Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

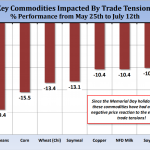

Judging by the reactions in the markets, sentiment on global equities has not been injured by the trade salvos, but sentiment on a number of demand-driven commodities has. With China posting yet another record trade surplus with the US for the month of June and…

by Daniels Trading

Apparently anyone predicting inflation will be wrong just because a large portion of the trade/economist community concludes that it “can’t develop” in the current environment. However, the dollar is rising, wages have been showing some gains, energy prices are…