Play Turner’s Take Ag Marketing Podcast Episode 246

Podcast: Play in new window | Download

Subscribe: RSS | Subscribe to Turner's Take Podcast

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

New Podcast

In this podcast we go over our thought in the equity, metals, grain, and livestock markets. We like buying the dips in the S&P, silver, and gold. The WASDE in September could be a little bearish against expectations for corn and soybeans. We also like cattle over hogs heading into the fall/winter. Make sure you take a listen to this latest Turner’s Take Podcast!

If you are not a subscriber to Turner’s Take Newsletter then text the message TURNER to number 33-777 to try it out for free! You may also click here to register for Turner’s Take.

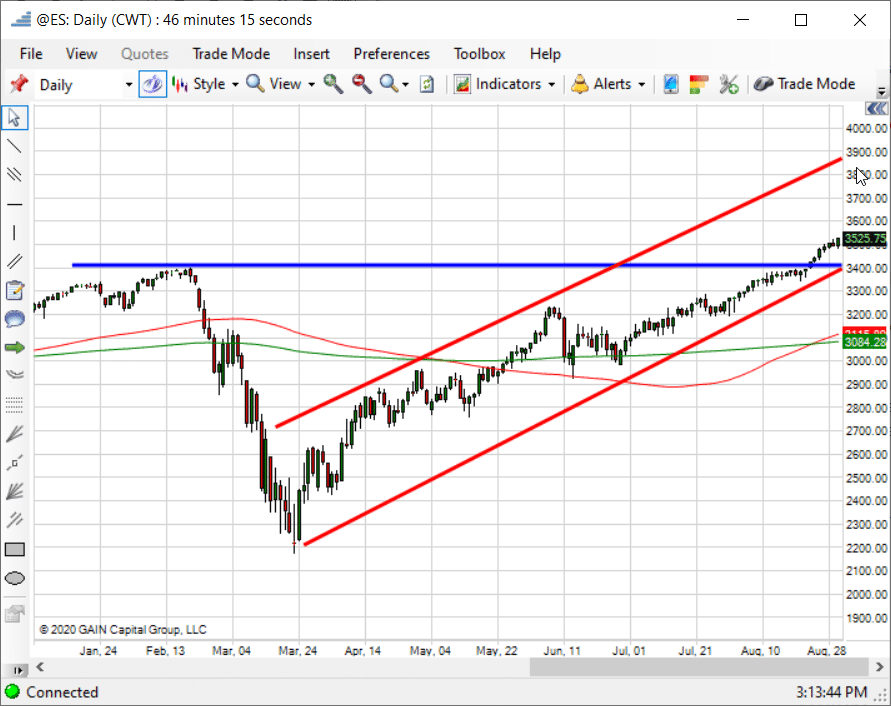

Emini S&P 500

I’ve always said the stock market tends to be “long only”. That is not 100% accurate but there is usually only a 15% short interest in the equities markets, which means the the other 85% is long. When you also consider the Fed and the US Government will enact policies and stimulus for the benefit of the market, it is hard to be bearish for any extended period of time.

I still like buying the dips but at 3500 the S&P 500 looks a little overvalued. I’m not one to short the stock market but I’ll be willing to by the dip. The election is not too far off and that event tends to put some volatility in equities. The last time we had a Presidential election the moves were large to both sides.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

S&P 500 Chart

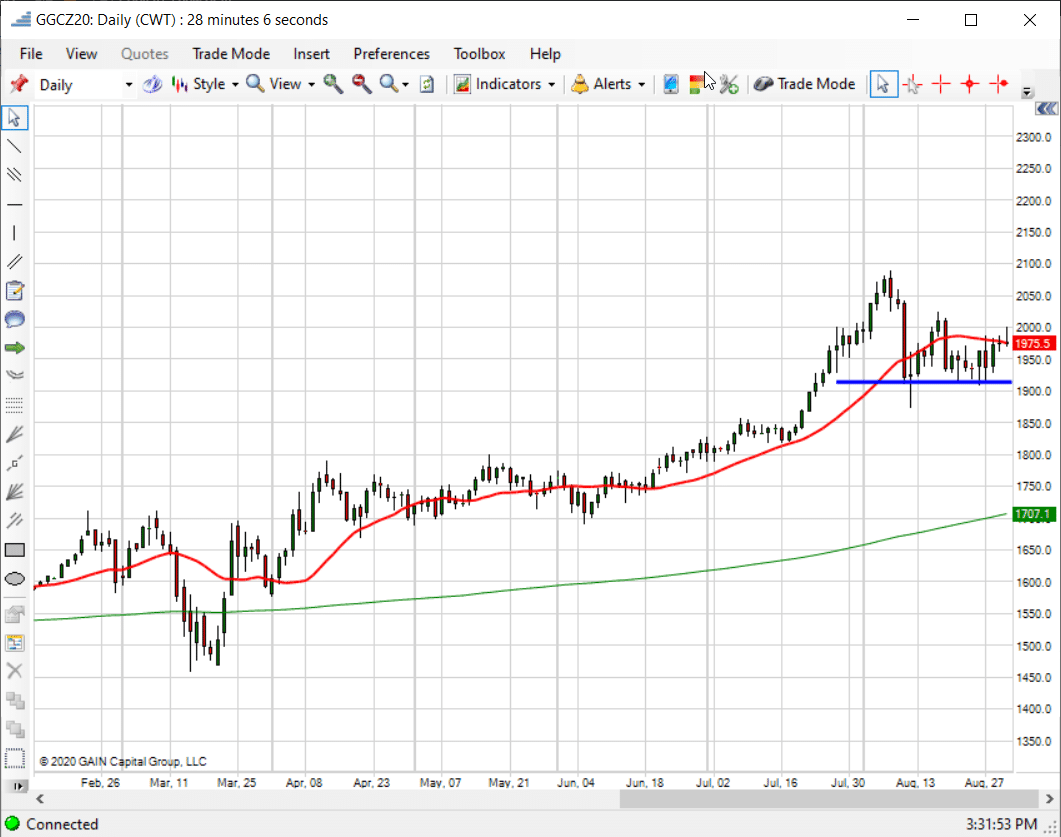

Gold & Silver

The Fed recently came out and said they are more concerned about unemployment than inflation. That is good for those who make up the 10% unemployment rate in the United States. It is not great for the value of the US Dollar and that is why we continue to like gold and silver. We expect the Fed and the US government to provide more stimulus for citizens and the economy, but we don’t that happens until after the election. It is rare for the Fed to act before an election and I can’t see the Republicans and Democrats agreeing on anything between now and November 3rd. I like buying the dips. I would use weakness in Sept and Oct to build a position for later this year.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

Dec Gold

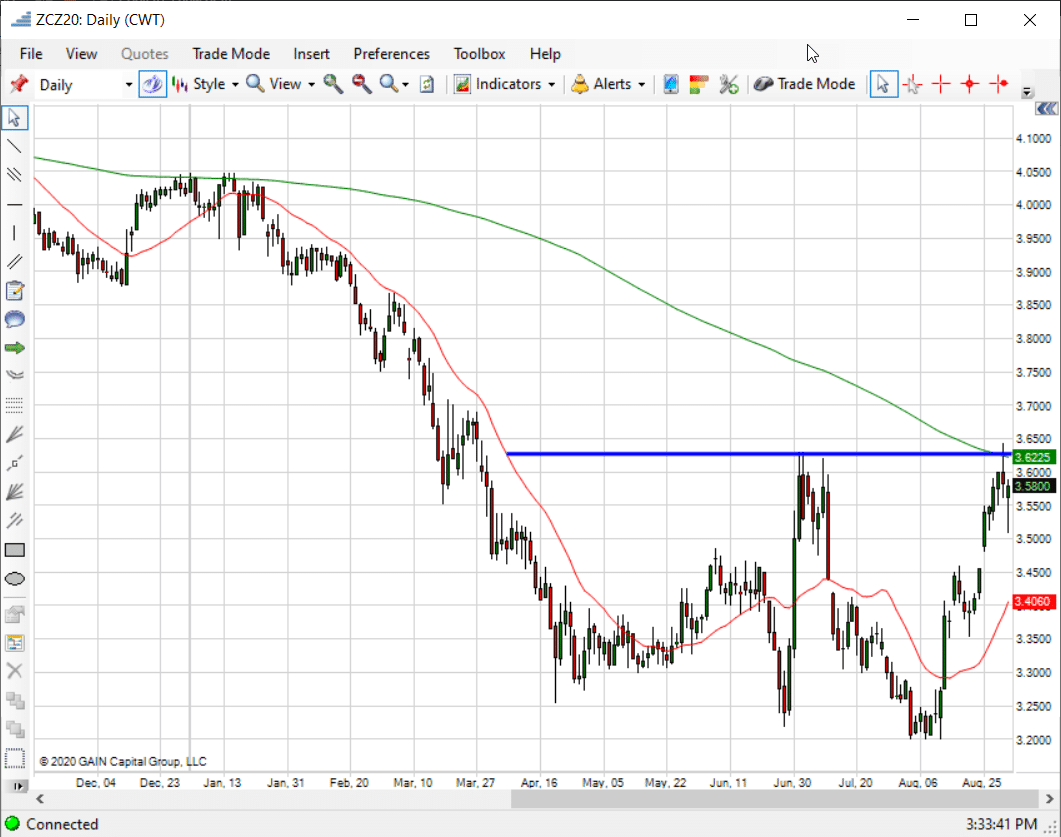

Grains & Oilseeds

We were filled selling 20% of new crop soybeans at $9.50. Turner’s Take Ag Marketing is now 50% sold for expected production at an average price of $9.55 basis Nov futures. The newsletter also has an existing order to sell 10% of 2021 soybeans at $9.50 basis Nov 2021 futures

I expect corn and soybeans to trade in a range between now and the WASDE. The market has priced in a good bit of yield loss in both corn and beans. It is important to note the USDA historically tends to make small decreases in yield changes from Aug to Sept during dry months. We could see a bearish surprise against expectations in the Sept 11 WASDE. We’ll be looking to buy puts ahead of the report.

*Keep an eye on the 200 Day MA (green line) for Dec Corn. The market has not been able to close above the 200 day. For this to happen the trade needs to believe corn yields are 174 or lower and carryout is below 2.0 billion.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

Dec Corn

Livestock

Hogs have rallied as of late due to strong exports and cash prices but there is a lot of supply coming to the market. Fall and winter also tend to be bearish periods seasonally for lean hogs. Cattle on the other hand has been coming down but we see demand picking up for the 4th quarter and supplies getting tighter into the end of the year and Q1 of 2021. In the short term we are bearish livestock and the play is to sell hogs. In the long term we like cattle and will be looking to buy Dec or Feb LC on the breaks.

If you are interested in working with Craig Turner for hedging and marketing, then click here to open an account. If you are a speculative or online trader then please click here.

About Turner’s Take Podcast and Newsletter

If you are having trouble listening to the podcast, please click here for Turner’s Take Podcast episodes!

Craig Turner – Commodity Futures Broker

Turner’s Take Ag Marketing: https://www.turnerstakeag.com

Turner’s Take Spec: https://www.turnerstake.com

Twitter: @Turners_Take

Risk Disclosure

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.