Play Turner’s Take Ag Marketing Podcast Episode 264

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

This week we go over the GameStop story in the equity markets, the possible bull market in energy for 2021, and how we are positioning ourselves in the grain markets. Make sure you take a listen to this week’s Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

GME Short Squeeze

The big story this week in the financial press is GameStop and the short squeeze retail traders are putting on professional hedge fund mangers. I’ll be shocked if this event is not made into a documentary or movie some day. If you are not up to speed on the story please click here for a good summary from CNBC.

I think the GameStop situation is a good reminder that even the pros need to have a good risk management strategy. If you are going to sell calls or short the futures, a stop or farther out long call is a good strategy against a black swan event. The same goes for long positions and short puts in leveraged markets. I have been talking a lot about replacing long futures with long calls or call spreads and short put spreads. It just makes the risk management a lot easier when you know you have a fixed risk on a position.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Energy Outlook

When a new president and administration comes in to the presidency, policies are expected to change. Energy is a great example. Keystone has been cancelled, energy production leasing on public land will be stopped, and the government is going to get tougher on fracking. Green energy policies will try to make up for the difference in production but I highly doubt it will be 1:1 for replacement. Crude was in the mid to high 40s around the election and now it is trading in the low $50s.

Supply and production capacity is likely to take a hit on the new energy policy. Economic growth and energy demand is likely to expand this spring and summer. The CDC estimates a majority of the US population will have access to the COVID vaccine by summer. We could have a situation where the economy is growing and energy supply is not.

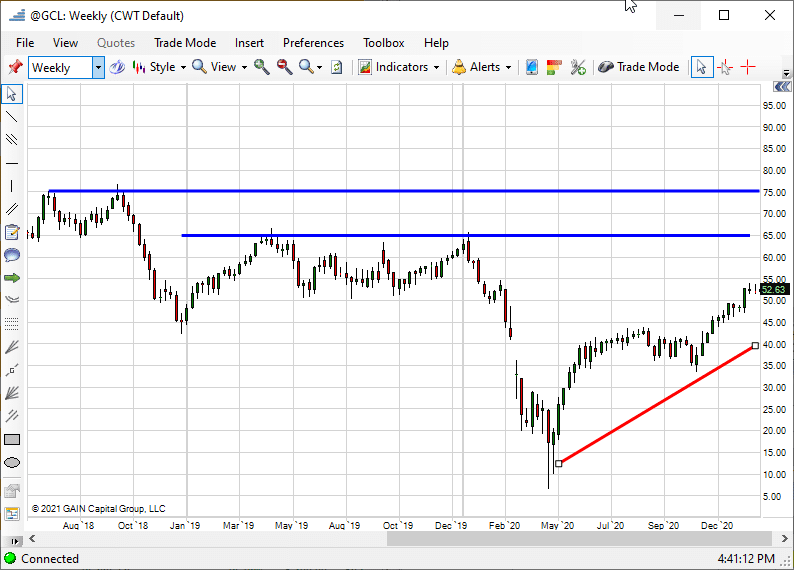

Below is a chart of weekly crude oil. I like buying call spreads and selling put spreads. The first target on the chart is $65 and then $75. These were the highs before COVID. If energy supply hampered by new regulations and demand grows this spring and summer, we could see a nice rally in the energy markets overall.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Weekly Crude Oil Chart

Corn & Soybean Export Demand

China bought 2 million metric tons of corn from the US over the past 48 hours. That is about 80 million bushels in demand. The USDA is going to have to increase exports in the next WASDE and we think ending stocks could eventually get to 1.3 or 1.2 billion. This should be supportive for old crop between now and the summer.

Soybean demand has also been strong. China bought another 132K of old crop today and 125K went to “unknown”. That is nearly 10 million bushels of old crop export demand. At this pace the US runs out of soybeans this summer and has to import from South America.

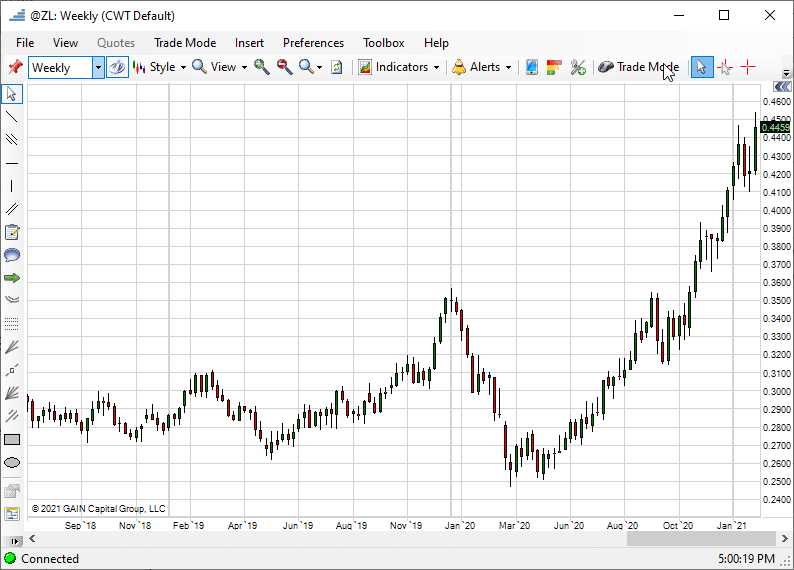

I still like being long the grain and oilseed markets. I think buying new crop call spreads and selling new crop put spreads could be easier on your health and margin account going forward as opposed to old crop futures. Soybean Oil made fresh highs today as Canola printed a record price. Global vegetable oil is still bullish.. Below is a weekly soybean oil chart and we are taking out the old highs. That is usually a bullish signal and it will be interesting to see if soybeans and corn can do the same.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Weekly Soybean Oil Chart

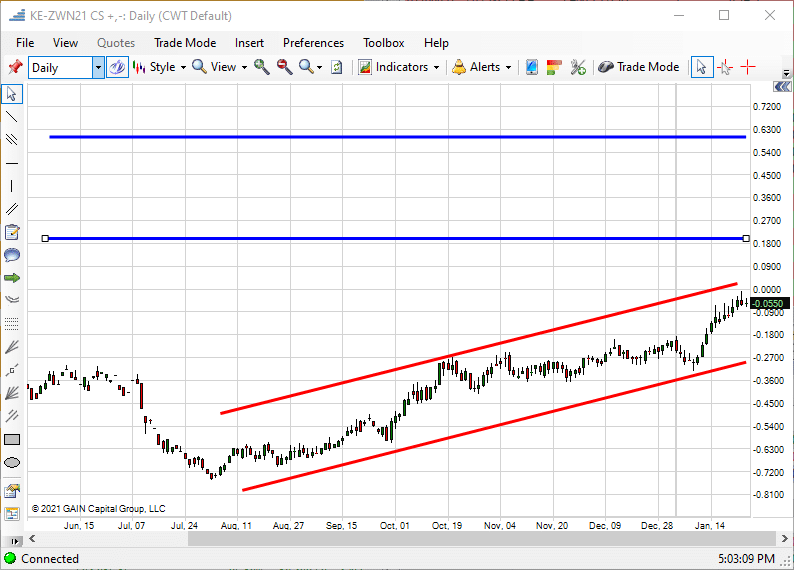

KC vs Chi Wheat

I still think KC vs Chicago wheat trades between 20 and 60 over in 2021. We are long July KC and short July Chi, which is the first new crop month for winter wheat. We are holding the position and I like adding on in a pullback. This trade will take time but over the next six months we see HRW stocks tighter than SRW ending stocks. That has not been the case for years and why SRW has been trading over HRW for so long.

HRW (KC) has a higher protein content and historically trades 20 to 60 cents over the lower protein SRW (Chicago) contract. SRW acres are expanding at a faster rate than HRW. Demand for HRW is stronger than SRW. Ending stocks should be tighter in HRW than SRW starting with new crop.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

July KC vs July Chicago Wheat

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.