Despite the best efforts of the left, right and center factions in Greece, the situation there should drift from being a major influence on international financial markets to a second page, sad, social event.

by Daniels Trading

Despite the best efforts of the left, right and center factions in Greece, the situation there should drift from being a major influence on international financial markets to a second page, sad, social event.

by Daniels Trading

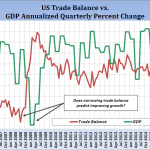

We have to predict a major agricultural and financial juncture just ahead.

by Daniels Trading

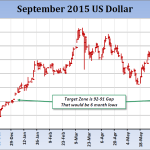

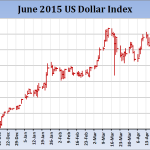

We think that a September US rate hike is off the table because of a lack of definitive forward progression in the US jobs sector. The unending Greek saga combined with a rising Dollar has created enough headwinds to keep the Fed on the sidelines until later in the year.

by Daniels Trading

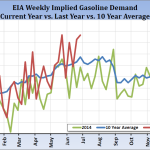

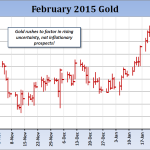

Things are changing on the macroeconomic front, as instead of patently deflationary fears, sentiment is starting to anticipate normal inflation ahead.

by Daniels Trading

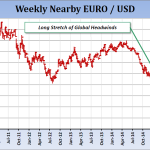

As we indicated last week, outside market forces appear to be reaching a zenith, and with the noted letdown in the dollar in June, the hope of sidestepping a financial debacle in Europe, and the promise of ongoing aggressive QE from the ECB, it would not be surprising to see a persistent improvement in global economic sentiment.

by Daniels Trading

In all markets, there are inside market forces and outside market forces. What outside forces are affecting physical commodity prices?

by Daniels Trading

Macroeconomic conditions are improving, and the Fed Chairman feels confident enough to weigh in with her own “irrational exuberance” moment with respect to equity valuations.

by Daniels Trading

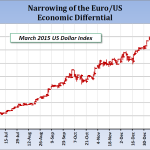

A number of central banks have implemented fresh easing efforts, German and European economic prospects have shown some minor improvement, and the prospect of lingering cheap energy prices is starting to offer global consumers new confidence.

by Daniels Trading

An impressive January rally in gold, a shift from a spec and fund net short position to a net long in US Treasury Bonds and a dramatic downside extension in the Canadian Dollar on its monthly charts suggests that global economic sentiment is factoring in a fall back towards recession.

by John Ryan

All eyes are on the debt market these days. Volatility in the debt market is forcing investors and traders to shift their assets as the global markets spin out of control. News of Greece defaulting on its bonds, the US raising its debt ceiling, and economic activity in the Far East have traders and investors… Read more.