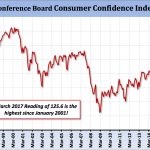

Despite the Treasury market’s strange reaction to the much better than expected US nonfarm payroll result for April, the overall outlook for the US and global economy was improved markedly by that data released last week.

by Daniels Trading

Despite the Treasury market’s strange reaction to the much better than expected US nonfarm payroll result for April, the overall outlook for the US and global economy was improved markedly by that data released last week.

by Daniels Trading

Consumer spending in the US grew at a 0.3% rate in the first quarter, the smallest increase since the fourth quarter of 2009.

by Daniels Trading

We hope that the Fed isn’t wrong about the recovery continuing, and we hope that the weak US data is a temporary trend and that the US economy is merely taking a pause.

by Daniels Trading

The US data has been patently discouraging; the Trump administration continues to squander political capital; and the prospect for pro-growth policy initiatives continue to be pushed further and further into the future.

by Daniels Trading

All things considered, it is clear that the global economic track has softened and has become a disappointment after the optimism that followed the US election.

by Daniels Trading

The steep drop in many commodity market sectors could be nearing an end as a little less volatility in financial markets, a more positive tilt to the Chinese and Indian economies and less safe-haven investing could leave the US economy in good shape going forward.

by Daniels Trading

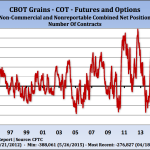

The spec and fund net long of 20 nonfinancial commodities has come down significantly in March (down roughly 650,000 contracts), but it remains at lofty levels.

by Daniels Trading

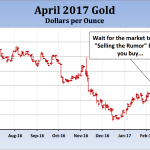

While the inevitable happened in the March FOMC meeting, the reaction in the dollar was very surprising and was modestly supportive to a number of commodities.

by Daniels Trading

It would appear that the markets are locked and loaded for a March 15th rate hike, with some players suggesting an increase in probability that there will be three hikes this year.

by Daniels Trading

The most important developments this past week were a market-perceived delay in the timing of the next US rate hike, another failed rally in the dollar, and upside breakouts in gold and silver off the latest wave of US/Chinese trade war fears.