Are you looking for a trading program to follow? CLICK HERE TO SIGN UP FOR A FREE TRIAL OF THE SWINE TIMES

Happy Memorial Day hog traders. I hope your day is full of remembrance, relaxation and hopefully some pork!

Our positions had a good week last week, lets hope we can see things continue as the heat gets turned up with June going off the board and with the summer weather season upon us.

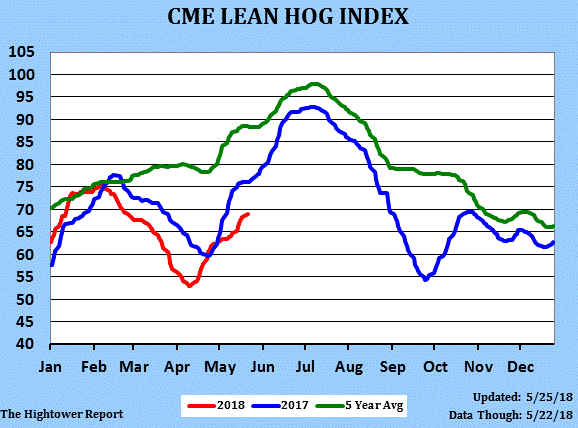

The July market traded much of the week trading lower, but found really solid demand at the back end of the week to bring it back to unchanged. Fund demand is apparent as folks move positions from June to July. The CME index traded at the best levels since February, up about 15 dollars from the early April lows. Seasonally, we should see this rally continue as the 5 year averages and last years index both traded higher into the midsummer, well above the late winter, early spring highs. As of right now the index remains well below winter highs. Last week was a decent week for our positions; the July/Aug spreads are up more than 1.00 from our entry. We expect that spread to increase, as you can read about below. We are optimistic about the bull spreads this week, but remain very cautious about being outright long given the China/NAFTA story that has not resolved itself yet.

Current positions

Long 2 units of July hogs

Short 3 units of August Hogs

Long 1 Unit of October Hogs

Looking into next week:

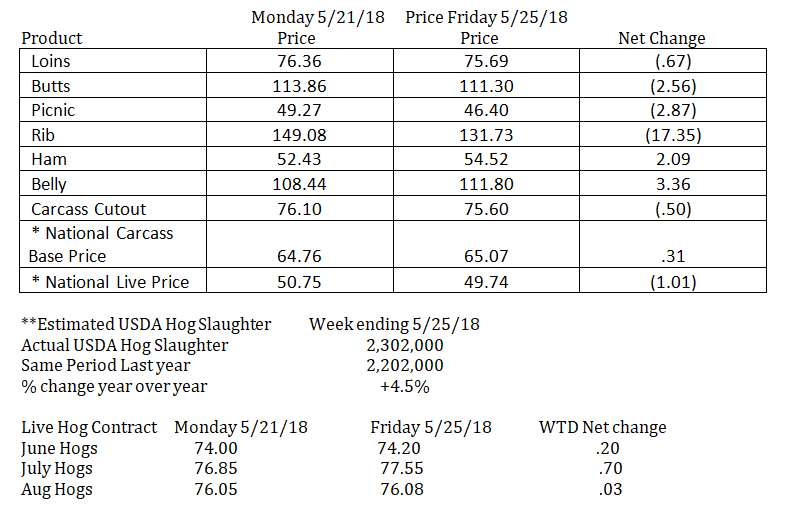

- The story next week will be primarily belly driven in terms of the cutout. We do not think it’s a question of if bellies will trade higher, its more about how much and for how long can they sustain a rally. Time will tell, but we do know there will be more bellies coming out of the freezer to be defrosted and processed after Memorial Day than there were prior to the Memorial Day weekend. This should be a limiting factor but my sources within the industry tell us they wouldn’t be surprised to see bellies top around 125-130, from the 111 where we traded Friday. This would be supportive to the cutout and packer margins.

- Hams should also as much as $3.00 to $5.00, possibly higher.

- Loins have been and continue to be a disappointment, while we think they will rise, albeit modestly, but for the short term the loins are more of a drag to the cutout rather than supportive.

- Butts will most likely be similar in price action as the loins, but could still be a value to the export markets.

- The major hurdle the industry faces going forward is the fact that the weekly slaughters will still be 1-2% higher than a year ago. Couple that with an increase in beef cuts and broilers, there is a lot of protein to be had and the retailer will not be inclined to chase rising prices in cuts.

How we trade this

- We continue to like the bull spread long LHN/LHQ, look for recommendations this week to take profits around 2.00. We have double the amount of positions as we do bear spreads at the back end, the gains should be pretty solid if you took the recommendation verbatim a couple of weeks back.

- We also like the bear spread of LHV/LHQ at $13.00 or better with the objective of taking profits when this spread comes in to $10.00 or narrower.

- We also recommend doing both of these spreads as a ‘butterfly spread’ with the wings of long LHN and LHV and short the LHQ’s. This spread does help minimize exposure in volatile markets. Once the cash hog market starts to top out we plan to add to the LHQ short leg of the spread and becoming net short August hogs. Keep this in your mind for down the road.

- Packer margins are good and this favors bull spreads LHN/LHQ spread, which is why we are trading this with more leverage than the bear spreads. Please note once again we need to remind out readers that we are trading for a short term ‘bull’ spike in a long term bear market.

- Now that Memorial day is behind us, the row crop weather factors will become more of an issue. Corn is trading at 3 year highs for this time of the year. Pay attention to the Corn Belt weather forecasts, if you see 90 degree temperatures predicted, be aware that this could cause cash hog bids to increase, so be prepared to adjust your positions accordingly. There is a ridge a couple of weeks out that looks to be targeting the western plains, if this would move east we think commercials could start getting nervous and the buy side could see a push of short covering and new long positions.

- If producers do not stay current in their marketing as we go through this summer, there could be a sharp drop in prices for live hogs this fall. We will need to be watching live weights to see if they track seasonally and continue to go down or slow and steady out and start to add weight sooner than is seasonal indicting marketing’s have slowed.

- The plan over the next few weeks is to trade lightly in these bull spreads and prepare for a break coming in the back half of the summer.

- Call us if you have any questions.

Below is how the weekly product market changed for the week ending 5/25/18.

*USDA National Hog and Pork summary

** Expressed in thousand head

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.