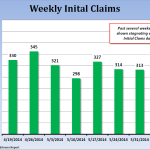

Economic skies continue to brighten as some of the most troubled areas of the world (the Euro zone and Japan) are beginning to show some improvement and the only major nations that appear to be degrading are Brazil and Russia.

by Daniels Trading

Economic skies continue to brighten as some of the most troubled areas of the world (the Euro zone and Japan) are beginning to show some improvement and the only major nations that appear to be degrading are Brazil and Russia.

by Daniels Trading

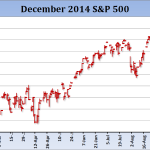

Recently a talking head on a major television business program was lamenting the ongoing pressure on equities due to the weakness in energy-related shares.

by Daniels Trading

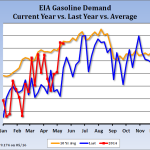

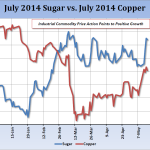

Negative headline news has reached a fever pitch, seasonal commodity price pressure remains in place, adverse Dollar action dominates, and perhaps most importantly, the international economic outlook continues to deteriorate.

by Daniels Trading

In retrospect, the sharp slide in physical commodity prices was well deserved, what with global macroeconomic sentiment eroding in the wake of signs of lost momentum in the US recovery, threats of additional sanctions against Russia, and perhaps most importantly, a soaring US Dollar.

by Daniels Trading

It would seem like US and global equity markets have finally come to grips with the less than anticipated rate of recovery, the fear of overvaluations and a rising measure of uncertainty toward the Middle East and oil prices.

by Daniels Trading

It seems that every positive report is matched up with a disappointing one, and with residual strength in Treasuries emerging at the drop of a hat, we think the marketplace has become a little jaded to actual recovery progress in the US.

by Daniels Trading

Global economic progress is apparently faltering, and noted fund managers are warning against having “too much equity market exposure.”