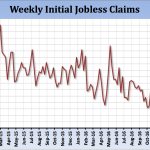

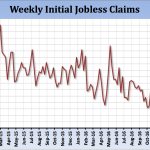

Recent US economic data has shown some signs of improvement, with industrial production, housing starts and jobless claims all indicating positive progression.

by Daniels Trading

Recent US economic data has shown some signs of improvement, with industrial production, housing starts and jobless claims all indicating positive progression.

by Daniels Trading

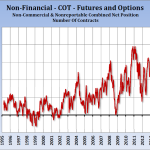

This week we have to wonder if the outlook toward the US economy is too lofty for the recent valuation in the Dollar.

by Daniels Trading

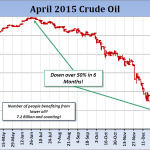

Recently a talking head on a major television business program was lamenting the ongoing pressure on equities due to the weakness in energy-related shares.