The North Korean situation flared up again with fresh threats from their leader, and while the markets have taken these types of threats in stride before, there will be some anxiety that affects risk sentiment.

by Daniels Trading

The North Korean situation flared up again with fresh threats from their leader, and while the markets have taken these types of threats in stride before, there will be some anxiety that affects risk sentiment.

by Daniels Trading

The most important developments this past week were a market-perceived delay in the timing of the next US rate hike, another failed rally in the dollar, and upside breakouts in gold and silver off the latest wave of US/Chinese trade war fears.

by Daniels Trading

US economic data continues to be disappointing, Trump and the GOP are trying to do everything at once, and they appear to be putting off tackling fiscal spending and tax reform in favor of wading into the quagmire of health care reform.

by Daniels Trading

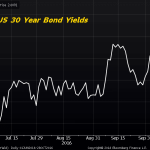

We are not sure if the signals being thrown by Treasuries this week are a sign of a longer term change or if we are “putting the cart before the horse.”

by Daniels Trading

We were a little surprised with the trading action over the last week.

by Daniels Trading

What we don’t know is the pace of the global recovery, but what we might know is that there is some measure of forward progress in the US, Europe and China.

by Daniels Trading

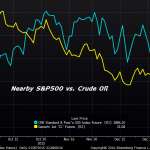

The Fed passed on hiking rates, but the lift to most commodity markets off that news was not very impressive, and this suggests that the path of least resistance is likely to remain down.

by Daniels Trading

We think that commodity markets were short-term and perhaps even intermediately overbought going into their recent highs.

by Daniels Trading

Several years ago, the amount of food consumed inside the home was surpassed by what was consumed outside of the home.

by Daniels Trading

Just when it appeared that sentiment had reached a trough, the crude oil market dragged commodities down even further.