We have to predict a major agricultural and financial juncture just ahead.

by Daniels Trading

We have to predict a major agricultural and financial juncture just ahead.

by Daniels Trading

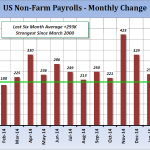

The US economy has bulldogged its way to growth in February, despite adverse weather, ongoing energy sector layoffs, adverse foreign exchange rate action and periodic talk of rising US interest rates.

by Daniels Trading

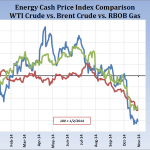

Recently a talking head on a major television business program was lamenting the ongoing pressure on equities due to the weakness in energy-related shares.

by Daniels Trading

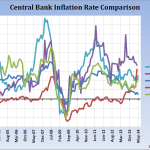

While the pace of the world economy remains disappointing to most commodity markets, a long list of central banks are exhibiting a commitment to a return to growth.

by Daniels Trading

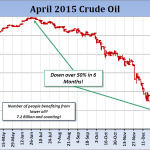

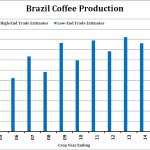

What have we learned in the month of October? We have learned once again that free markets work and that market forces, given time, will provide a cure.

by Daniels Trading

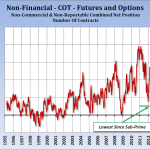

The spec net long in physical commodities continues to decline, fears of global slowing (particularly from Europe and China) are front and center, and the ever-strong US Dollar is adding into the bear case for commodities.

by Adam Nicholson

The outlook for the global economy has improved marginally, with a series of positive US data providing some respite from the generally discouraging economic news flowing from Europe and China.

by Daniels Trading

The outlook for the global economy has improved marginally, with a series of positive US data providing some respite from the generally discouraging economic news flowing from Europe and China.

by Daniels Trading

The markets are facing a repeat of “irrational exuberance.”

by Daniels Trading

The Fed managed to extend the pattern of new highs in global equities by maintaining its old stance and simply reiterating the prospect for rates to remain at low levels for an extended period of time.