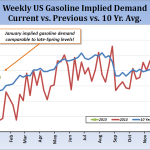

A number of central banks have implemented fresh easing efforts, German and European economic prospects have shown some minor improvement, and the prospect of lingering cheap energy prices is starting to offer global consumers new confidence.

by Daniels Trading

A number of central banks have implemented fresh easing efforts, German and European economic prospects have shown some minor improvement, and the prospect of lingering cheap energy prices is starting to offer global consumers new confidence.

by Daniels Trading

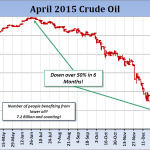

While we think the bear case for the global economy is already overstated, more long liquidation selling in crude oil is possible.

by Daniels Trading

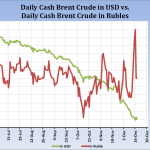

An impressive January rally in gold, a shift from a spec and fund net short position to a net long in US Treasury Bonds and a dramatic downside extension in the Canadian Dollar on its monthly charts suggests that global economic sentiment is factoring in a fall back towards recession.

by Daniels Trading

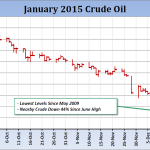

Global Negative Sentiment in many ways has probably already exceeded rationality. To the bears’ credit, unrelenting declines in crude oil, copper and equities justifies some fear of slackening demand.

by Daniels Trading

Recently a talking head on a major television business program was lamenting the ongoing pressure on equities due to the weakness in energy-related shares.

by Daniels Trading

The events in the second half of 2014 will do more to stimulate the global economy than all the central bank and governmental efforts combined.

by Daniels Trading

Sometimes the problem with a cure is that it takes too long to work. In the case of sagging crude oil market, it appears that it has become daily confirmation that the global economy is slowing down.

by Daniels Trading

The ongoing fear of global deflation just doesn’t fit with most of signals flowing from the marketplace.

by Daniels Trading

Global economic activity remains disappointing, but medicine in the form of another wave of central bank easing, cheaper energy prices and currency exchange windfalls for the weakest areas of the developed world are in place.

by Daniels Trading

While the pace of the world economy remains disappointing to most commodity markets, a long list of central banks are exhibiting a commitment to a return to growth.