Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

Global markets have not regained a “risk on” tone, but they are showing signs of looking beyond the turbulent events of the past few weeks.

by Daniels Trading

US economic data continues to be disappointing, Trump and the GOP are trying to do everything at once, and they appear to be putting off tackling fiscal spending and tax reform in favor of wading into the quagmire of health care reform.

by Daniels Trading

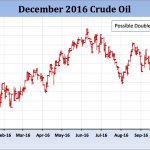

A strengthening US dollar and uncertainties in global stock markets have helped to drive some commodity markets lower over the past few weeks, and the possible appearance of a double top in crude oil has many macro-fund traders getting concerned about the outlook ahead.

by Daniels Trading

To hike, or not to hike, that is the question!

by Daniels Trading

Recent talk of fresh easing from the BOJ and BOE seems to have been largely discounted as ineffective, and that has prompted a revival of safe haven interest in gold and US Treasuries.