The Fed passed on hiking rates, but the lift to most commodity markets off that news was not very impressive, and this suggests that the path of least resistance is likely to remain down.

by Daniels Trading

The Fed passed on hiking rates, but the lift to most commodity markets off that news was not very impressive, and this suggests that the path of least resistance is likely to remain down.

by Daniels Trading

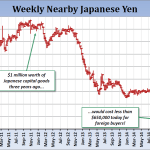

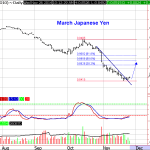

The recent retrenchment in bean oil, crude oil, sugar, corn, equities, cattle, gold, platinum, palladium and copper as well as significant rallies in Treasuries and the Japanese yen mostly started around March 14th, and some have labeled the period since mid-March as a “crisis.”

by Daniels Trading

While we think the bear case for the global economy is already overstated, more long liquidation selling in crude oil is possible.

by Daniels Trading

The ongoing fear of global deflation just doesn’t fit with most of signals flowing from the marketplace.

by Daniels Trading

Global economic activity remains disappointing, but medicine in the form of another wave of central bank easing, cheaper energy prices and currency exchange windfalls for the weakest areas of the developed world are in place.

by Matt Vitiello

Recently, I had a number of clients involved in a futures spread in the live cattle market. The idea behind the trade was to get long the cattle market heading into the summer by buying in the front month and selling in the back month – specifically, they were buying June Live Cattle and simultaneously… Read more.

The trading strategy of purchasing a deep out-of-the-money call or put option has been referenced as purchasing a “lottery ticket”. Both present an opportunity for profits but with a low rate of success. Depending on how far out-of-the-money the strike price and time remaining until expiration, it would take a considerable move in the underlying futures market to profit.

by Scott Hoffman

Doji bars are one of the single most useful single bar patterns that any trader can identify. They can be used for entries, exits, or to determine position bias. “Doji” is a term used by Japanese candlestick chartists that refer to a bar where the open and close of a bar are in close approximation to each other.

by Craig Turner

When it comes to Futures Spreads, many traders ask us what is the benefit of spreading futures contracts. They want to know why we often choose to spread futures contracts instead of either being long or short a single futures contract or option, or use option spreads instead.

You must be logged in to post a comment.