Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

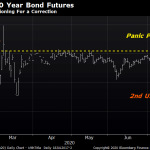

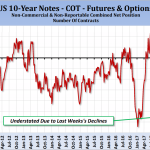

The old adage that “what doesn’t kill you makes you stronger” applies to the prospects of a return to inflation. Clearly the latest Fed hike and continuation of hawkish views did not produce any anxiety in the marketplace, and from our perspective there were no suggestions that…

by Daniels Trading

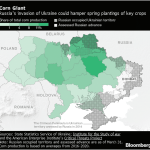

The number of global geopolitical/economic flashpoints has expanded dramatically,Given the ongoing gains in US equities, unrelenting strength in crude oil prices, and a lack of sustained concern over the possible derailment of the global economy by US/China trade salvos, one gets the sense that…

by Daniels Trading

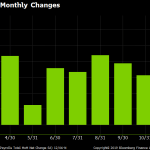

A major shift in the commodity environment might be in motion. Strength in energy prices has not only surprised the trade, it has also strengthened fund interest in the commodities. A potential massive inflation development could come…