In retrospect, the recent sharp declines in equity prices and significant pressure on industrial commodities were justified by disappointing US scheduled data and the Fed’s move to notch interest rates upward.

by Daniels Trading

In retrospect, the recent sharp declines in equity prices and significant pressure on industrial commodities were justified by disappointing US scheduled data and the Fed’s move to notch interest rates upward.

by Daniels Trading

The good news is that a series of potentially serious geopolitical issues were traversed recently without sustained damage to the global economy or investor sentiment.

by Daniels Trading

By many measures the world economy continues to recover. The pace is apparently disappointing to commodities but not to equity markets.

by Daniels Trading

We hope that the Fed isn’t wrong about the recovery continuing, and we hope that the weak US data is a temporary trend and that the US economy is merely taking a pause.

by Daniels Trading

The US data has been patently discouraging; the Trump administration continues to squander political capital; and the prospect for pro-growth policy initiatives continue to be pushed further and further into the future.

by Daniels Trading

The steep drop in many commodity market sectors could be nearing an end as a little less volatility in financial markets, a more positive tilt to the Chinese and Indian economies and less safe-haven investing could leave the US economy in good shape going forward.

by Daniels Trading

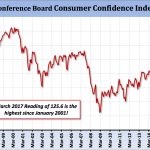

It would appear that the markets are locked and loaded for a March 15th rate hike, with some players suggesting an increase in probability that there will be three hikes this year.

by Daniels Trading

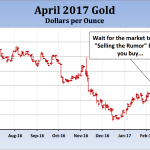

The most important developments this past week were a market-perceived delay in the timing of the next US rate hike, another failed rally in the dollar, and upside breakouts in gold and silver off the latest wave of US/Chinese trade war fears.

by Daniels Trading

Just when it appeared that the reflation play was being reversed, the new US Administration managed to return its focus to pro-growth policy initiatives.

by Daniels Trading

The outlook for China seems to have improved enough for them to raise short-term interest rates. In the wake of this general progression, growth-sensitive industrial commodities like crude oil and copper have already benefited.