Play Turner’s Take Ag Marketing Podcast Episode 250

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

This week we go over our thoughts on soybeans for the rest of this year and for 2021. Soybeans could be tight this year and next if we don’t plant over 90mm acres this spring. There is going to be a lot of trading and marketing opportunity in the grain markets for at least the next few months and possibly into the summer. Make sure you take a listen to this week’s Turner’s Take Podcast

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

Soybeans

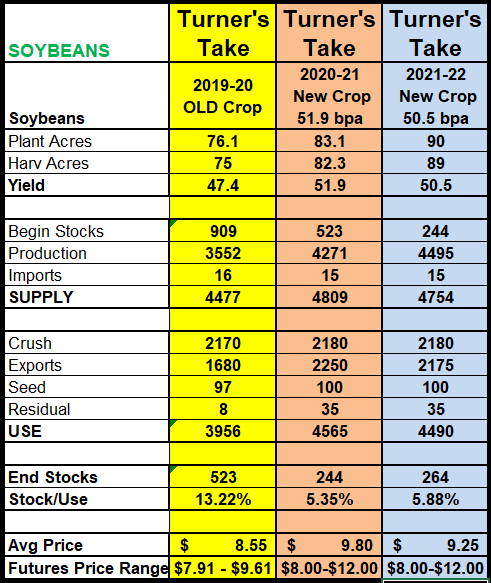

On the podcast today we look at the 2020-21 and 2021-22 soybeans. Below is a soybean table for old crop, new crop, and next year’s crop. For new crop I have ending stocks at 244mm bushels and the USDA is at 290mm. Soybean exports are 90mm ahead of pace based on current USDA estimates so I increased exports and down came ending stocks. At a 250mm carryout and 5% stock/usage, soybeans should be trading over $10 and testing $11 on weather rallies or strong demand increases.

South America needs to have a good crop or we are going to have to price ratio for the rest of the marketing year. It is dry in Brazil and Argentina. La Nina is part of the reason. Rains are in the forecast for central and northern Brazil. Southern Brazil and Argentina still look dry. Stocks are already so tight in Brazil that they are going to lift their 8% import tax on grains and oilseeds. China cleaned them out during the tariffs period. It is possible that Brazil may import from the US to meet demand until their harvest in early 2021.

In the mean time any serious weather scare that can reduced production will lead to strong rallies. If South America loses 5% of soybean production, which is within the range of possibilities in a La Nina year, that is about 500mm bushels. If have of that comes back to the US in the form of export demand we wipe out all existing stocks. That can’t happen. In order to make sure that doesn’t happen the market rallies and that is what we call price rationing. This is the scenario when “beans are in the teens.”

That is just the 2020-21 crop. Now take a look at the 2021-22 crop. The US planted 83mm acres of soybeans last season. In 2021 the US needs to plant at least 90mm acres to keep ending stocks the same year-over-year. That is a 7mm acre increase. Corn is over $4. SRW Wheat is over $6. Those are good prices and now soybeans needs to gain 7mm acres minimum. I’ll focus on corn next week and wheat the week after. You’ll see that it will be hard for soybeans to gain more than a few acres from those crops. There was about 5mm acres this year not planted that usually go to corn or soybeans. Soybeans needs to take all 5mm of those (when corn is over $4) and then needs to steal a few more or bring more land into production.

On top of that, we need trend line or better in 2021-22 not to be tight. Moral of the story – soybeans should be well supported for at least a few months. Declines to the 200 day moving average should be bought. Weather issues in South America will lead to rallies. Chinese demand will lead to rallies. US weather issues will lead to rallies this spring and summer. A lot has to happen between now and this time next year to just keep soybeans reasonably tight.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

Craig Turner – Commodity Futures Broker

312-706-7610

cturner@danielstrading.com

Turner’s Take Ag Marketing: https://www.turnerstakeag.com

Turner’s Take Spec: https://www.turnerstake.com

Twitter: @Turners_Take

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.