Play Turner’s Take Ag Marketing Podcast Episode 281

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

The DOW was down 900 points midday and crude was $5 lower as the market took a “risk-off” approach to possible new covid related shutdowns. The grain markets were up in the overnight but could not fight off the selling in the energy and global equity markets. When the macro market stabilize we expect the grain markets to rally. Make sure you take a listen to this week’s Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Macro Market Meltdown

Stocks sold off today due to concerns of the covid delta varient spreading around the globe. The threat of economic shutdowns brought on the selling and the DOW was down over 900 points today. Crude oil also sold off due to the shutdown threat but OPEC didn’t help their cause either as they announced the end of production cuts by the end of September 2022.

We had talked about being short in energy in Turner’s Take incase of economic shutdowns but ultimately I think this ends up being a buying opportunity. The US and global economies are just getting going again. Any covid related shutdown will just pent up more demand going forward.

Keep in mind when you have 2nd and 3rd reiterations of a crisis or crash, it is rarely as bad as the first time around. If you think back the debt ceiling fights or when the Euro was at risk of collapse, the biggest shock to the system is the first time it happens. As with many things, the sequels never quite pack the same punch as the original.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Weather

Weather models over the weekend trended hotter and drier in the 10-14 and also in the longer term outlooks into August. Problem issues continue to be parts of the western corn belt, northern plains, and Canada.

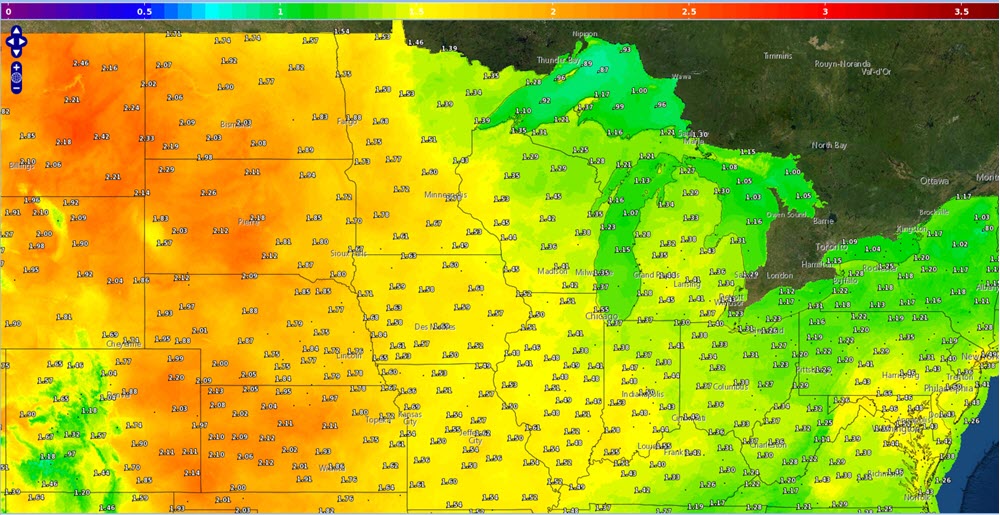

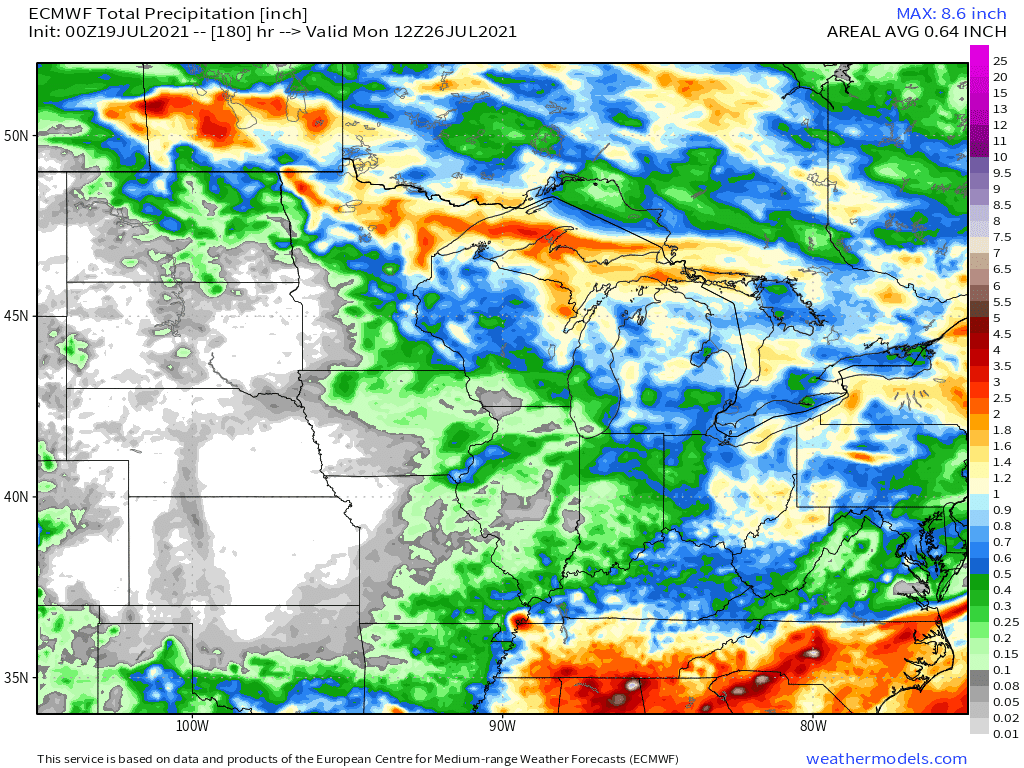

The images below are from BAMwx.com and weathermodels.com. They show the weekly evaporation rates are about 1″ to 2″ this time of year. They take a look at the predicted weekly rain accumulation. There is just not enough rain in the forecast for the western midwest and northern plains.

Grains & Oilseed

The big debate is if the above average yields in the eastern corn belt are enough to make up for the western corn belt and the northern plains. The constant back and forth in the market is causing trading fatigue amongst all market participants. Weather markets are a marathon, not a sprint, and we probably still have a couple of big events on the horizon. It will take a few weeks for the market to start to get a handle on corn production. The August WASDE and new crop corn yields will be highly anticipated. It could be another four to six weeks before the market has a better idea on national soybean yields.

Moral of the story is to expect more volatility with the bias to the upside. The situation in Canada is dire and the farmers I talk to north of the border are calling is a “100 year drought”. There are not many resting orders in the market (from spec traders, end users, or farmers) so any surprises or new announcements can have outsized market reactions. Once the outside macro markets calm down and stabilize, we could see the CBOT rally. As long as stocks and energy are diving lower it will be difficult for any risk asset to stay in the green.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.