Play Turner’s Take Ag Marketing Podcast Episode 282

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

Today on the podcast we talk about the possibility of new US lockdowns for August. It is starting to leak out the WH and CDC have been talking to governors about lockdowns starting in the second or third week of August. This is not set in stone but it is being considered. States do not have to follow WH/CDC recommendations but I’m sure those governors who are politically aligned with the administration will follow orders. If the US goes into a partial lockdown in the next few weeks we expect the markets to decline but as much as they did last year. The trade knows how to discount economic growth during covid lockdowns. Their is not as much market uncertainty as the last time around and the big funds, commercial producers, and corporate end users should all have some sort of playbook now. Make sure you check out this week’s Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Out of the Office Next Week

I am out of the office next week. If you are a client and need something please call my office at 312-706-7610 and one of the brokers on our trade desk will be able to help you out. It always helps covering brokers if you have your account number handy when you call. I tend to take my family vacation at the end of summer after the crops are generally made but before school starts. We took our family vacation during July 4th week back in 2012 and I think I spent half my time on the phone. Lesson learned!

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Weather

Rains in South Dakota last night and better chances for cooler weather and rain in the Midwest this weekend is weighing on the CBOT right now. The milder temps are a reason for natural gas to sell off today too.

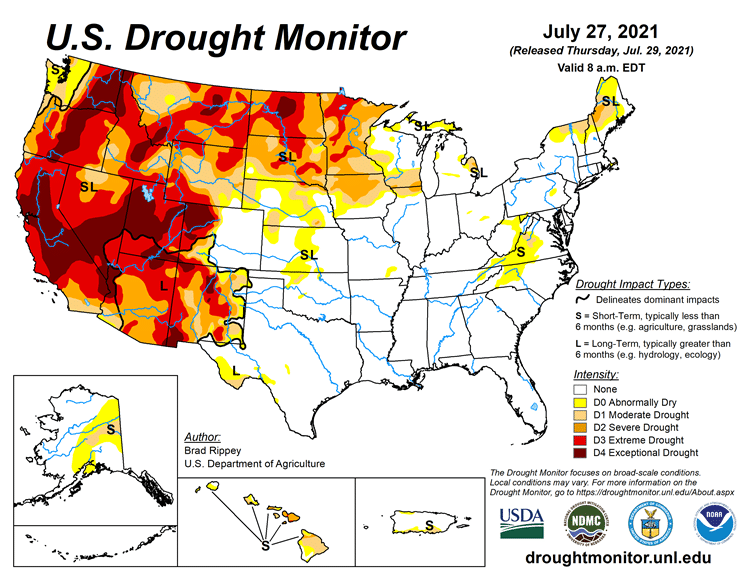

Below is the US Drought Monitor as of 7/27 (released yesterday). The eastern corn belt is going great. North Dakota is in extreme drought while MN and SD are in severe drought. N. IA is experiencing widespread moderate to severe drought.

The next WASDE is August 12th and there is a good change the USDA will make their first adjustment to yield estimates for corn. It is still too early for the USDA to comment on soybean yields.

Grains & Oilseed

If any farmers still have old crop corn and soybeans now is probably the time to sell. The marketing year ends Aug 31 and harvest isn’t that far away. As a rule Turner’s Take Ag Marketing has always sold the last of old crop by the end of August to make room for new crop.

For the markets to go higher in August we need to see worse than expected yields. I think we continue to see a broad chopping range between now and Labor Day. If the markets are going to rally it will be led by a demand rally at harvest. Corn and soybeans will have tight old crop ending stocks and also have projected tight new crop ending stocks. End users will want to secure product as it becomes available during harvest. Unless a consumer desperately needs grains or oilseeds now, there is really no reason to buy in the next few weeks in such a tight old crop market.

A few things to keep in mind while I am out of the office next week

- Crop ratings will probably be lower again on Monday, sparking new speculation on lower corn and soybean yields

- Shutdown talk may amplify if the WH/CDC is serious about lockdowns in mid August.

- The WASDE in Aug 12 and yield estimates will start hitting the wires at the end of next week.

I’m starting to sound like a broken record by I think we will see more of the same next week. Volatile markets trading in a wide range as traders debate weather, yields, lockdowns, and future demand.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.