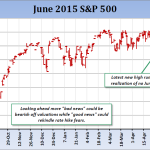

The S&P 500 took 27 years to increase by $2,000 (going from $300 in 1990 to $2,300 in 2017). Just last week, the equity index notched another $2,000 in less than an eighth the time.* This exponential rise has been cause for uneasiness and questions among investors.