Good morning friends

- FOMC day. Any indication that interest rates may not stay at zero forever should send shocks through out risk assets. The phenomenon that is Gamestop is something the fed is likely to address, maybe not today but at some point. Its beginning to become clear to me the challenges the FOMC and Treasury face to stimulate the economy but do it in “the right way”. That will have ramifications.

-

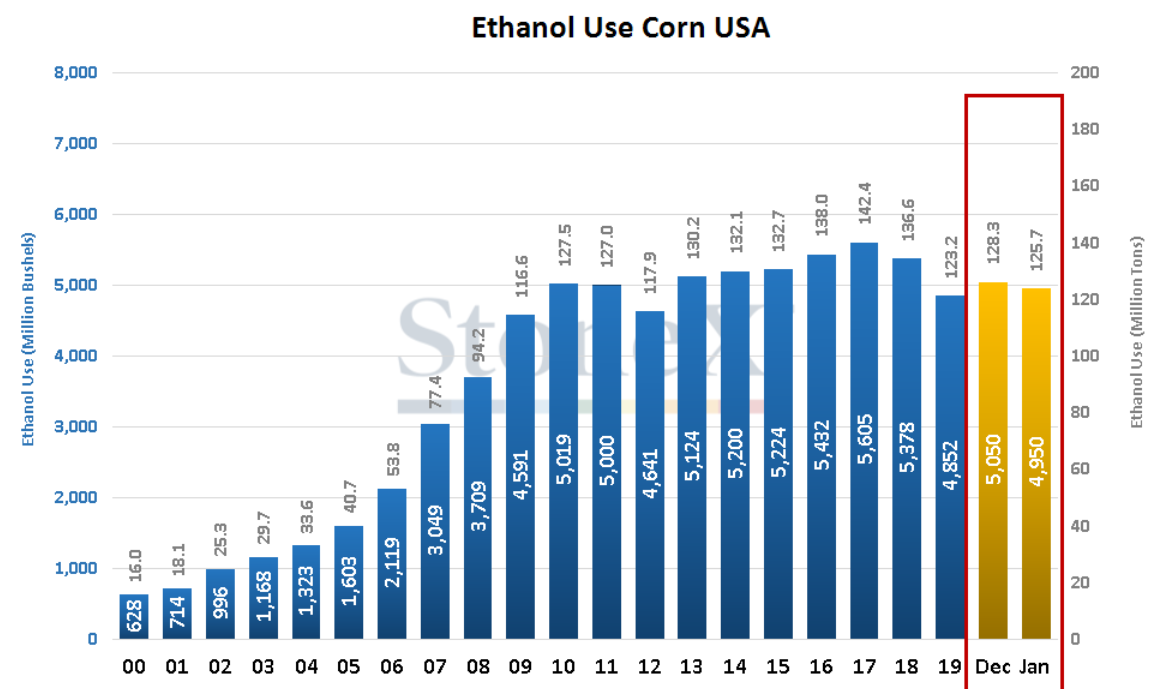

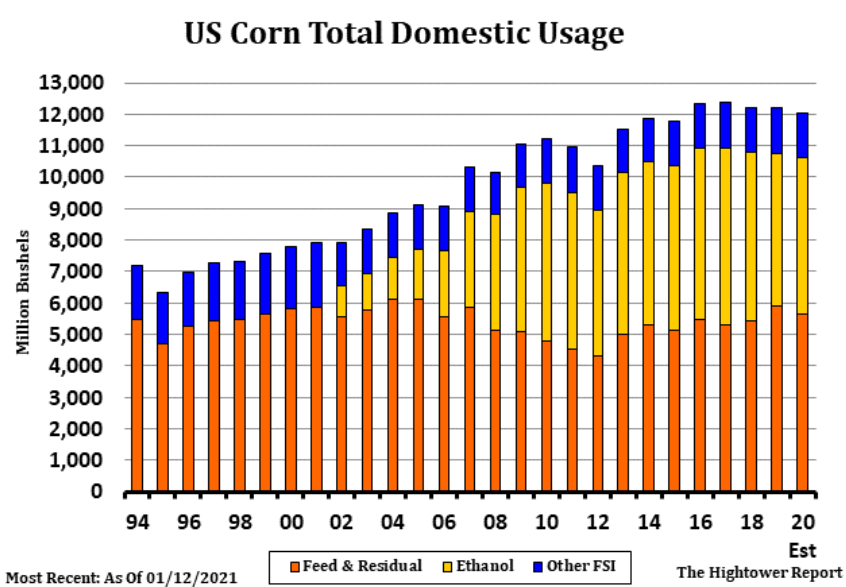

ADM announced China bought 200 million gallons of ethanol for Q1 delivery. If this is the start of a trend, its a game changer. Until yesterday, the market was counting on ethanol margins tightening at these prices to ration demand. That may not be the case with the Chinese helping out.

-

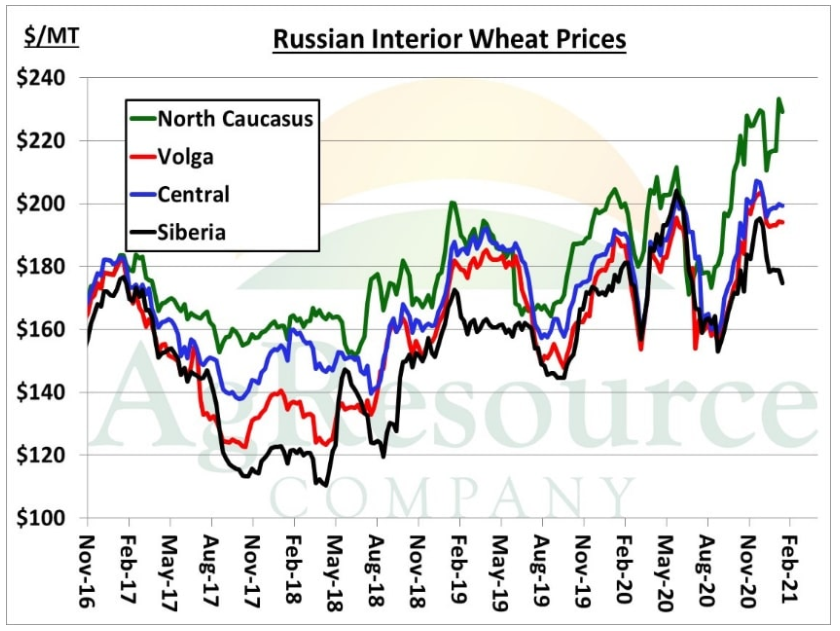

Russian export taxes are having a mixed effect. Producers who hold supply in Russia are not lowering offers, buyers at the ports are simply paying the tax. This is bullish for replacement supply like the US. I expect the US supply to catch a bid somewhere in N. Africa sometime this year. I do not see any weather problem priced into the July contracts yet. I promise, you will know when the world is concerned with wheat supply. Its not happening at 6 dollars. We will get a new wheat crop conditions report for the KC region next week. Eyes will also be on the next GASC tender.

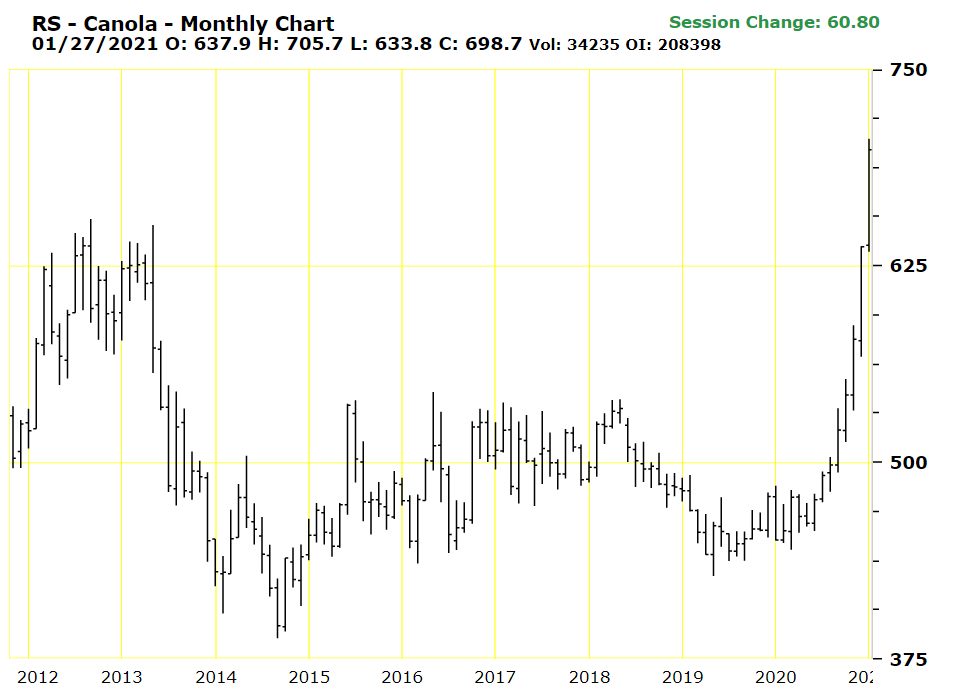

- Canola futures closed limit up for the second day in a row. The edible oil market remains on fire. I would look at upside calls in bean oil if you are a speculator. The market is fully inverted. The March delivery is going to be nuts, especially if the Brazilian and Argentinian transportation strikes would pop up.

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved