Shorted the Canadian Dollar futures contract and trailed the stop loss lower this week once to reduce the risk.

Canadian Dollar

Trade Spotlight: Futures – Weekly Summary: OJ, Canadian Dollar, Corn

Trailed the stop loss to lock in gains Purchased the OJ futures contract and trailed the stop loss to lock in gains. Stopped out of the Corn and Canadian Dollar contracts for profit. the Canadian Dollar position. Sold the Corn contract and already lowered the stop loss to reduce the initial risk.

Trade Spotlight: Futures – Weekly Summary: Canadian Dollar, Corn

Trailed the stop loss to lock in gains on the Canadian Dollar position. Sold the Corn contract and already lowered the stop loss to reduce the initial risk.

Trade Spotlight: Futures – Weekly Summary: Canadian Dollar

Trailed the stop loss to reduce the risk on the Canadian Dollar position.

Trade Spotlight: Futures – Weekly Summary: Canadian, Feeder Cattle, Sugar

Shorted the Canadian Dollar futures contract. Trailed stop losses on the Feeder Cattle and Sugar positions to lock in gains and stopped out in both for a profit.

Breaking Down the Key Market Drivers of Canadian Dollar Futures

For currency traders, CME FX futures offer a collection of diverse products and opportunities. Based on popular forex pairs such as the EUR/USD and USD/JPY, FX futures give active traders the ability to gain currency market exposure via standardized derivatives contracts. One of the most popular CME FX listings is Canadian dollar futures (6C). Based… Read more.

Trade Spotlight: Futures – Weekly Summary: Canadian, Bean Oil

Stopped out of the Canadian Dollar position for a loss and the target triggered on the Soybean Oil position.

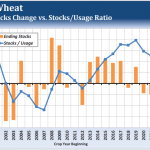

Rallies in Commodities and Bullish Grain News Add to Inflationary Sentiment

Please log in to view this content.

Trade Spotlight: Futures – Weekly Summary: Currencies, Wheat, Notes

Stopped out of the Currency positions, initiated a position in the Ten-Year Notes, and trailed the stop loss lower to reduce the risk on the Chicago Wheat position.

Trade Spotlight: Futures – Weekly Summary: Currencies, Wheat

Trailed the stop loss lower on the short Euro FX position. Holding steady on the Canadian Dollar and Chicago Wheat positions.