The track of the US economy is important, but seeing a trend of better economic news from China is probably more important to physical commodity markets.

by Daniels Trading

The track of the US economy is important, but seeing a trend of better economic news from China is probably more important to physical commodity markets.

by Daniels Trading

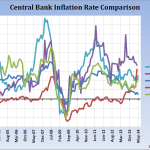

The Fed managed to extend the pattern of new highs in global equities by maintaining its old stance and simply reiterating the prospect for rates to remain at low levels for an extended period of time.

by Daniels Trading

It would seem like US and global equity markets have finally come to grips with the less than anticipated rate of recovery, the fear of overvaluations and a rising measure of uncertainty toward the Middle East and oil prices.

by Daniels Trading

Macroeconomic recovery prospects were improved by the actions of the ECB last week, even if the action was months and perhaps years late in coming.

by Daniels Trading

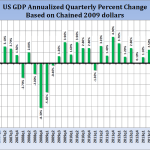

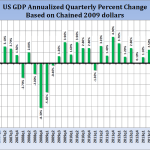

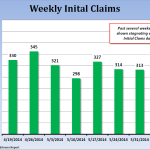

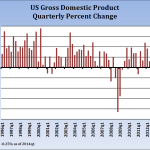

Another month has drawn to a close, and US economic data has continued to be mixed and largely disappointing to the trade.

by Daniels Trading

It seems that every positive report is matched up with a disappointing one, and with residual strength in Treasuries emerging at the drop of a hat, we think the marketplace has become a little jaded to actual recovery progress in the US.

by Daniels Trading

Global economic progress is apparently faltering, and noted fund managers are warning against having “too much equity market exposure.”

by Daniels Trading

by Daniels Trading

Into the end of April, the US economy was clawing its way toward self-propagating growth, but clearly recent growth has not been strong enough.

by Daniels Trading

Going into the end of April, the economic outlook for the Chinese economy is “unchanged”, the outlook for the US is only minimally improved, and the outlook for the Euro zone is better than most expectations.