Play Turner’s Take Ag Marketing Podcast Episode 288

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

This week we take a look at inflation and why we are seeing substantial price increases for many goods and services. We also talk about Fed policy, high energy and ag prices, and they supply chain issues in the US and globally. Make sure you take a listen to the latest Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Macro Markets

Inflation in the US and global economy is has been a major theme of the macro markets lately. The Fed is open to tapering asset backed purchases but they don’t want to start raising interest rates until 2022. Money is flowing into commodities and crypto. Supply chain issues are keeping products from reaching the shelves and increasing prices at the same time.

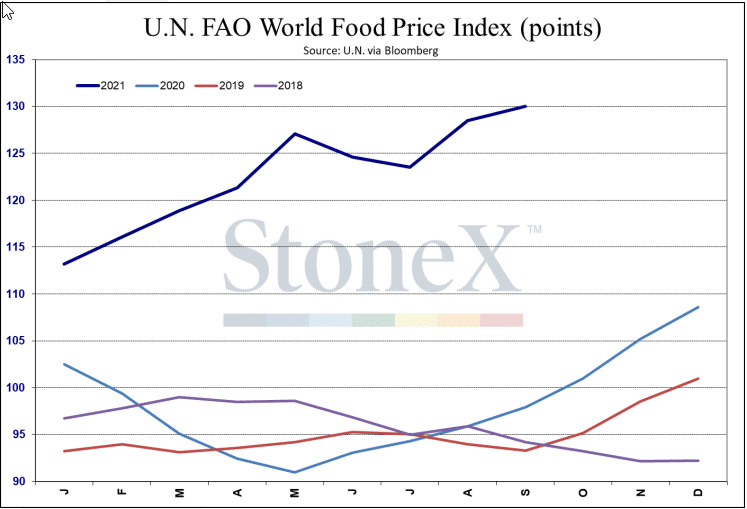

The Fed has recognized inflation is a real issue. Tapering asset backed purchases will be the first step in fighting inflation. Interests rate hikes in 2022 will be the second step. Solving supply chain issues will allow more supply of goods into the market and keep prices from rising due to low inventory. Analysts don’t see energy supply catching up with the demand until the spring so expect elevated energy prices to last until March. Ag prices will also stay elevated until we can get a large crop out of S America and the US next summer (see Food Price Index chart below).

Some of the inflation we are seeing has to do with US monetary policy. Some of the inflation is transitory but supply will eventually catch up to demand for energy and ag. The rest is due to government policy and regulations. The good news is a lot of these issues eventually work themselves out but it will take some time.

Energy

Crude oil can run to $95 if OPEC does not increase supplies. OPEC can change the market at anytime by increasing production. Right now they don’t have as much competition from US Shale producers as they did seven years ago. The US “drilled but uncompleted wells” are at 2017 levels. $85 crude oil is profitable for US Shale companies but you can’t turn on new production overnight. It is hard to see OPEC increase supply until they feel the threat of a non-OPEC nation coming in and taking market share.

Natural gas rallied today too. NG is trading in a range of $5 to $6.50. I don’t think we can break higher without colder temperatures. Keep in mind in the years we had tight NG stocks the market traded between $6 support and a record high $14. The majority of the time NG traded between $8 and $11. We have not seen those types of prices in years but 10 to 15 years ago it was a common occurrence.

Natural gas is still my favorite energy play heading into the winter. The trick is to find limited risk trades that don’t cost an arm and a leg in premium.

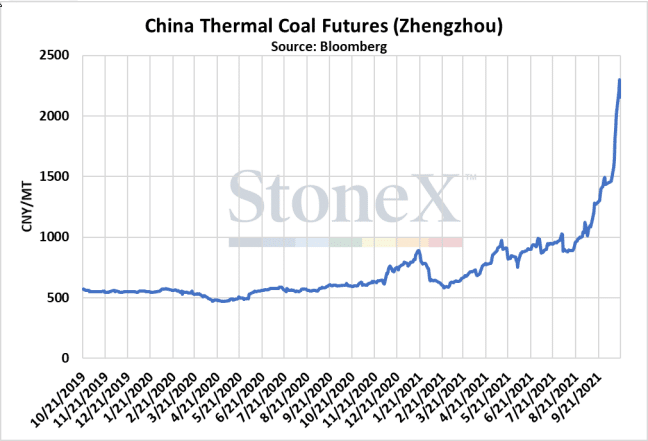

Finally, even coal is making a comeback. China is trying to source as much energy as possible as we head into the winter and they are turning to coal to hopefully make up the deficit. China committed to cleaner energy for the past 4 or 5 years. To see them switch back to increasing coal production is a strong sign of energy shortages in Asia this winter.

Grains & Oilseeds

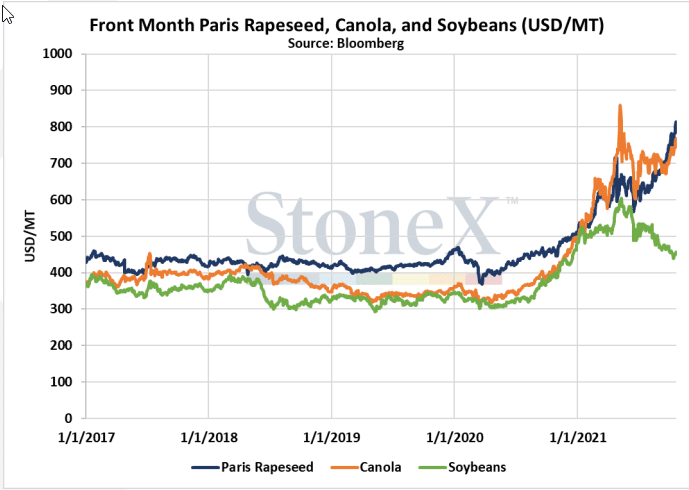

Global vegetable oils remains to be tight, canola and palm oil are soaring, and that is still supportive of soybean oil (see char below). Oats are trading over $6. Minneapolis Wheat has been over $10. Corn is well supported at $5. China is buying soybeans and that is supporting $12 beans.

I think new crop soybeans has a potentially bearish story. Due to high chemical and fertilizer prices I think we see more soybean and less corn acres in 2022. If soybean ending stocks get back to 500mm bushels then SX22 could be $10 by harvest next year. On the flip side corn could the winner if acres are a few million lower than expected.

I like making new crop soybean sales at $12.50. I also like buying back old crop corn. If fertilizer and acres are an issue, then that will show up in S. America first. March corn could be a good value in a La Nina weather market combined with fertilizer shortages.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.