Play Turner’s Take Ag Marketing Podcast Episode 263

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

Today we take a deep dive into soybeans and where we think old crop and new crop prices could be going. We also talk about soybean oil, corn, and the KC vs Chicago wheat spread. Make sure you take a listen to this week’s Turner’s Take Podcast

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Soybeans

We are still bullish soybeans but our range remains $12.00 to $15.50 based on the current carryout estimates. Rains are falling in South America and that should help stabilize the crop. The correction in prices has lead to greater export demand. Time will tell if Arg and Brazil have the beans or not. If production is lower this season we could see soybeans at $15 later this winter or early spring.

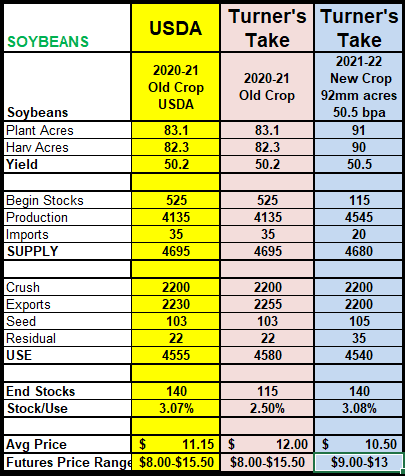

Below is my supply and demand table for old crop and new crop. For new crop we are estimating 91mm acre and 50.5 bpa. At those levels the US new crop production equals the total usage. Soybean stocks are still around 140mm bushels and a 3% stock/usage ratio. The bull market in soybeans should be a two year story at minimum.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Soybean Oil

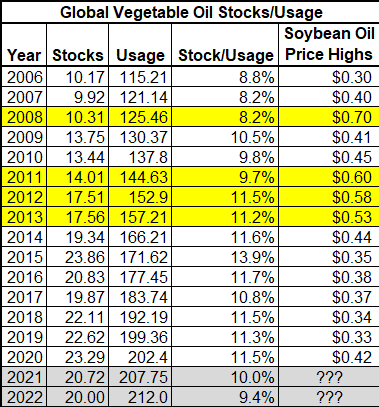

Below is a chart of annual global vegetable oil stock/use and soybean oil highs dating back to 2006. For soybean oil prices I rounded to the nearest cent. The point of the table below is to show how global vegetable oil usage has inelastic demand. It doesn’t seem to matter what vegetable prices are any given year. Demand has grown year-over-year since 2006. It grew during the drought years. It grew during the Chinese ASF and tariffs years. Demand is expected to grow this year and most likely next year too.

Moral of the story is global vegetable oil is in tight supply. Soybeans are in tight supply. In 2008 soybean oil traded as high as 70 cents/lb. In 2011 to 2013 period soybean oil was consistently in the 50s. We think price go back to the 50s this year and next year until global soybean supplies can be build back up to adequate levels.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Corn

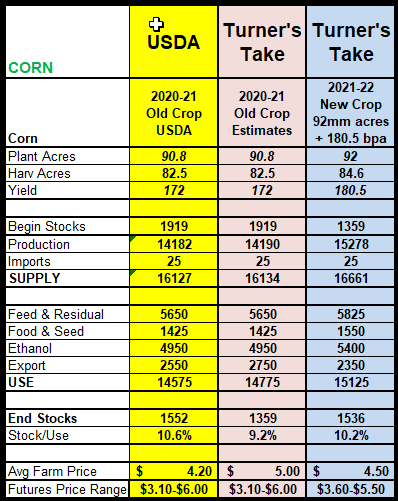

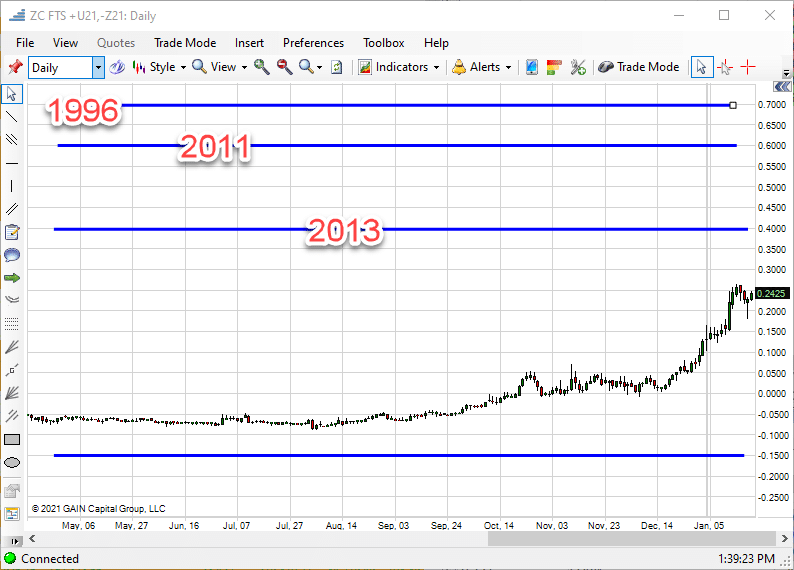

Below is my corn supply and demand table. Stocks are low but not tight enough to push old crop above $6 or new crop above $5…yet. I am getting a lot of calls about the July vs Dec and Sept vs Dec corn bear spread. July is 70 over Dec and Sept is 25 over Dec. I’ve always liked trading the Sept/Dec spread when it gets to 25 or over. Keep in mind this spread traded to 70 cents over in 1996, 60 over in 2011, and 40 over in 2013. Eventually this spread comes in and many times goes back to a carry and possibly 15 cents under. See the chart below the supply and demand table

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

Wheat

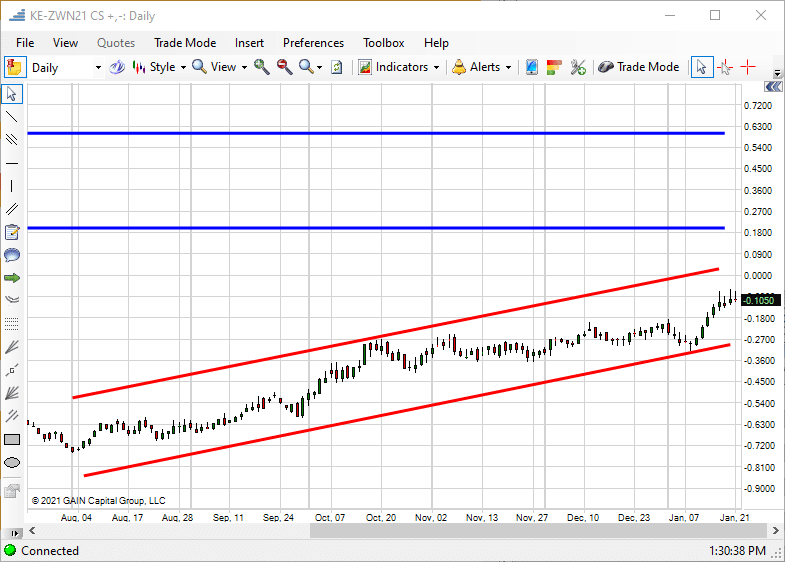

As I said last week and on the podcast today, I think KC eventually goes 20 over or higher against CHI in new crop wheat. Acres are expanding at a greater pace in Chicago than KC. Demand is better for KC than Chicago. That means on a percentage basis Chicago is gaining supply while KC is gaining demand. Based on our supply and demand expectations, we see the HRW new crop ending stocks having a tighter stock/usage ratio than SRW. That has not been the case for years and why Chicago has been traded over KC. We believe this changes with the new crop and why KC could trade between 20 to 60 over Chicago in the coming years.

Interested in working with Craig Turner for hedging and marketing? If so then click here to open an account. If you are a speculative or online trader then please click here.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.