Play Turner’s Take Ag Marketing Podcast Episode 257

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

Goldman Sachs is calling for a long lasting commodity bull market that will benefit energy, metals, and agriculture. We are bullish on corn, the soybean complex, and winter wheat. The US will be issuing more debt for stimulus in the aftermath of the coronavirus shutdowns the the rest of the world’s central banks and governments will most likely follow suit. Ag and the rest of the commodity markets look bright for 2021. If you want to hear more then take a listen to this week’s Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Secular Commodity Bull Market

Goldman Sach’s global head of commodity research, Jeffrey Currie, is predicting a long lasting bull market in most commodities. Crude Oil is breaking out on the charts after nine months of lower production and under investment. Copper is strong as emerging markets and China find demand in a post COVID economy. Strong feed demand is supporting corn and the oilseed complex. Combine economic growth with a weaker USD due to stimulus and new government debt and commodity prices could be on the upswing for years. You can read more in the link below:

S&P Global Platts | Goldman Sachs’ Currie Predicts Long Lasting Commodity Bull Market

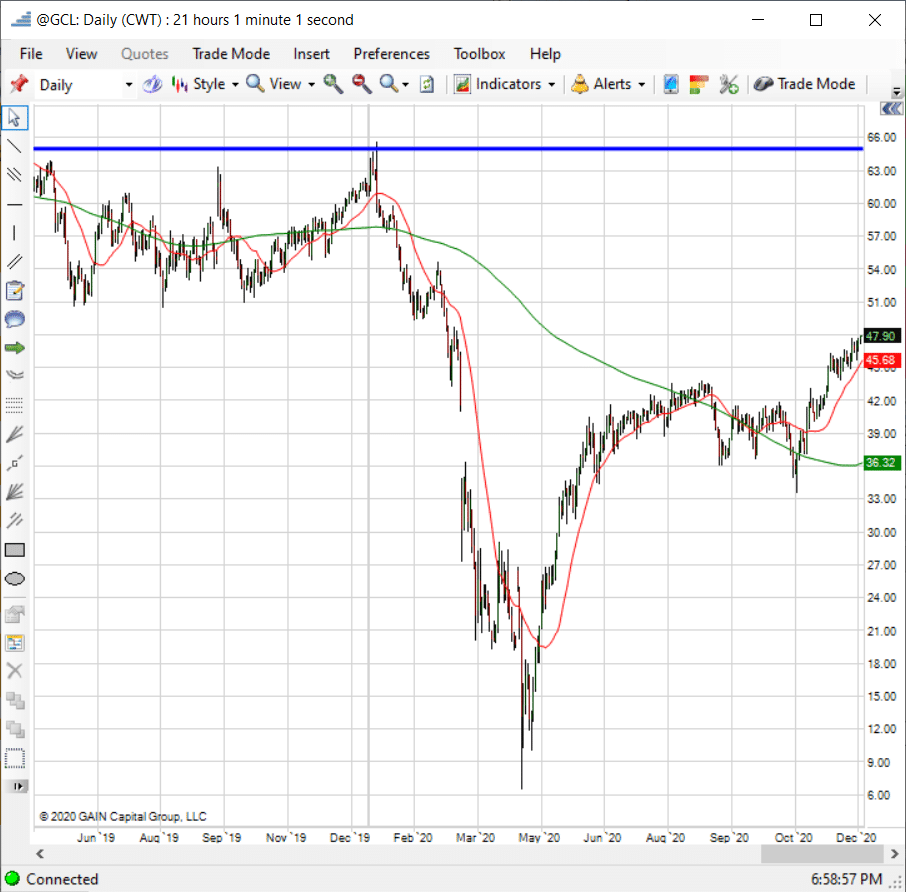

Goldman has a $65 target on crude oil by the end of 2021. That would match the highs from Dec 2019, right before COVID started to become a concern. Below is a continuous chart of crude oil with the $65 price target. A move from $48 to $65 is $17 dollars. That is $17,000 in the standard 1000 barrel contract or $8,500 in the mini 500 barrel contract.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

Continuous Crude Oil Daily Chart

Corn

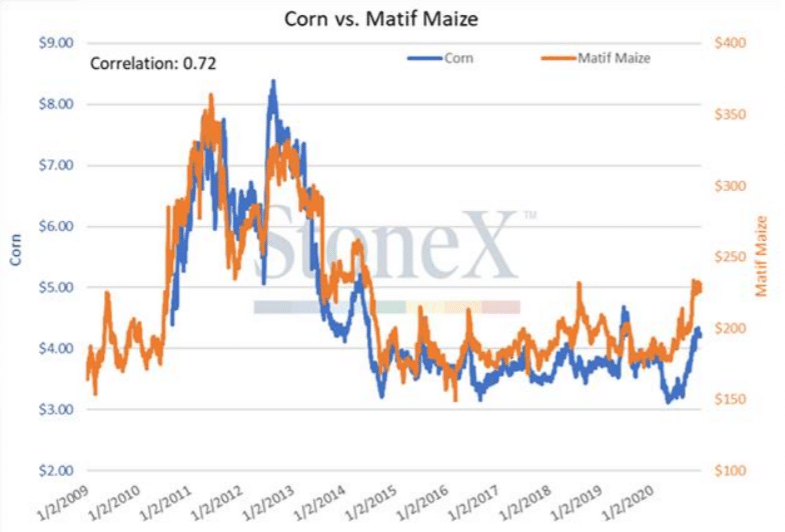

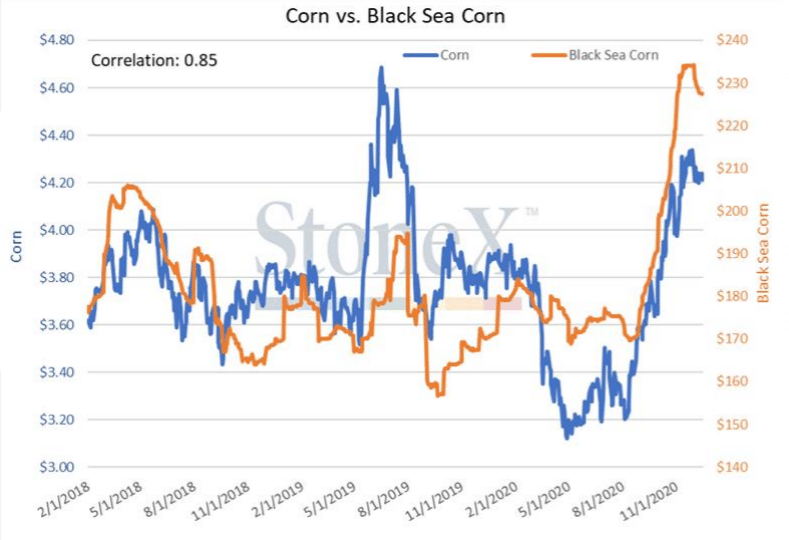

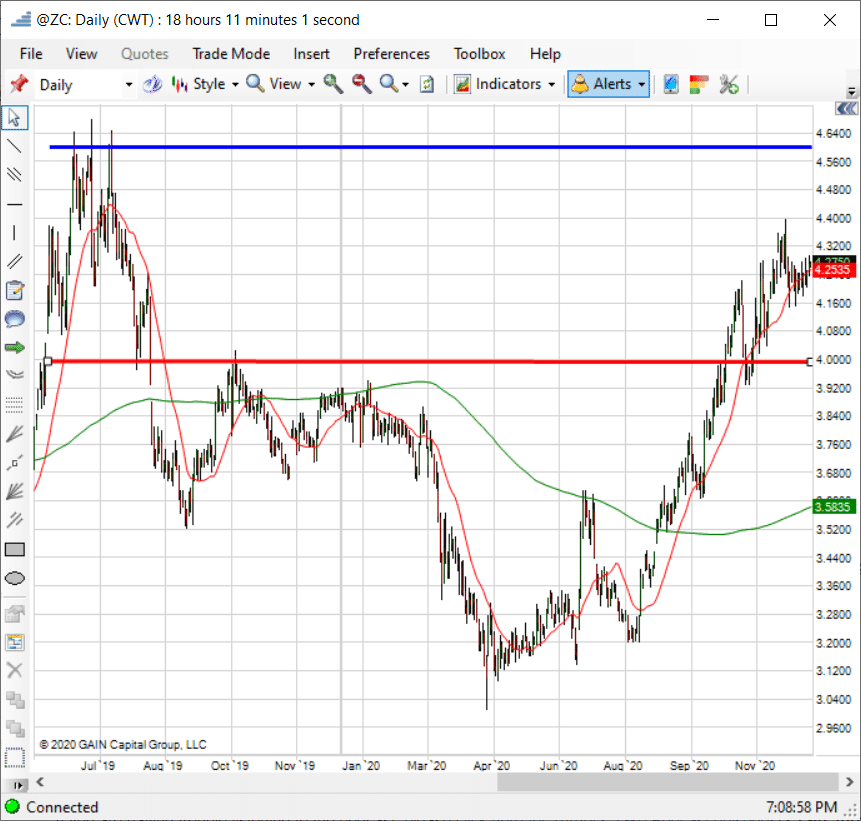

US corn is the cheapest feed grain on the global export market. Below is a chart of US corn vs Matif Maize (Europe) and US Corn vs Black Sea Corn (Ukraine). US corn at $4.20 is about $210/mt. Black Sea corn is $230/mt or $4.60/bushel. Matif is $250/mt or $5.00 per bushel. US corn is much cheaper than Europe and the Black Sea. US corn should have strong demand until the South American harvest, At a 1.7 billion to 1.5 billion carryout and superior export price competitiveness, corn will be supported at $4.00 across the board. A strong demand rally or weather issues in S. America this winter or the US this spring/summer could send old crop to $4.60.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

Continuous Daily Corn Chart

Oilseeds

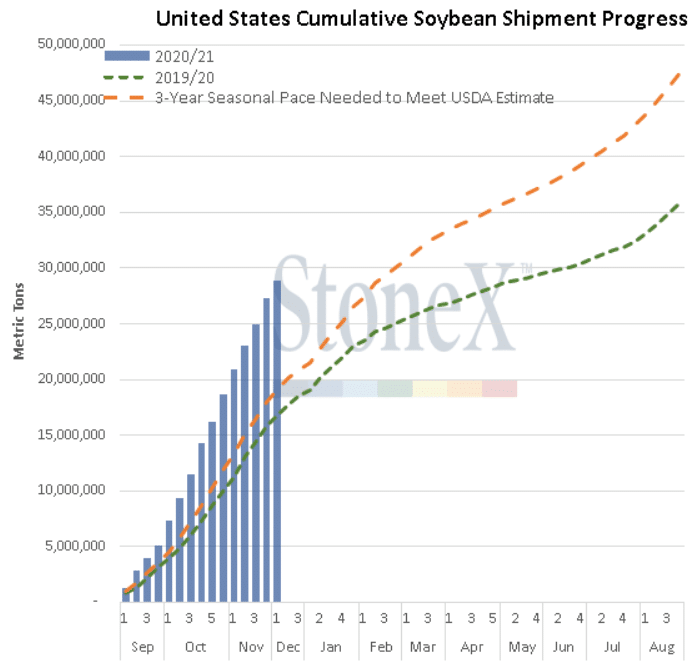

Below are two charts. The first for US cumulative soybean shipment progress. We are well ahead of pace of the USDA and ending stocks are already estimated at a tight 175mm bushels. Exports are likely to increase in the Jan WASDE. At the same time we’ve seen two record NOPA crush numbers in Oct and November. The crush in the US is strong and showing now signs of slowing down.

Canola is now $475/mt compared to $420/mt for soybean oil. Palm oil is close to eight year highs. Sunflower oil is so strong Russia needs to put export quotes and taxes on sunflower to fight food inflation. Soybean oil is the only global vegetable oil in adequate supply between now and South American harvest. Palm, sunflower, and canola are primarily Northern Hemisphere crops and will not have another harvest until the fall of 2021. Soybean oil at 39 cents a pound is too cheap and we see it trading to 45 cents/lb sooner rather than later.

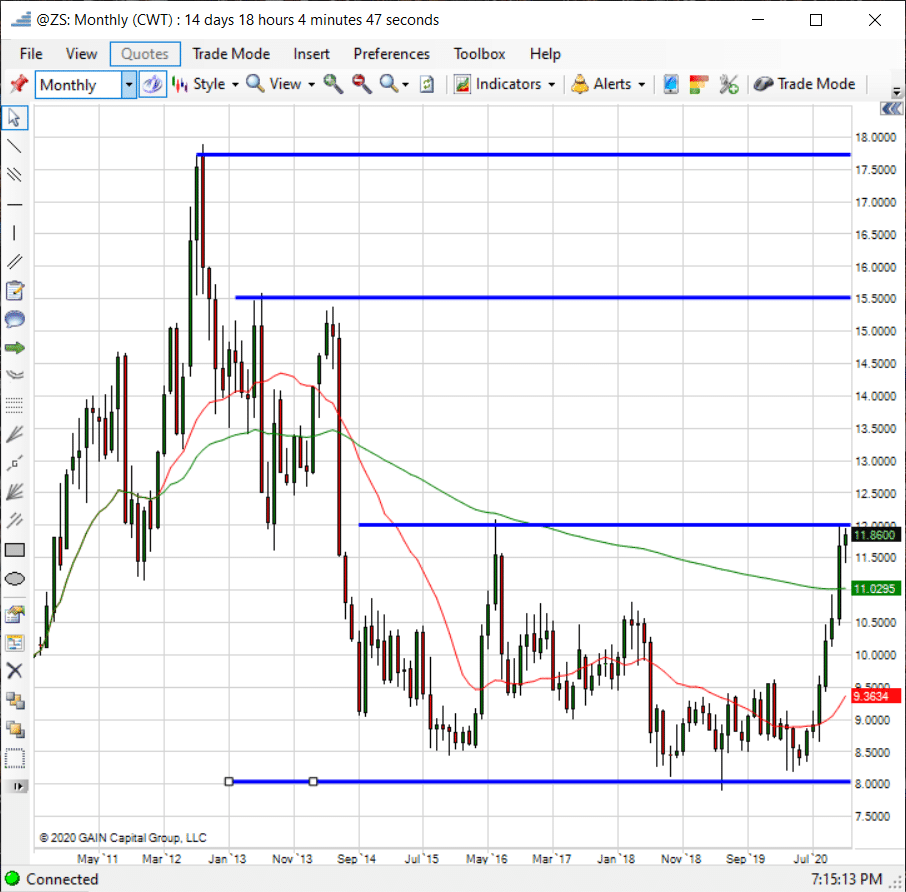

The final chart below is for monthly continuous soybeans. A close above $12 on the monthly chart calls for much higher prices. We think soybeans will remain elevated and bullish for all or most of 2021. Traders and hedgers who want or need upside exposure to soybeans can call me at 312-706-7610 or email cturner@danielstrading.com

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

US Cumulative Soybean Shipment Progress

Monthly Continuous Soybean Chart

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes! Craig Turner – Commodity Futures Broker 312-706-7610 cturner@danielstrading.com Turner’s Take Ag Marketing: https://www.turnerstakeag.com Turner’s Take Spec: https://www.turnerstake.com Twitter: @Turners_Take Contact Craig Turner

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.