Beyond the Spotlight is a weekly video released on Mondays that spotlights two or three markets that may become trading opportunities for the week ahead. This enables you as a subscriber of the Trade Spotlight advisory service to look ahead with us, while potentially creating additional trading opportunities for yourself. The week’s video linked below… Read more.

30 Year Treasury Bond

Trade Spotlight: Futures – Weekly Summary: British Pound & Bonds

Stopped out both the British Pound and Bonds positions on a Sunday overnight market rally.

Trade Spotlight: Futures – Weekly Summary: Pound, Bonds, Sugar

Stopped out of the Sugar position. went short the British Pound, and went long the 30-Year Treasury Bonds.

Beyond the Spotlight: December 07, 2020 (Pound, Bonds, Cocoa)

Beyond the Spotlight is a weekly video released on Mondays that spotlights two or three markets that may become trading opportunities for the week ahead. This enables you as a subscriber of the Trade Spotlight advisory service to look ahead with us, while potentially creating additional trading opportunities for yourself. The week’s video linked below… Read more.

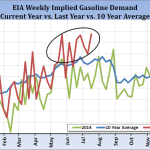

Forward Progress in the US Economy Has Disappointed

The “talking heads” and “talking fund managers” are suggesting that the rally in commodities is done, unjustified and poised to be reversed.

Growth in the Rest of the World Showing Signs of Improvement

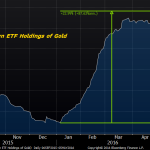

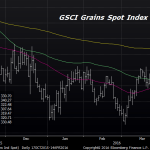

Just when it appeared that commodities were settling back on a deflationary track, leadership surfaced in fresh buying interest in gold, silver, platinum, soybeans, corn and crude oil.

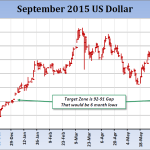

Current Sentiment in Favor of the Bear Camp

We continue to think that the current crisis lacks a pedigree, and industry leader Jamie Dimon (CEO of JP Morgan) would seem to concur, given that in the wake of stock declines he purchased shares of his company.

This Week’s Economic Outlook

Once again it appears that deflationary sentiment has reached an excess level with respect to physical commodity pricing.

Commodity Sentiment Anticipating Normal Inflation Ahead

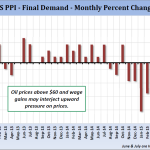

Things are changing on the macroeconomic front, as instead of patently deflationary fears, sentiment is starting to anticipate normal inflation ahead.

Change Is In the Air!

While the world continues to be disappointed with the rate of recovery in the US, Europe and parts of Asia, the skies are clearing, and signs of improving US Payrolls, strong global auto sales figures and rising energy prices suggest that the economy is moving back towards normal.