Play Turner’s Take Ag Marketing Podcast Episode 267

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

Big news out of the Ag Forum today. Large multiyear Chinese demand for US corn might be a reality. In other news new crop stocks will start off adequate for corn and tight for soybeans next marketing year, which should not be a surprise to traders. If you want to hear more about our thoughts on new crop and why China is likely to be a big player in US corn for foreseeable future, then take a listen to this week’s Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Ag Forum New Crop

Below is US Corn and Soybean balance sheets for 2021/22. Click here for the full presentation. At 92mm acres and a 179.5 yield corn starts off at 1.552 billion ending stocks. This is an adequate supply of corn but runs the risk getting tight if demand surges or the crop is sub par. There is no reason for new crop corn to go below $4 but it is hard to argue for $5 or higher without a real weather scare this spring/summer.

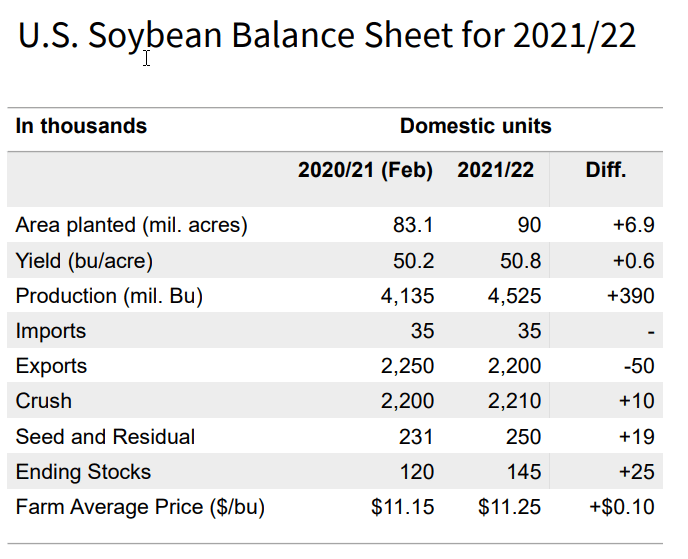

Soybeans is the second table below and with 90mm acres and a 50.8 bpa new crop ending stocks are only 145mm. That is tight and it could be a record starting point. Soybeans need acres and a good crop. This suggests soybeans should be elevated the next 12 to 18 months. Old crop should trade in a $12 to $15.50 range and new crop between $11 and $13.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Chinese Corn Demand

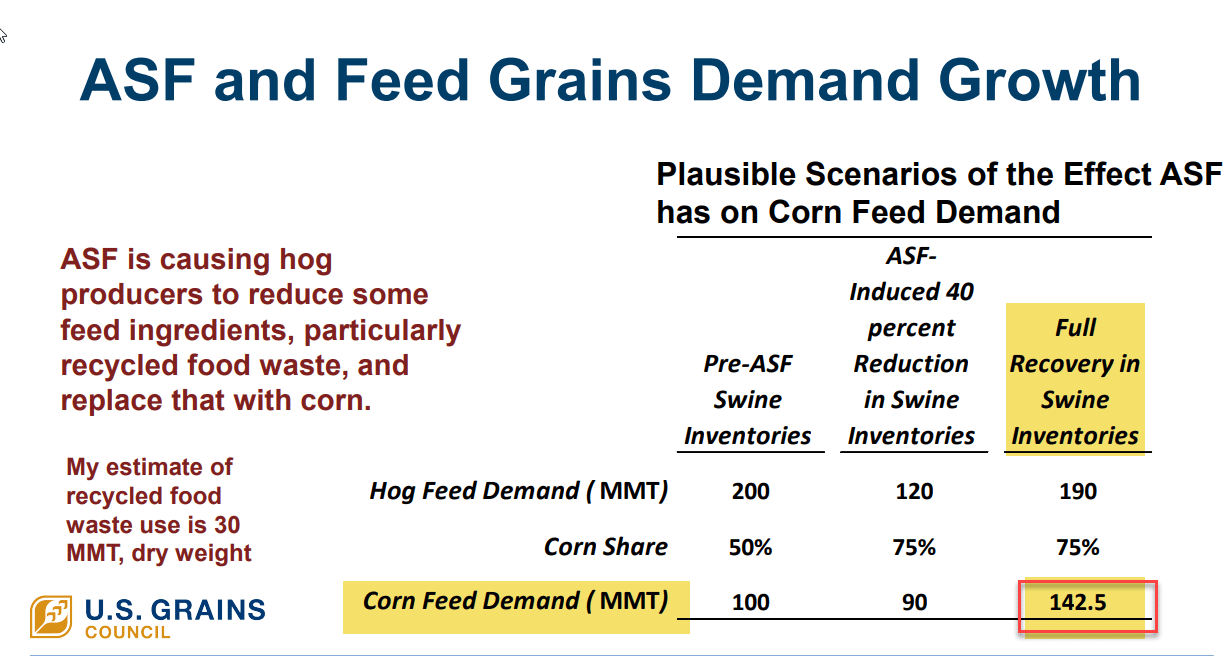

For me this was the big news out of the Ag Forum today. Click here for the full presentation. The USDA thinks there is a possibility that Chinese demand for US corn could stay strong for years. To combat a return of ASF, hog producers in China will need to feed more corn. It is believed that before the ASF crisis only 50% of hog feed was corn. A significant portion of hog feed was recycled food waste and that could have contributed to the spread of ASF in China. Food waste will be removed from feed and replaced by corn. The USDA think corn could make up 75% of feed post ASF.

Corn feed demand pre ASF was 100mm MT. When the Chinese swine inventory full recovers the USDA thinks the demand could increase to 142.5mm MT. China can’t grown all of that corn and a lot of it will have to come from imports. The US could be the biggest beneficiary of China using more corn for hog feed.

These are just estimates by the USDA. On the first page of the presentation they state no one knows how much corn China will buy and for how long it will last. However, the USDA does think this is a “systemic” change to their feed program and not a one-off year of strong demand.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Turner’s Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.