Stopped out of the Currency positions, initiated a position in the Ten-Year Notes, and trailed the stop loss lower to reduce the risk on the Chicago Wheat position.

Ten Year Treasury Note

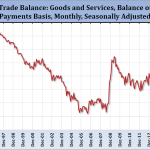

Signs of Slowing Inside and Outside the US

It seemed like the initial threat to western markets was from China, but that threat has expanded with a lengthening pattern of slack US data.