The June E-mini S&P 500 is rebounding this morning following weakness to start the week off the past 2 trading sessions. I find this bounce higher on bullish momentum as reassuring to my current view. TAS Navigator and TAS Ratio now confirm with the TAS Vega breakout higher seen below on my chart. In agreement to my longer-term bullish view on equities, I think this is a good opportunity to front-run a new potential test of the All-Time Highs in this market. I recommend the following:

BUY ESM21 @ 4140.00 or Better

SELL STOP @ 4110.00 ($1,500 risk per contract) = Under Today’s Low and 4-Hour Support

SELL LIMIT = 4200.00 ($3,000 profit per contract)

The MICRO contract is 1/10th exposure per contract = $150 risk / $300 profit per micro contract

*Risk/reward are calculated before commissions and fees*

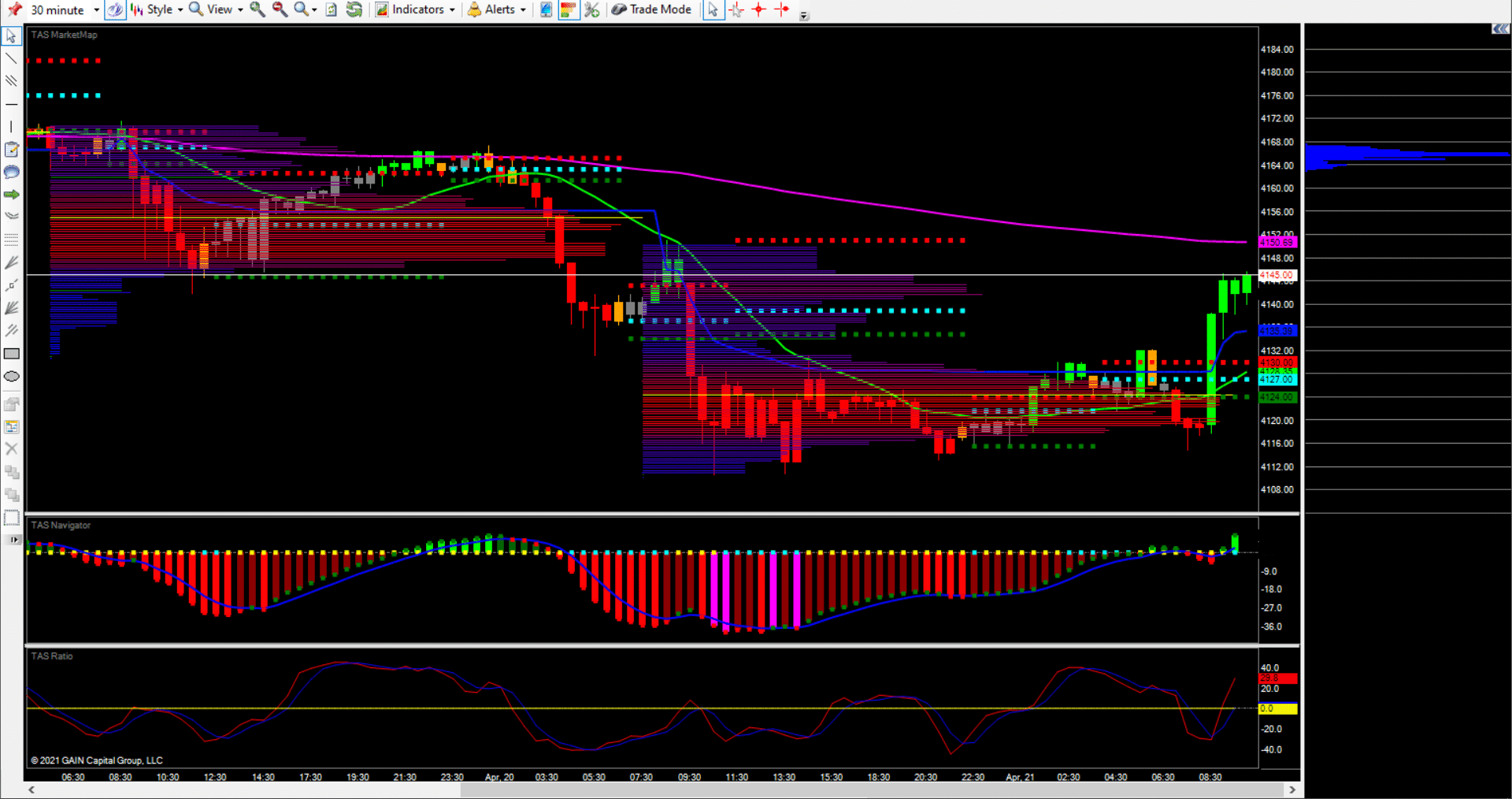

30 MIN ES – Bullish Navigator & Ratio Now Agreeing with Breakout in Vega = BUY

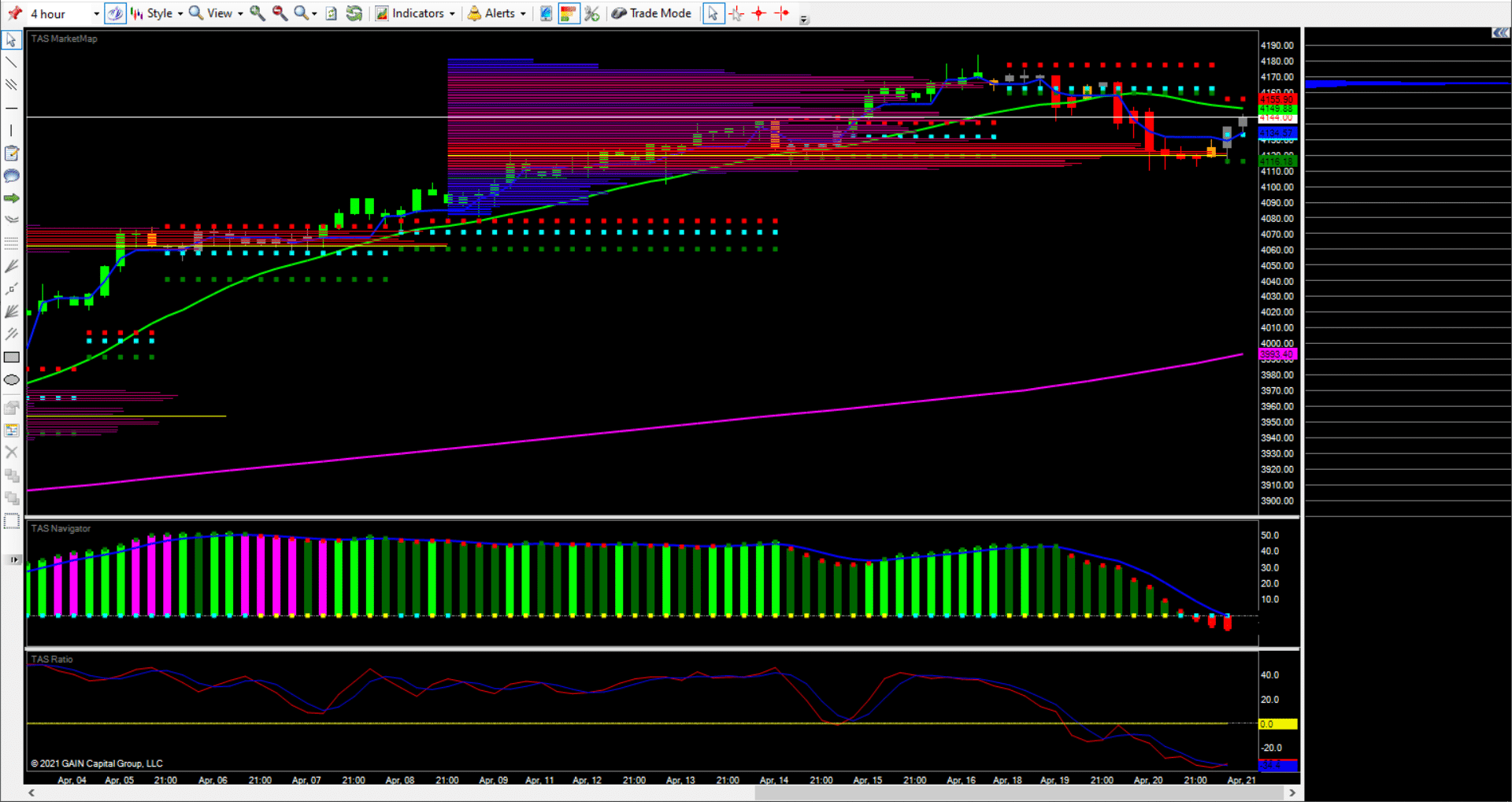

4-Hour ES – TAS Ratio Crossing Over and Risking Down to Under Support @ 4116

Jace Jarboe | Futures & Options Broker:

Phone: 312-706-7639

Email: jjarboe@danielstrading.com

Broker Bio

Find More Opportunities in E-mini S&P 500 Futures Like This One

We hit our target for this trade, but navigating today’s markets can be tough for new and experienced traders alike. If you’re actively trading futures and are looking for the insight, education, and empowerment to make better trades, join the Jarboe Trading Journal for the guidance you need. In the meantime, download my free Introduction to E-mini Equity Futures guide to expand your knowledge of the e-mini markets and prepare for the next opportunity.

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.