Good morning friends

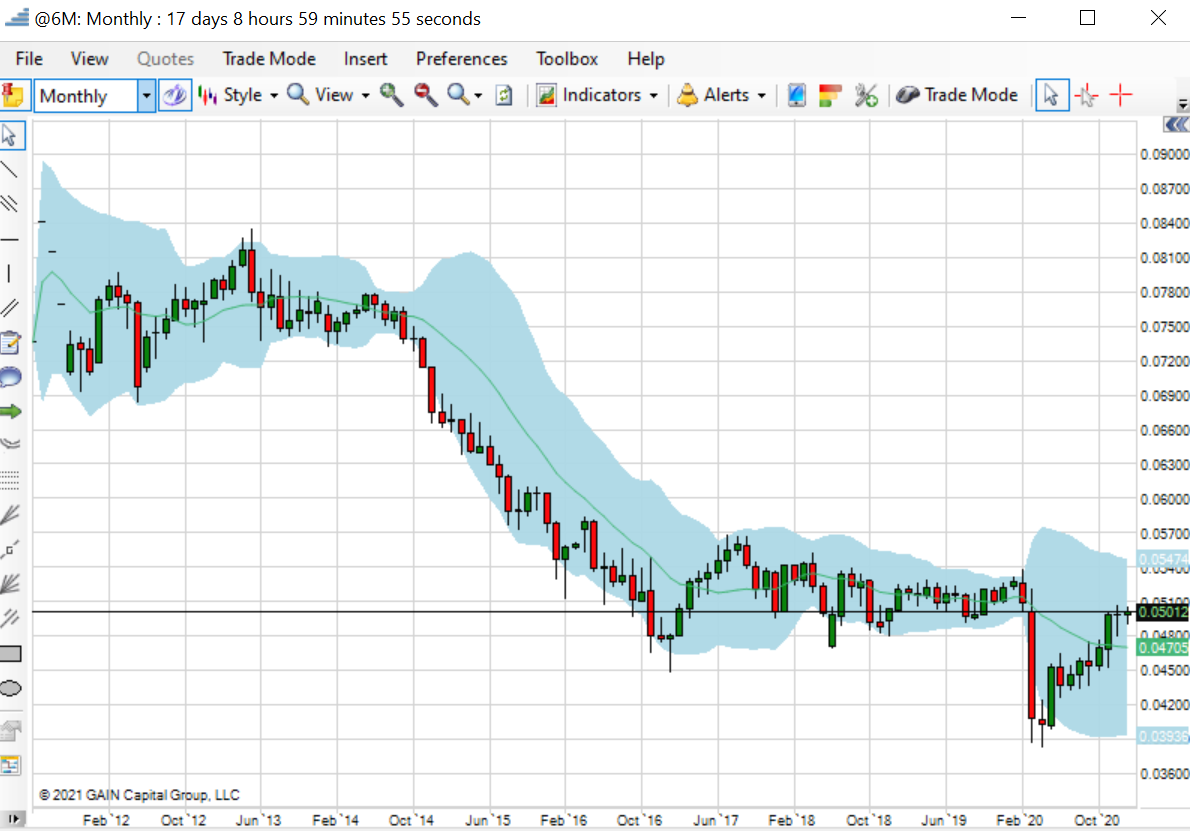

- President Elect Biden is eying another stimulus package, this time to the tune of 2 trillion dollars (nearly 10% of GDP). Currencies like the Brazilian Real and Mexican Peso are jumping on this news. The next shoe to drop in the US ag story is for the Real get stronger and keep acreage expansion in Brazil to a minimum (without higher prices). Speculators should look at both markets to the buy side.

BRAZIL REAL

MEXICAN PESO

- Its not all bullish this AM. Eyes need to be on the Chinese COVID cases continuing to persist. A nationwide lockdown in China would throw this recovery back into the soup. Chinese Yuan remains strong while new cases around Beijing climb daily. With plans for a huge Chinese New Year celebration Chinese commodity markets are at all time highs as the Yuan remains strong below 6:5 to 1 (and headed lower).

- Rumors are a China/US trade meeting will take place soon after Biden takes office. Chinese propaganda papers are encouraging a new round of talks and cooperation between each government as new negotiators are put in place.

- Good rains are expected across much of Brazil while Argentina remains sketchy. CONAB and other S.Am prognosticators are keeping Brazil bean production near 133 MMT while reducing corn in Argentina slightly. Keep in mind much of the Brazil crop remains in the bag for second crop plantings.

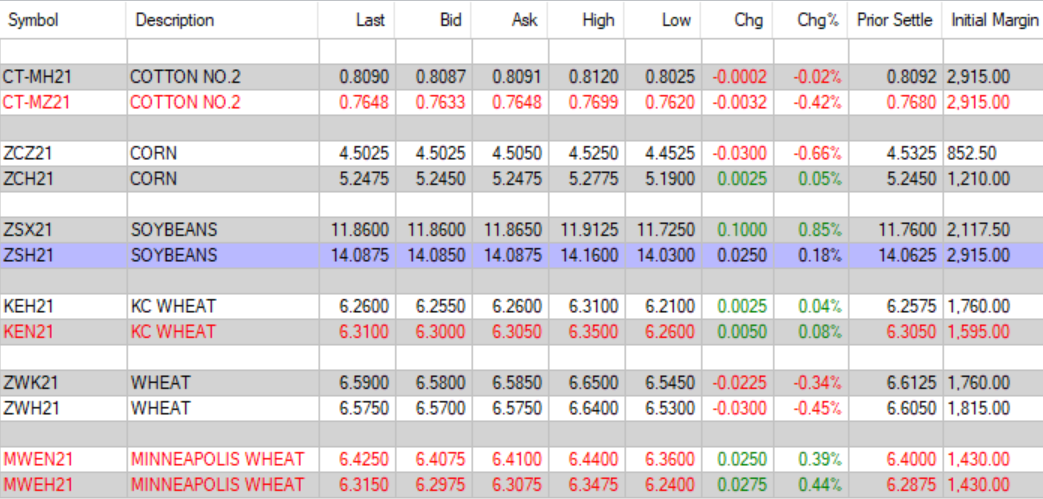

- USDA export sales were just released:

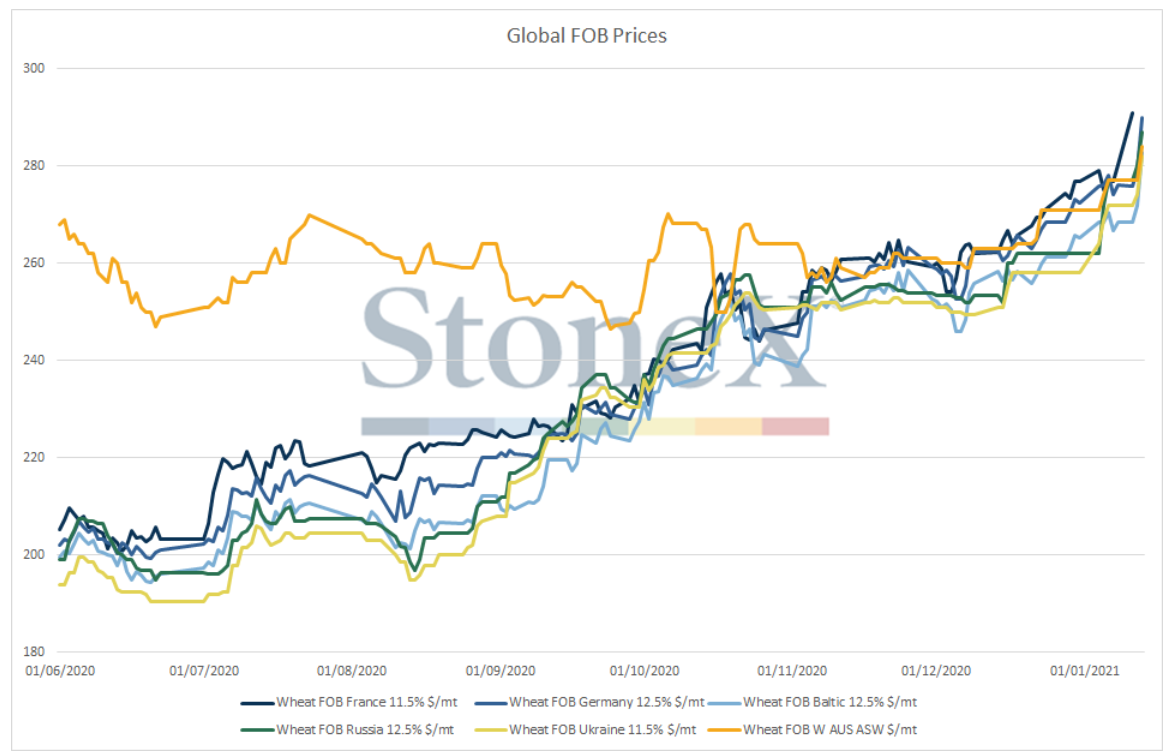

- Russia is finding their export taxes are not high enough to keep interest away. The plan is to double the tax to almost $55 per MT. This measure designed to stop food inflation in Russia will only exacerbate it elsewhere. FI am hearing from the StoneX London office a tax on barley and corn are also coming. This is going to be the tact taken by governments to slow prices growing domestically. US producers should begin to see business creep up on this side of the hemisphere. Right now, the only major exporter with inflation problems are Argentina and Russia. That will not be the case forever in my opinion.

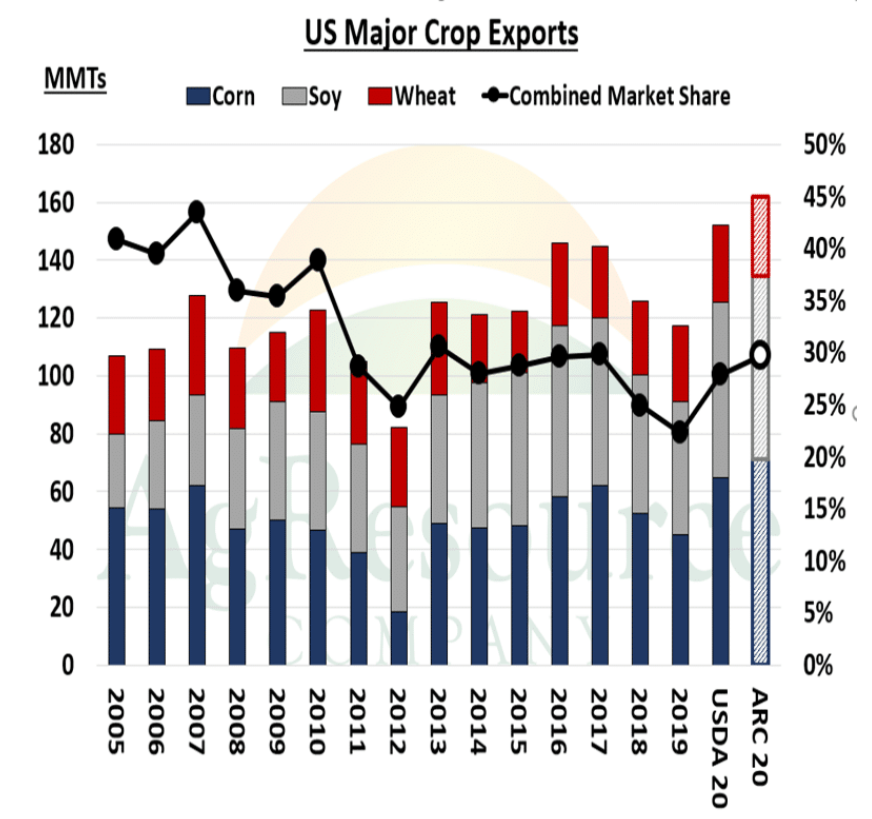

- Here is a fantastic look at US exports and the relative market share. While we have seen a major boost in total numbers, we have not seen much of a boost in global market share. This is thanks to the big increases in Russian and South American production over the last 8 years (much thanks to a strong dollar). With the US now fully in the spending camp (see Biden’s 2 TRILLION stimulus) I expect weak dollar action could bring market share back to the US. If we would see US market share back to pre 2010 levels, total exports would be north of 180 MMT. The US does not have that kind of supply (at these prices). This could push exports even higher in the coming year as China continues phase 1 purchases. Just another reason to be long term bullish ag.

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved