into the energy, grain, and livestock markets. There are some seasonal spreads in corn and soybeans that we like and we are still bullish on soybean oil, crude oil, and the deferred contracts for hogs and cattle. Make sure you take a listen to this week’s Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

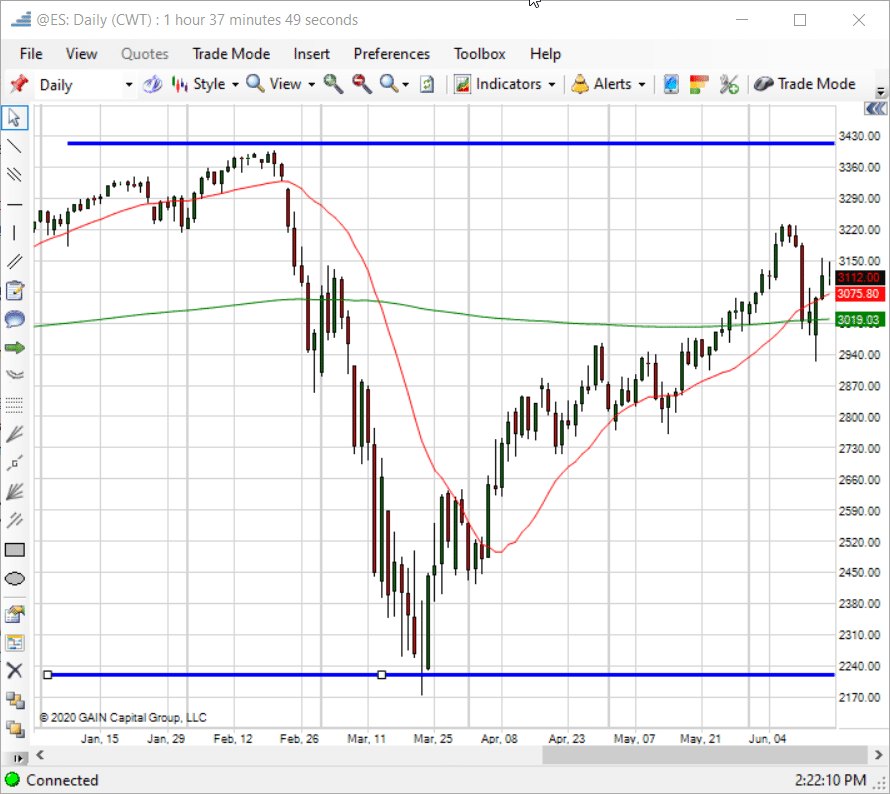

Macro Markets

The stock market continues to rally we still like buying the dips. We understand that valuations have run ahead of earnings but the market if forward thinking and believes better days are ahead. The Fed has unlimited resources and like it or not, they are a supportive force in the stock market. The Fed is now buying investment grade corporate bonds. This is on top of keeping the short term interest rates low and their treasury and mortgage backed security purchases. The 200 day moving average (green line) should be major support going forward.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

Emini S&P 500

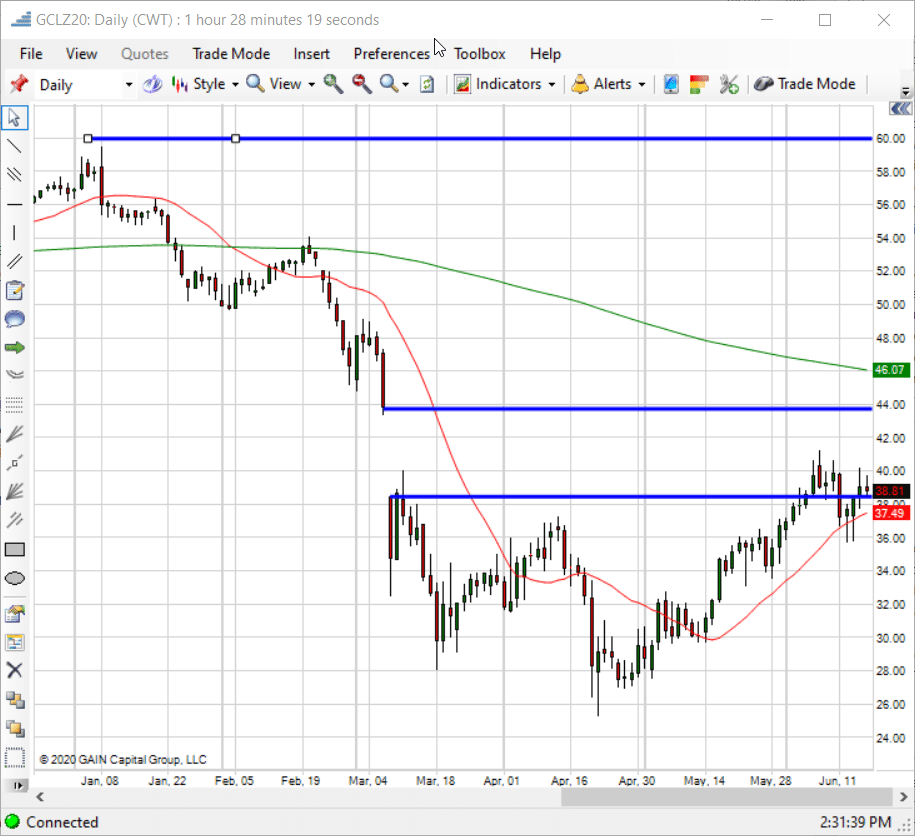

Energy

This is a very interesting article on why crude oil prices are likely to average less than $60 during the next business cycle. There is an argument between Russia, Saudi Arabia, and the other OPEC nations about what is a good price for crude. Saudi Arabia wants prices in the $70s to pay their national budget but Russia and some other nations realize $50 to $60 is more in line for capturing market share. There is a real difference of thought about margins vs market share. The higher the price, the better the margins. The lower the price the more market share the low cost providers gain. Russia seems to want the market share and Saudi Arabia want the higher margins.

I still like Dec Crude Oil and I think we eventually fill the gap around $43.50. Our long term targets for 2021 are changing. If Russia only needs crude oil to be $50 or higher and they are after market share, they could be the nation that drives price going forward. I still like buying Dec Crude on the dips and our price target remains $43.50

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Dec Crude Oil

Ag

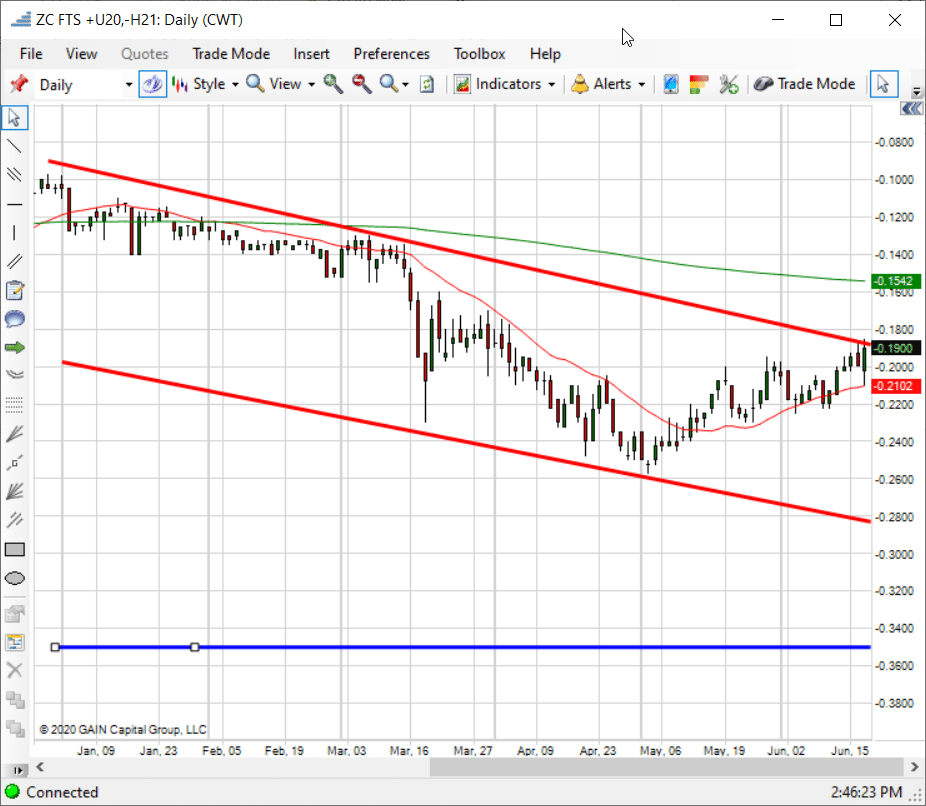

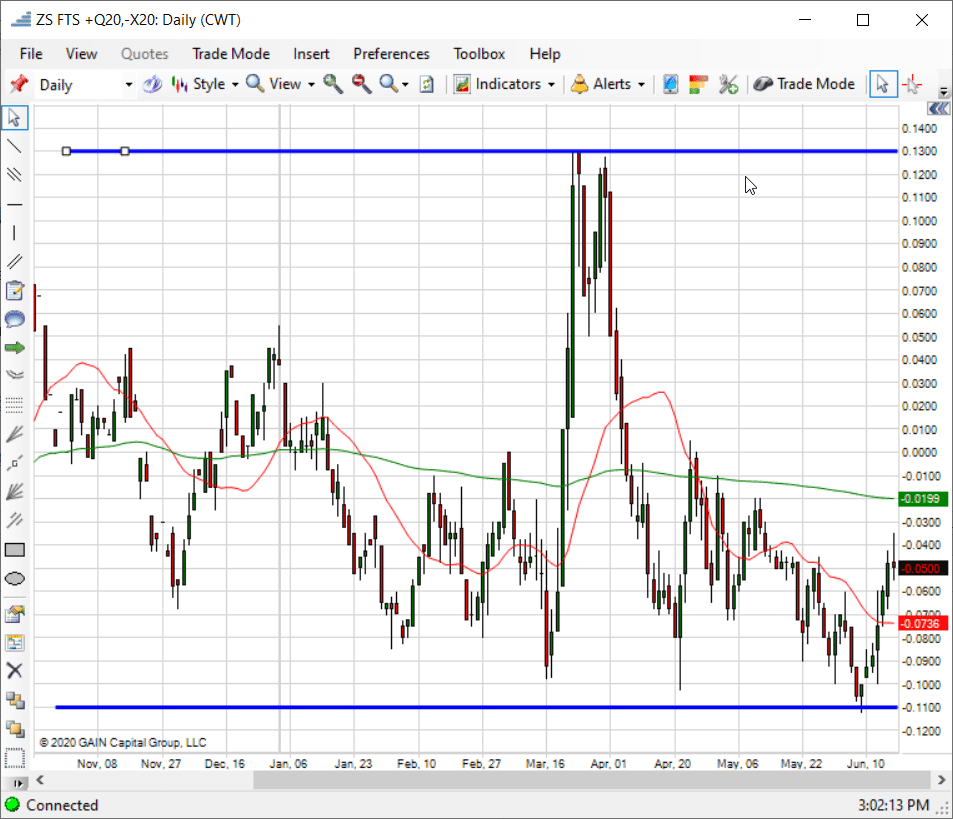

During the podcast I talked about three season spreads. The first two were bear spreads. Selling Sept Corn and buying Dec Corn was the first. The second was selling Sept KC Wheat and buying Dec KC Wheat. I also talked about the Aug vs Nov soybean bull spread. I like the corn one best for the bears and the soybean spread for the bulls. Also, instead of Sept vs Dec corn, I like the profit potential for Sept vs March corn better. Below are charts of both. The margin on corn is about $200. The margin on soybeans is about $350.

Sept vs March Corn – full carry is around 50 cents but our target will be 35 cents. If this new crop is made anywhere close to expectations and we have ample old crop, I think the Sept/March spread comes in once the market believes the new crop is made.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

Aug vs Nov Soybeans – this spread is near its lows and should have support at these levels. Soybeans develop later in the summer so there is still a lot of time to put weather premium into the market. Soybeans also has demand potential as China buys from the US. Seasonally this spread is strong for the next few weeks, we don’t have to risk much, the margins are low, and a combo of weather and Chinese demand could work out for this spread between now and the end of July.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

Craig Turner – Commodity Futures Broker

Turner’s Take Ag Marketing: https://www.turnerstakeag.com

Turner’s Take Spec: https://www.turnerstake.com

Twitter: @Turners_Take

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.