The Chinese economy continues to be a weight around the neck of many commodities, but another weight, in the form of the US Fed, comes into focus for the coming week.

by Daniels Trading

The Chinese economy continues to be a weight around the neck of many commodities, but another weight, in the form of the US Fed, comes into focus for the coming week.

by Daniels Trading

An important junction lies ahead as fears about China have returned to the marketplace despite two days of Chinese holidays finishing out the week.

by Daniels Trading

We won’t suggest that the recent lows in many commodities are solid, but value-hunt buying of copper assets by Carl Icahn, a $4.00 single-day rise in crude oil prices, and a 1,000-point, 2-day bounce in the Dow suggest that sentiment was overdone on a number of fronts.

by Daniels Trading

Bearish sentiment toward China, equities and commodities is clearly justified in the wake of ongoing evidence of slowing in China, consistent deflationary signals from the crude oil and copper markets, and weak global shipping rates.

by Daniels Trading

On one hand the Chinese currency debacle has tripped up sentiment, but on the other hand the markets have not shown progressive anxiety, and the shelf-life of the crisis appears fairly short.

by Daniels Trading

The challenges for physical commodities are slack global demand, the Dollar remains strong and commodity supplies are generally burdensome.

by Daniels Trading

by Daniels Trading

Once again it appears that deflationary sentiment has reached an excess level with respect to physical commodity pricing.

by Daniels Trading

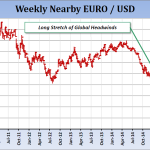

Despite the best efforts of the left, right and center factions in Greece, the situation there should drift from being a major influence on international financial markets to a second page, sad, social event.

by Daniels Trading

We have to predict a major agricultural and financial juncture just ahead.