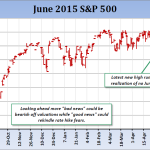

While the hype and equity market euphoria from the election has started to moderate, a shift in economic sentiment from inside and outside the US was already in motion, and that could allow for a “risk on” vibe until the markets get closer to the mid-December FOMC meeting.