THE WEEK AHEAD

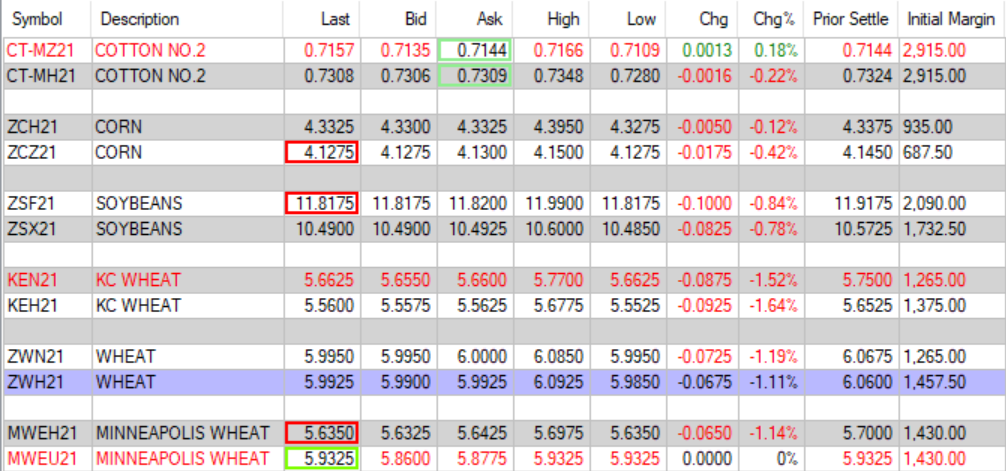

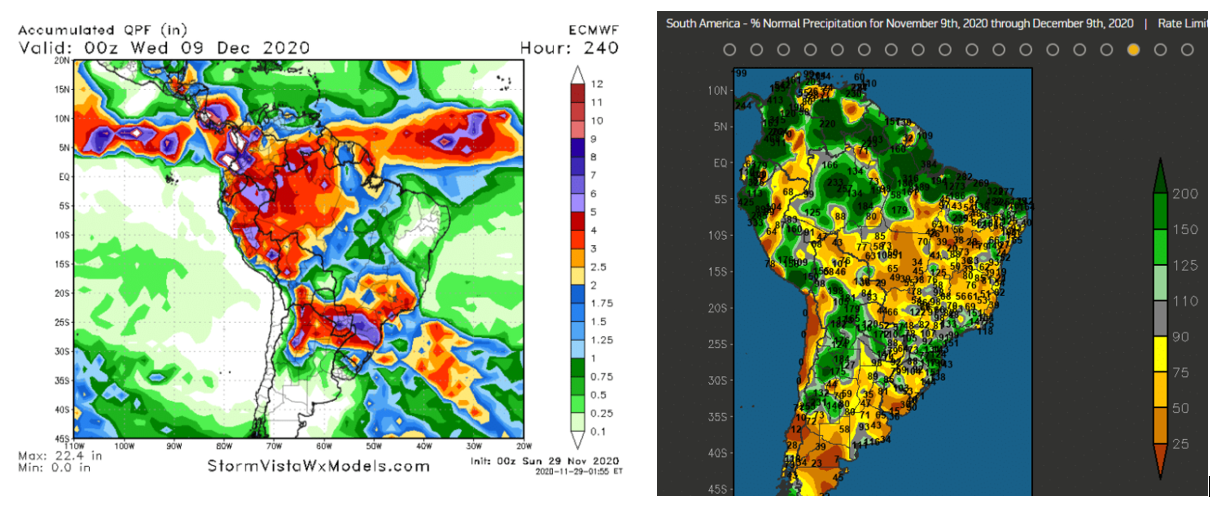

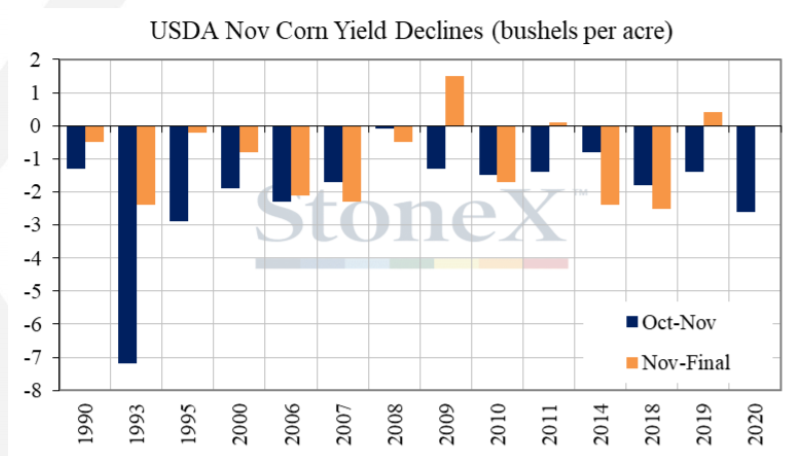

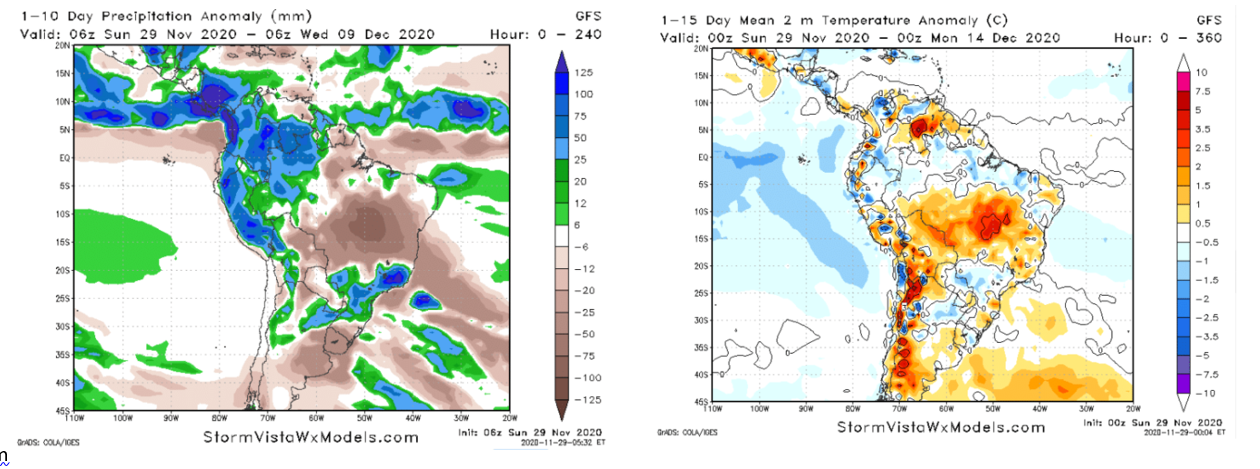

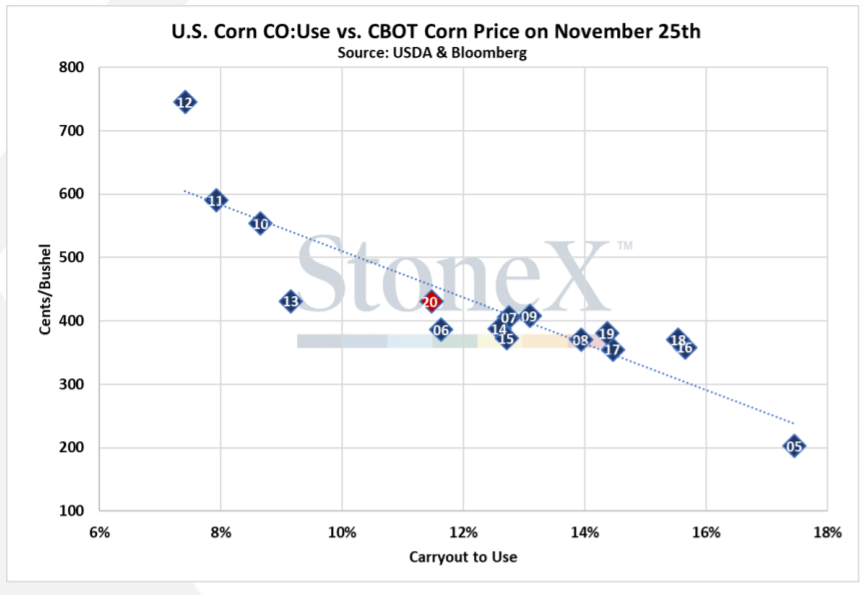

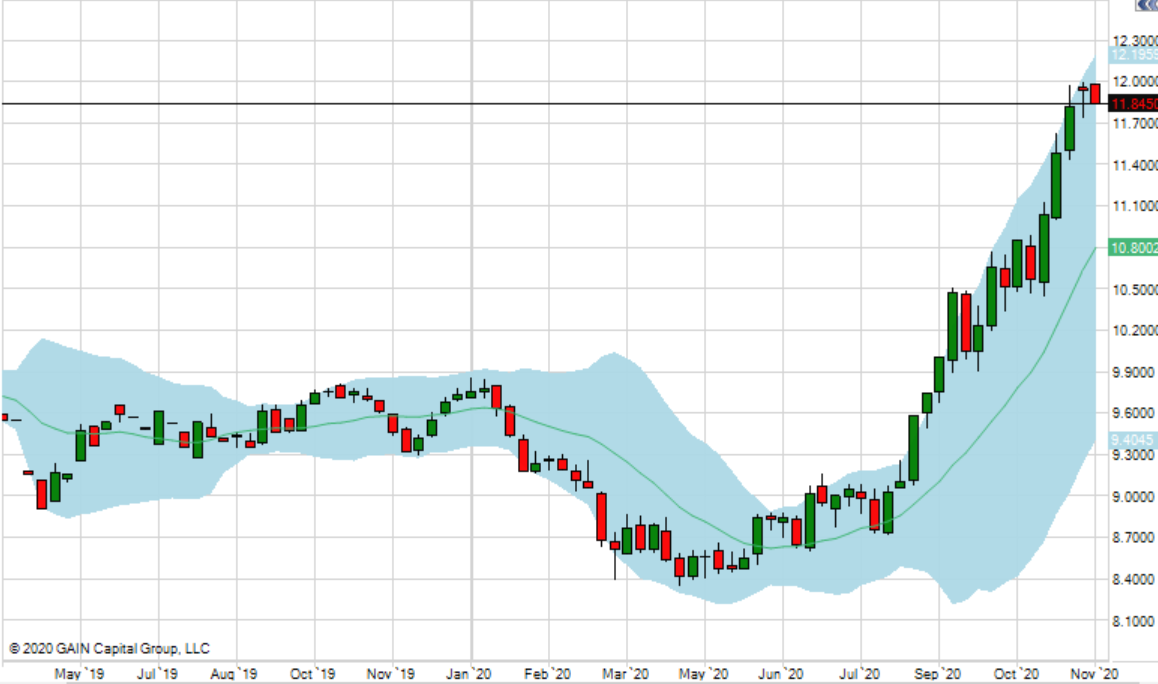

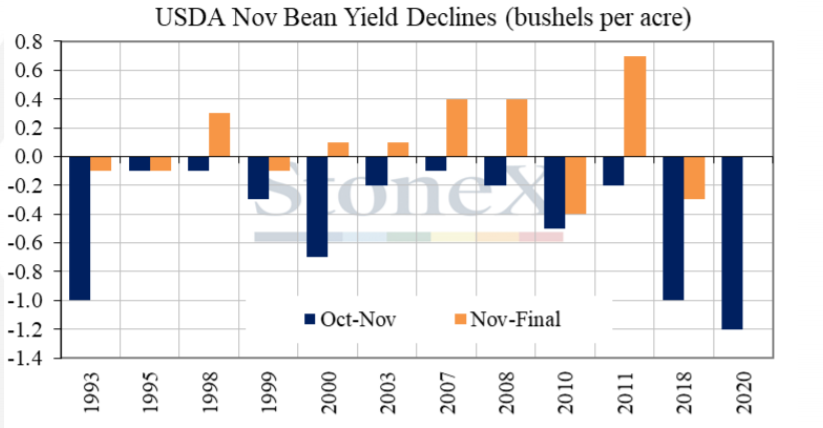

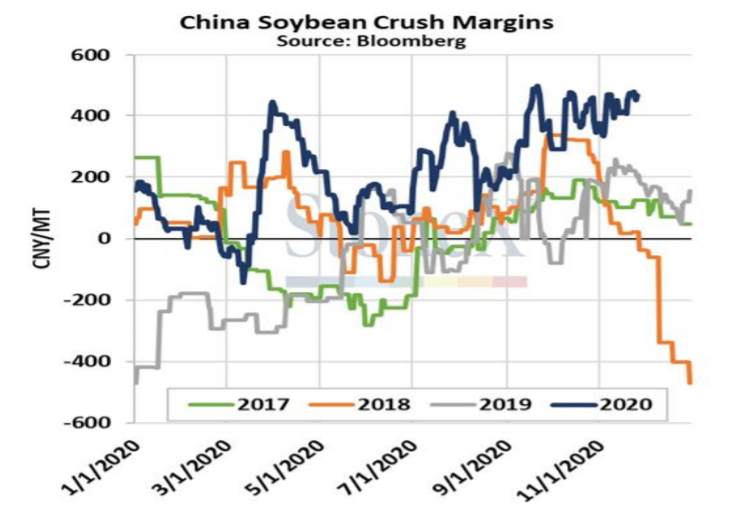

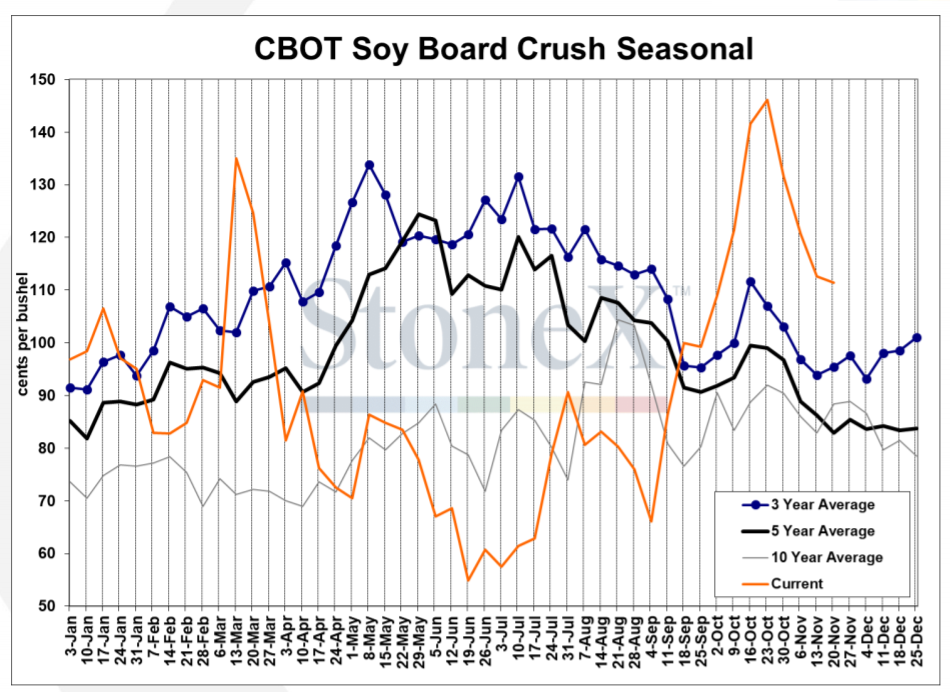

- For the 5th time, soybeans fail at 12.00. Soymeal and soybean oil remain strong, I expect liquidation sales to be picked up. As of right now, there has been little to no write downs of Brazil or Argentina yields. Given what I hear down there, we should see some in the 2021 USDA reports. The next WASDE is likely to reduce yields for both corn and beans (if historical trends hold, see below), it will be released on Dec 10.

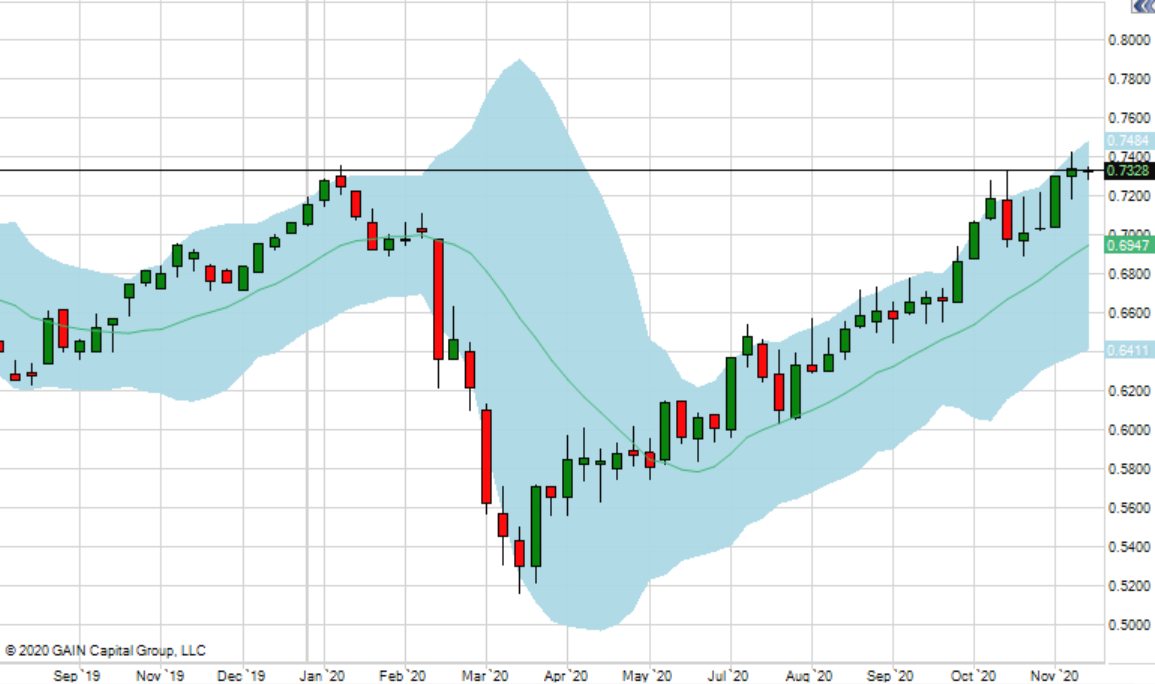

- China is on the defensive regarding price spikes in grain markets. Meanwhile, Chinese PMI was released last night and shows very strong expansion in their manufacturing sector. Cotton bulls want to see this continue combined with improved US retail sentiment. COVID cases here in the US appear to be topping again, following a weekend of encouraged lockdown.

- Congress returns today with just a week or so before the House is set to leave town again, this time for good until Jan. Focus will be on dealing with a stopgap spending measure that runs through Dec. 11, and perhaps coming to an agreement on the illusive next Covid-relief package. On the economic front, Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin will testify before the Senate Banking Committee. The Labor Department will release the November employment data on Friday. For agriculture, the focal point will be USDA’s farm income estimates on Wednesday. USDA should finally get more realistic about U.S. farm income for 2020, reflecting a more inclusive forecast of Coronavirus Food Assistance Program 2 (CFAP 2) payouts and perhaps the recent uptick in commodity prices.

- The Russian Agricultural Ministry is proposing to raise the planned grain export quota by 2.5Mt to 17.5Mt. This follows an appeal from the Russian milling and animal meat industry to replace the quota with a tax. Russia’s Union of Grain exports subsequently appealed against the proposal of the tax, stating it would raise global prices. The possible increase in the size of the quota bodes well for major importers of Russian wheat and will ease concerns over the availability of the origin in the second half of this season. For the domestic market though, this announcement will maintain concerns over record high domestic prices with this proposal meaning that the likelihood of an export tax is very low, although the strength of the ruble will also be a strong driver of this. Domestic prices closed out last week above the 18,000 Rb/t mark, although FOB prices did ease off slightly in Novorossiysk; however, they remain above $250/t for both the 11.5% and 12.5% specification. Wheat is torn between large plantings in the Black Sea and increased demand globally.

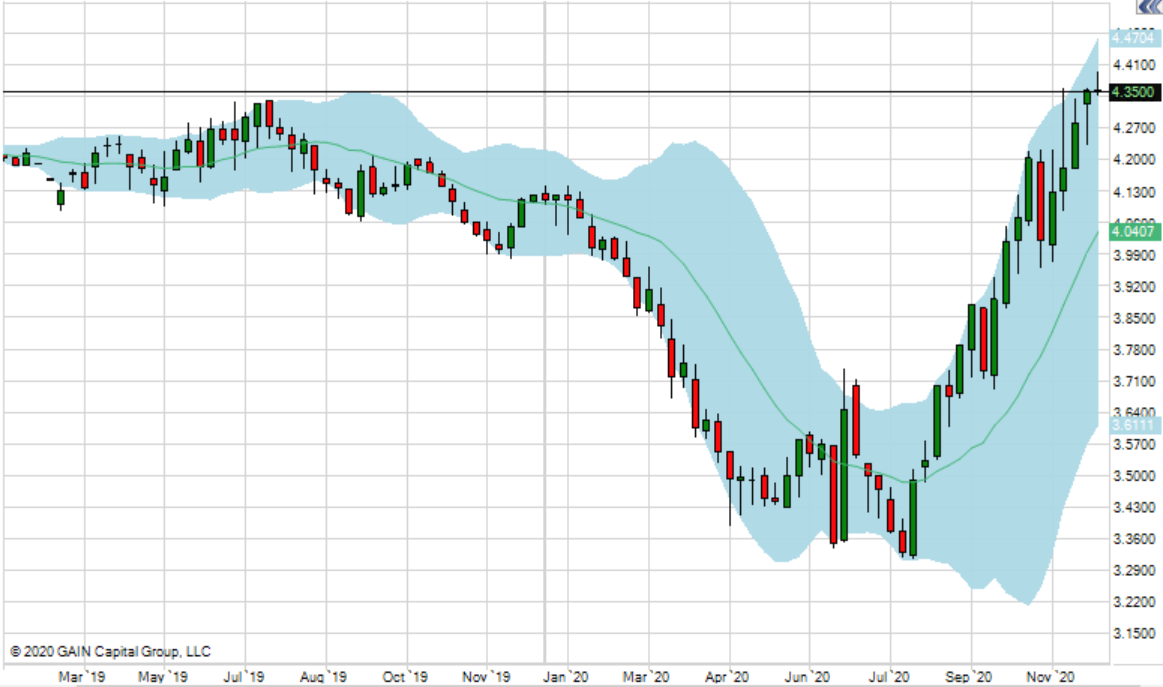

CORN- MARCH

SOYBEANS- JANUARY

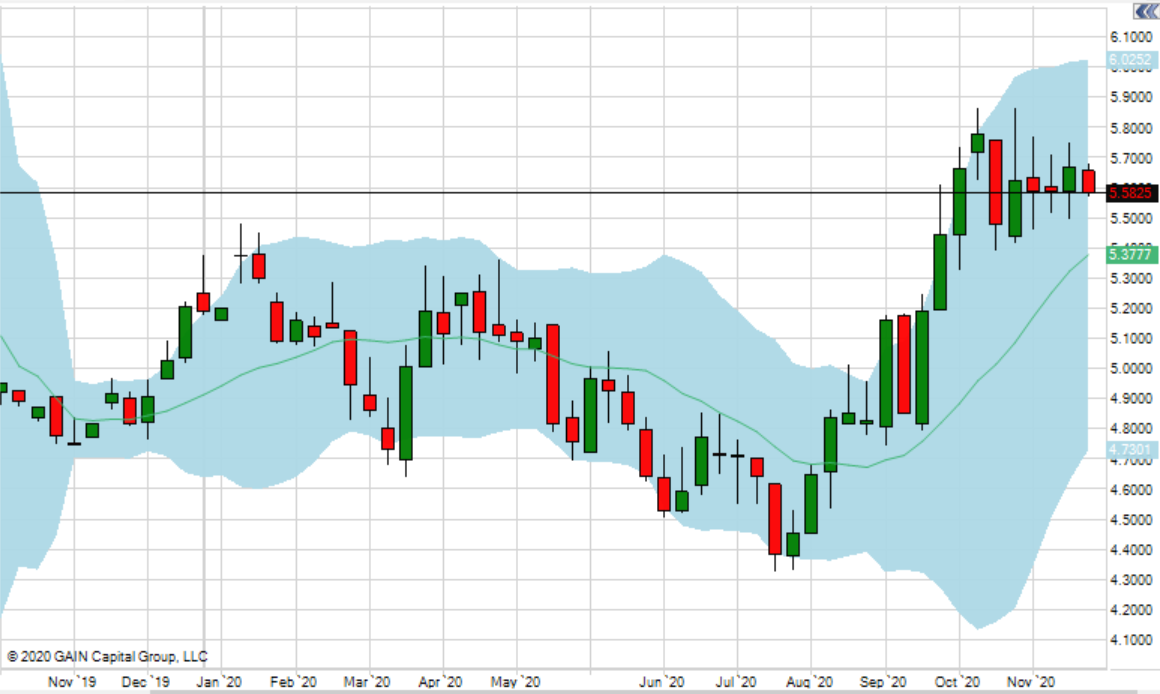

COTTON

WHEAT

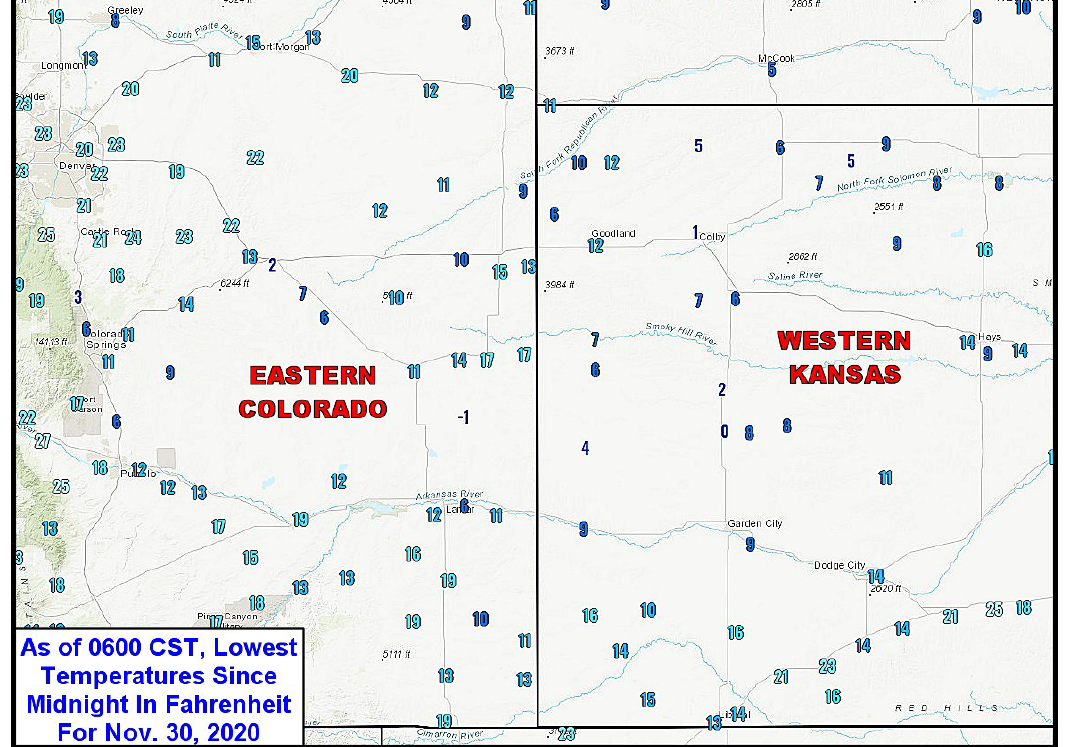

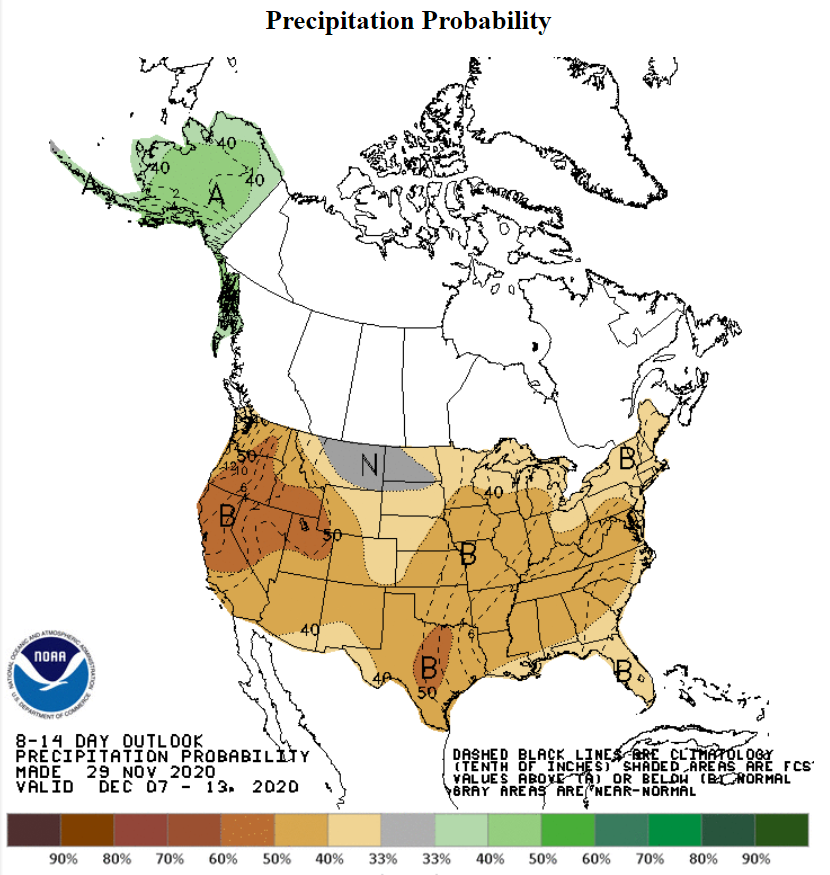

From World Weather Inc.- The region has been quite dry recently and crops were not as well established as they should be at this time of year. The dryness might have helped spare the dryland crop since there was less moisture in the plants to freeze in this environment and the crop has been pressing into dormancy recently. The lack of snow cover is a concern, but enough warmth likely remains in the ground to protect the crown of these plants and especially since the coldest temperatures have not prevailed very long this morning. Some of the irrigated crop might have been a little more vulnerable to damage, but the bottom line remains the same with little to no permanent damage suspected.

This week’s weather will continue quite chilly throughout U.S. hard red winter wheat production areas pushing more of this year’s crops into dormancy. That leaves some of the poorly established crops vulnerable to extreme winter conditions this year and a close watch on the intensity of cold and snow cover through the winter.

KC MARCH

WHEAT- MARCH CHI

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved