Please log in to view this content.

by Daniels Trading

Please log in to view this content.

by Daniels Trading

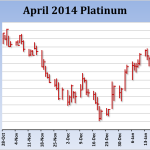

The number of global geopolitical/economic flashpoints has expanded dramatically, and the potential for a major risk-off event is growing. Given that US/China trade tensions are escalating and given China’s outsized impact on physical commodities, the threat against…

by Daniels Trading

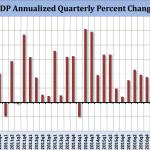

On balance, global economic conditions improved over the last week, with a slight tempering of trade tensions, strong US growth readings, and ideas that a number of central banks are seeing conditions that will allow them to plan stimulus exits…

by Daniels Trading

After a slight brightening of the skies, the US Fed has stepped in and stoked recovery efforts further with a reduction in the number of anticipated 2016 rate hikes and a nod to the importance of international headwinds in their future policy decisions.

by Daniels Trading

Despite the best efforts of the left, right and center factions in Greece, the situation there should drift from being a major influence on international financial markets to a second page, sad, social event.

by Daniels Trading

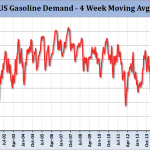

Looking at the action in stocks last week, we might develop some concern for the pace of the US recovery, especially in the wake of a soft December Non-Farm Payroll result, sub-par sales guidance from a couple of bellwether US companies and from fears that the Fed might continue to taper even in the face of uneven US data.