Rarely do traders buy a stock or currency at the absolute lowest price, and so the conversation over whether or not to buy should come down to whether or not you still see upside.

by Frank Kaberna

Rarely do traders buy a stock or currency at the absolute lowest price, and so the conversation over whether or not to buy should come down to whether or not you still see upside.

by Daniels Trading

This has been a big year for the U.S. dollar (USD). The onset of the COVID-19 pandemic brought sweeping government stimulus and unprecedented policy moves from the U.S. Federal Reserve (the Fed). Subsequently, U.S. dollar devaluation became a primary theme throughout the second and third quarters of 2020. As we move into late 2020, experienced… Read more.

by Daniels Trading

Please log in to view this content.

by Frank Kaberna

The US dollar (USD) is in a bit of a downward spiral in recent trade as it closed lower yesterday for the thirteenth time in the last seventeen trading days. More than 6% off its highs of mid-March, USD has fallen at the hands of a few different characters that mainly include the Australian dollar… Read more.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

It could be a very volatile week ahead as the market deals with factors that could slow US economic growth in the short term.

by Daniels Trading

The Fed symposium in Jackson Hole failed to offer any distinct direction on the state of the US economy, but recent Fed commentary suggested that a government shutdown off the budget ceiling battle and the possible effects from Hurricane Harvey could impact policy decisions next month.

by Daniels Trading

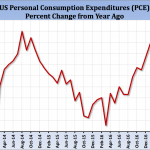

Despite the very disappointing US nonfarm payroll report for the month of May, the US and global economies continue to recover, albeit at a slow pace.